Is the 60/40 rule dead?

For decades, the standard advice for building a portfolio has been to keep 60% of your money in shares and 40% in bonds. But does it make sense to invest in bonds when the balance between return and risk seems so poor?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

For decades, the standard advice for building a portfolio has been the 60/40 rule: keep 60% of your money in riskier investments (generally shares) and 40% in safer assets (bonds). But as government bond yields grind ever lower, investors are increasingly questioning that principle. If yields rise as surely they must eventually do investors in bonds now will be sitting on sizable losses. So does it really make sense to invest in bonds when the balance between return and risk seems so poor?

This isn't an easy question: today's market conditions are so unusual that we don't have much precedent to go on. But first, it's worth considering what the point of the 60/40 rule is. There's nothing magical about this figure it's just that historically 60/40 has been a decent compromise, trading off some of the higher return you'd get from having much more of your wealth in shares in return for a substantial reduction in volatility. However, those who can stomach plenty of volatility could keep much more than 60% in equities.In other words, 60/40 is just a simple, concrete way of saying "stay diversified".

Higher returns, higher volatility

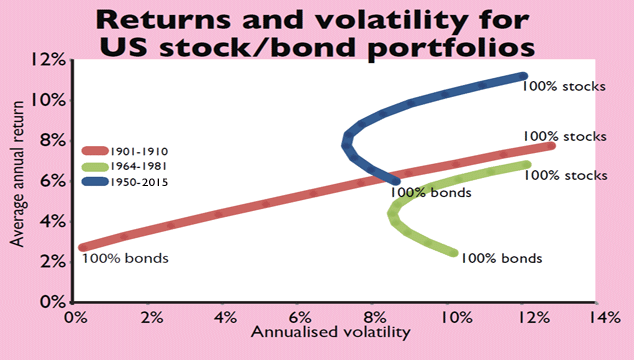

You can see this trade off in the blue line on the chart above. This shows the volatility and the return for a portfolio invested in varying amounts of stocks and bonds, based on average returns since 1950 (I've used US stocks and government bonds here simply because it's much easier to get long-term monthly data). Notice the surprising "fish hook" shape of the chart: a portfolio that's mostly bonds with a small amount of shares has been less volatile than one that's 100% bonds, due to the way that shares and bonds sometimes rise and fall together. Keeping part of your portfolio in shares has usually been a good idea, even for very conservative investors.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Two lessons from history

Saying that the 60/40 portfolio rule is dead doesn't just mean that bonds offer poor value. It's saying that this trade off is going to break down, because bonds will be so volatile relative to their returns. But is this really likely?

Let's consider what happened in the past when bond yields rose steadily for many years at a stretch when shares were relatively expensive (as they are today). One such time was the mid-1960s. Back then, ten-year US government bonds yielded around 4%. Yields had picked up from their post-war lows of around 2.5%, but the big move was still to come. The green line in the chart showed what happened to a 60/40 portfolio between 1964 and 1981 when interest rates finally peaked at over 15%. You can see that returns were poor across the board. However, the same trade-off between bonds and shares remained intact.

Alternatively, let's consider 1901, when bond yields began a much slower trudge upwards from around 3%, peaking at around 5% 20 years later. The red line shows returns between 1901-1910 (we haven't taken it through to 1920 because the impact of the war years would distort the results).

Interestingly, you can see that this line has a different shape: it's almost straight rather than a fish hook. That's because interest rates and Treasury bond yields were much less volatile before the 1950s. However, you can still clearly see the trade-off between volatility and returns.

Still no better option

This doesn't mean that returns from holding government bonds will be good in the years ahead: they're likely to be very low in real (inflation-adjusted) terms unless we see severe deflation. Investors may well prefer to stomach the volatility of holding mostly shares to get slightly better returns. However, the 60/40 rule isn't about maximum returns.

Instead, it aims to balance returns and volatility. Unless the future looks very different from the past, it seems rather premature to conclude that the rule will break down entirely once yields start rising from their current record lows. Major government bonds are still likely to be less volatile than equities. And they are still likely to offer more protection in a crisis than any of the other assets that investors have proposed to replace them in the safe part of a portfolio (see box below). So while the 60/40 rule isn't perfect, it seems likely that the principle of sensible diversification will still offer the simplest way to balance returns and volatility for most investors.

What could replace government bonds?

When the 60/40 rule first entered the mainstream, individual investors essentially had a choice of just two main assets: domestic shares and high-quality bonds (both government and corporate). Anything else was too esoteric or expensive for the average individual to hold. But today, we have access to a much wider range of investments. So has this altered the 60/40 rule?

Perhaps the most important investment innovation has been the arrival of inflation-linked government bonds, first introduced by the UK government in 1981. The value of their interest payments and capital rises in line with inflation, meaning that they combine some protection against a potential rise in inflation with the security of conventional government bonds. They have tended to deliver lower returns than conventional bonds, but have been less volatile than conventional bonds. This makes them a useful addition to a lower-risk portfolio.

Some advisers are increasingly suggesting that investors include other assets, such as high-yield (lower-quality) corporate bonds, real estate, private equity and hedge funds in a portfolio in the place of government bonds. The argument for this is that they either pay a higher income than government bonds or have returns that are not correlated to stockmarkets (meaning that they don't rise and fall in line with stocks).

These investments can play a role, but treating them as true safe havens can be misleading: they mostly belong in the riskier part of the portfolio. That's because one of the most important features of government bonds is that they tend to rally strongly in a crisis, which you can't rely on these other investments to do. Overall, the benefit of the 60/40 rule has always been that it's intended to provide a genuine balance between risk and safety. Investors should be cautious of complicated alterations to the strategy that move away from that core principle.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn