12 February 1994: Edvard Munch’s The Scream is stolen

One of the world's most famous paintings, The Scream by Norwegian artist Edvard Munch, was stolen from the National Art Museum in Oslo on this day in 1994.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

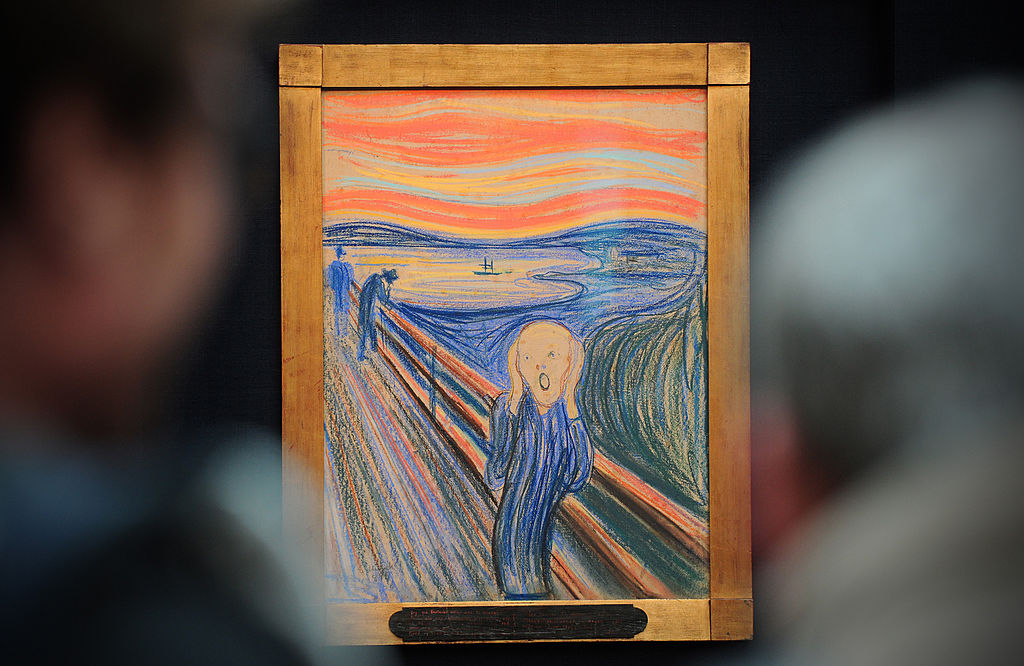

The Scream, painted in 1893 by Norwegian artist Edvard Munch, is one of the world's most iconic works of art (Munch actually created four versions between 1893 and 1910). The haunting image of the skeletal figure clutching its head and wailing before the setting sun is famous for its depiction of despair. And it's why, on the morning of 12 February 1994, it was stolen.

The Winter Olympics were due to open in Lillehammer later that day. As part of a special cultural exhibition, the painting had been moved to a less secure spot in Norway's National Art Museum in Oslo. While everybody was focusing on the Games, two thieves smashed a window, cut down the painting, and made off with their valuable prize – all in 50 seconds.

Over in London, the Metropolitan Police had earned itself a reputation for tracking down stolen paintings. And so it was to the British bobbies that the Norwegian authorities turned for help.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Because The Scream was so famous and everybody was looking for it, it was believed almost impossible that the thieves would be able to sell the painting. Instead, the gallery received a ransom demand for $1m, which it refused to pay.

Frustrated, the thieves agreed to sell the masterpiece to a pair of art dealers for £250,000 that May. The dodgy dealers, however, turned out to be undercover British police officers, and the thieves were arrested. The Scream was found undamaged in the southern seaside town of Åsgårdstrand, and returned to the gallery. Four men were convicted of the theft in January 1996.

It's not hard to see why The Scream attracted and continues to attract thieves' attention (another version was pinched in 2004). In May 2012, a pastel version from 1895 fetched $119.9m (£74m) at Sotheby's in New York a record at the time. The bidding lasted just 12 minutes.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

What the government’s baby boomer retirement data says about the future of pensions

What the government’s baby boomer retirement data says about the future of pensionsA study of the retirement routes of people born in 1958 paints a worrying picture for people’s pension savings

-

An experienced investor’s end of tax year checklist

An experienced investor’s end of tax year checklistThe clock is ticking down before the end of the 2025/26 tax year, when any tax-free savings and investment allowances are lost. For experienced investors, though, the deadline for some tax-saving schemes is even earlier.

-

31 August 1957: the Federation of Malaya declares independence from the UK

31 August 1957: the Federation of Malaya declares independence from the UKFeatures On this day in 1957, after ten years of preparation, the Federation of Malaya became an independent nation.

-

13 April 1960: the first satellite navigation system is launched

13 April 1960: the first satellite navigation system is launchedFeatures On this day in 1960, Nasa sent the Transit 1B satellite into orbit to provide positioning for the US Navy’s fleet of Polaris ballistic missile submarines.

-

9 April 1838: National Gallery opens in Trafalgar Square

9 April 1838: National Gallery opens in Trafalgar SquareFeatures On this day in 1838, William Wilkins’ new National Gallery building in Trafalgar Square opened to the public.

-

3 March 1962: British Antarctic Territory is created

Features On this day in 1962, Britain formed the British Antarctic Territory administered from the Falkland Islands.

-

10 March 2000: the dotcom bubble peaks

Features Tech mania fanned by the dawning of the internet age inflated the dotcom bubble to maximum extent, on this day in 2000.

-

9 March 1776: Adam Smith publishes 'The Wealth of Nations'

Features On this day in 1776, Adam Smith, the “father of modern economics”, published his hugely influential book The Wealth of Nations.

-

8 March 1817: the New York Stock Exchange is formed

8 March 1817: the New York Stock Exchange is formedFeatures On this day in 1817, a group of brokers moved out of a New York coffee house to form what would become the biggest stock exchange in the world.

-

7 March 1969: Queen Elizabeth II officially opens the Victoria Line

Features On this day in 1969, Queen Elizabeth II took only her second trip on the tube to officially open the underground’s newest line – the Victoria Line.