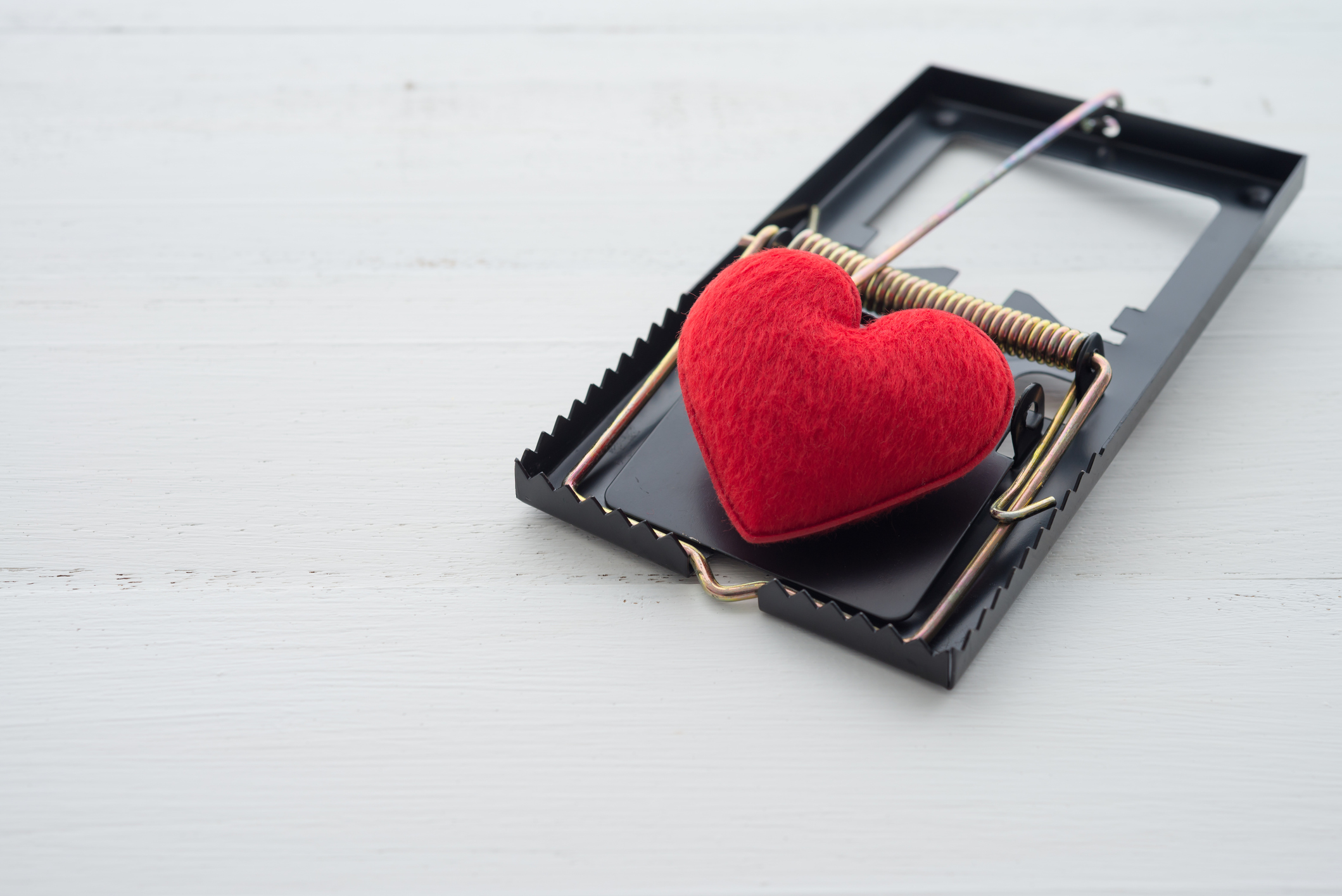

A tempting 100% mortgage for first-timers

Barclays launched its “Family Springboard Mortgage” marking the return of the 100% mortgage, says Sarah Moore.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The 100% mortgage is back. Last week, Barclays launched its "Family Springboard Mortgage", making it the first high-street bank since the 2008-2009 financial crisis to allow homebuyers to borrow the full value of their property. But the deal comes with a bit of a twist and certainly isn't a full return to the lax lending standards that we saw before the crisis.

Barclays will offer this mortgage to first-time buyers only and on the condition that a family member or guardian puts 10% of the purchase price into an account with Barclays for three years. This money earns interest at the Bank of England base rate plus 1.5%. The buyer can then get a mortgage at an interest rate of 2.99%, fixed for three years, borrowing a maximum of £500,000.

Stricter regulations mean 100% mortgages are rare today: there are just eight products available, compared with 238 in August 2007, according to Moneyfacts. Those on offer from smaller lenders, such as Aldermore and Bath Building Society, tend to have higher interest rates (up 5.5%) and are secured against the parents' property. So Barclays' version may appeal to a wider range of buyers. In the event that a borrower is unable to keep up with their repayments, Barclays can hold on to the parents' money for more than the initial three years, and stop paying interest on it.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

If the house is repossessed and there's a shortfall between the money owed and the money generated through the sale of the property, the bank draws on the deposit to make up the difference. So while the mortgage is marketed as a way of allowing first-time buyers to get on the housing ladder without financial contributions from family members, they still need helpful parents, who could stand to lose money if the worst happens.

For borrowers who can afford a deposit, or whose family are willing to hand over the money for one outright, other deals are available. For example, those with a 10% deposit may be able to get the new 2.67% three-year fixed-rate mortgage from the Post Office. However, this comes with an arrangement fee of £1,495. So the Barclays' mortgage, which is fee-free, could be cheaper, depending on how large a mortgage you need and what happens to rates after the fixed-rate period expires.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Sarah was MoneyWeek's investment editor. She graduated from the University of Southampton with a BA in English and History, before going on to complete a graduate diploma in law at the College of Law in Guildford. She joined MoneyWeek in 2014 and writes on funds, personal finance, pensions and property.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

Nationwide promises to protect all its branches from closures until at least 2030

Nationwide promises to protect all its branches from closures until at least 2030The building society has extended its pledge to keep all high street Nationwide and Virgin Money branches open, now until at least 2030.

-

Barclays bank switch: how to get £400 'free' cash by moving accounts

Barclays bank switch: how to get £400 'free' cash by moving accountsBarclays has unveiled a £400 current account switching offer, running alongside its £500 ISA transfer deal. Which accounts are on offer, and are you eligible?

-

Green mortgages: how do they work and how much can you save?

Green mortgages: how do they work and how much can you save?Most high-street lenders now offer some kind of green mortgage deal. We look at who’s eligible, how to apply and the mortgage rates and cashback on offer

-

Thousands of Brits switch to Nationwide, Monzo and NatWest – which banks are least popular?

Thousands of Brits switch to Nationwide, Monzo and NatWest – which banks are least popular?We look at the most and least popular banks and building societies as current account bank switches reach a record high. Is it worth moving your money?

-

Barclays to pay millions in compensation after IT outage chaos

Barclays to pay millions in compensation after IT outage chaosBarclays intends to compensate customers after an IT outage caused payment problems for three days

-

Barclays reports large spike in romance scams - here's how to avoid them

Barclays reports large spike in romance scams - here's how to avoid themThe UK bank found a 139% increase in the total value of romance scams

-

Nationwide, HSBC, Barclays and Virgin Money customers hit by payment issues

Nationwide, HSBC, Barclays and Virgin Money customers hit by payment issuesThe problems have been compounded as Friday is the last day of the month when many people are paid by their employer

-

Best and worst UK banks revealed

Best and worst UK banks revealedWe reveal the best UK banks – and the worst – when it comes to managing your money and good customer service. How does your provider compare?