Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The high-yield, or "junk" bond market bonds issued by companies with low credit ratings hit the headlines this week, as the US saw the biggest failure of a fund aimed at retail investors since 2008.

Third Avenue Management put its Focused Credit Fund into liquidation at the end of last week. It will sell off its assets and return money to investors over the course of the next year. In the meantime, it has frozen withdrawals. The fund was investing in distressed debt and the more exotic areas of the high-yield market. But with prices for such debt falling rapidly as borrowers (mainly in the energy sector) begin to run into trouble, investors have been pulling their money out of the sector.

At the start of 2015, for example, the Third Avenue fund had nearly $3bn under management. It now has less than $800m.As a result, the fund was in danger of having to sell the bonds in its portfolio quickly to raise cash to hand back to investors and these aren't the sorts of assets that are easy to get rid of in a hurry. The freeze was imposed to allow it to sell off the bonds at a more manageable pace, rather than fire-sale prices. And while Third Avenue was the biggest casualty in the sector, it wasn't the only one. On Monday, Lucidus Capital announced that it had sold off its entire portfolio and is returning $900m to investors next month. Stone Lion Capital Partners has suspended redemptions at one of its hedge funds too.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

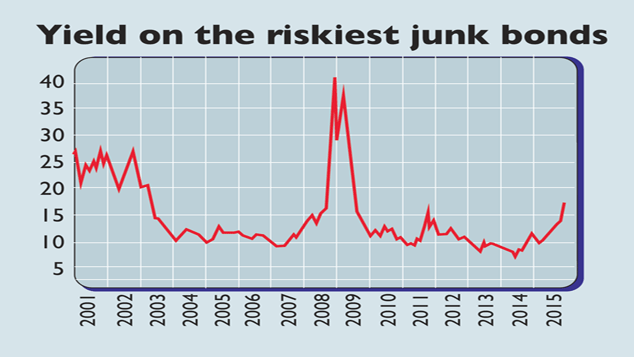

Meanwhile, the yield on the riskiest debt has shot up to more than 18% (see chart) suggesting that investors fear that many issuers will be unable to pay up. So what's going on with junk bonds? And can we expect problems to spill into the wider market?

In the near-term, this is the result of the collapse in commodity and oil prices. Of the $1.35trn of debt in the BoA Merrill Lynch US High Yield index, the two biggest sectors, energy and basic industries (which includes mining and chemicals) "account for 28%", says Liam Denning on Bloomberg. They are also chockful of smaller companies. Normally such diversification would be a good thing but as all of these companies, particularly in the energy sector, are exposed to the same problem, it just adds to investors' confusion, never good in a febrile market.

This in turn points to the deeper problem: years of high oil prices, plus easy credit and low default rates since the Federal Reserve started printing money in 2009, led investors to believe that bankruptcy had been abolished, which saw them pour billions into risky projects in return for low returns. As Brian Gibbons of CreditSights puts it: "The breadth of the issuers is simply staggering and emblematic of the go-go financing days of 2010-2014, when oil was stable at $100 a barrel for such a long stretch of time".

But as Bonnie Baha of DoubleLine Capital warned in the Financial Times, this is "not just an energyor metals and mining issue". Even if you exclude energy, reports the FT, "leverage has reached levels last touched in 2001". Indeed, notes Goldman Sachs, this looks set to be the first year ever in which high-yield bonds have lost money (as an asset class), without an accompanying recession. And more highly rated debt has not been immune to the sell-off higher-quality bonds have sold off too.

Several pundits have rushed to brush off the idea that there is a problem here. Others have a more balanced take (see the box below) that this is an issue to watch, but it's not yet a repeat of 2008. That seems to make sense. However, the widespread use of exchange-traded funds (ETFs) and other bond funds that promise both easy access to, and an easy exit from, bond markets raises concerns about a "run" on the bond market. If bond prices continue to fall, and investors start to fret that their money will be trapped, we could see a self-fulfilling race for the exits. And regardless of whether or not this is a sign of a wider meltdown, it's likely that we'll see a lot more pain in the junk-bond sector before it's all over. Here at MoneyWeek, we've been bond bears for a long time. We certainly don't think now is an opportune time to change that view.

How bad could it get?

However, Harrison adds that while it bodes ill for "junk" in general and certain areas of the economy he doesn't yet see a repeat of 2008. "The real economy is in a different place and bank exposure to marginal credits is lower due to the lack of energy sector scale and the lack of securitisation." In short, this debt is certainly going bad, but there's not enough of it and it's not widespread enough to bring down the entire financial system. In terms of sectors that are vulnerable to further pain inflicted by the resources crash, Harrison suggests watching natural gas, US municipals (as shale-exposed states are caught out by the downturn), and commodity-exposed, overindebted economies, such as Canada and Australia.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how