Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

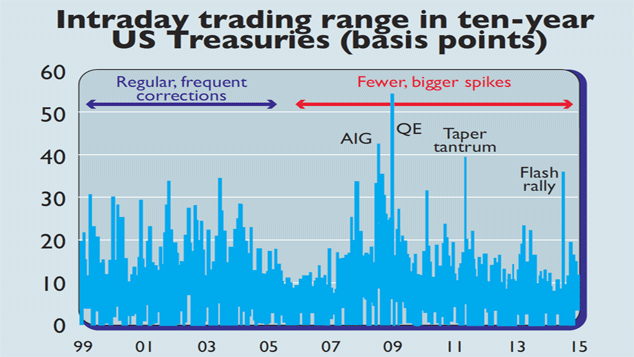

Bond-market liquidity "sounds like a pretty niche subject", as The Daily Telegraph's Ben Wright puts it. Yet it has many people's "knickers in a twist". Why? It seems that as usual regulators' response to the last crisis may have sown the seeds for the next. Liquidity refers to both the size of a market (how many buyers and sellers there are) and its depth (how many buyers and sellers of small and large amounts of securities are available). In bond markets, banks have traditionally acted as market makers, matching buyers with sellers, or buying big chunks of bonds themselves in anticipation of selling later. They have thus "smoothed out temporary mismatches" in the market, says Wright.

But now, rules to make banks safer have made it pricier for banks to hold bonds so they are increasingly reluctant to do so. So now, "market depth is far lower than it was prior to the Lehman crisis", notes CrossBorder Capital. The total inventory of US Treasuries available to market makers today is roughly $1.7trn, from $2.7trn in 2007. Yet the overall market is far bigger worth $13trn, up from $4.5trn in 2007. In corporate-debt markets, too, there is much less liquidity to grease the wheels. According to Deutsche Bank, the amount of US corporate debt outstanding has doubled since 2001, but dealer inventories are down 90%.

A sudden lurch downwards?

Meanwhile, the yields on interest-rate swaps (derivatives used by companies to manage their interest-rate exposure) have slipped below those on short-term US Treasuries. That's illogical investment banks are the counterparties in the swaps market, so swaps being more expensive than the underlying bonds "suggests that governments are less creditworthy than the very financial institutions they bailed out", says Bloomberg.com. Again, this seems at least partly due to new rules, which have prompted banks to switch bonds for swaps because they are cheaper and exempt from tough capital requirements. Nobody is certain of the cause, but as Thomas Urano of Sage Advisory Services says, the fear is there is something big "brewing under the surface that so far hasn't been pinpointed".

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Food and drinks giants seek an image makeover

Food and drinks giants seek an image makeoverThe global food and drink industry is having to change pace to retain its famous appeal for defensive investors. Who will be the winners?

-

Britain is still suffering from Tony Blair's terrible legacy

Britain is still suffering from Tony Blair's terrible legacyHere are ten ways in which Tony Blair's government sowed the seeds of Britain’s subsequent poor performance and many of its current problems, says Max King