Big shake-up for Alliance Trust

There are major changes afoot at Dundee-based investment trust Alliance Trust. Sarah Moore explains.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

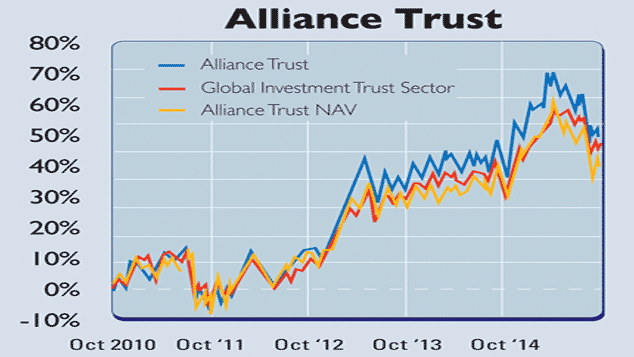

After eight months of "softly, softly" attention from activist hedge fund Elliott Advisors, there are major changes afoot at Dundee-based investment trust Alliance Trust. Elliott, which owns a 14% stake in the trust, succeeded in having two independent directors appointed to the board in April (despite the management team initially spending £3m resisting their proposals). But the activists have continued to pile on the pressure, pointing to the trust's underperformance: Alliance has lagged rivals Scottish Mortgage by 46% and Witan by 19% over the past five years, according to data from Reuters.

Now Alliance has announced major changes to the structure of the 127-year-old company. Katherine Garrett-Cox has stepped down from the main board. But she is still managing the trust's investments she becomes chief executive of Alliance's fund management unit, Alliance Trust Investments (ATI), which will have a separate, independent board. But crucially, if ATI doesn't deliver against the new benchmark (1% above the MSCI All Country World index net of fees), says Alliance, then "a full review will be undertaken and external managers considered".

In other words, if the board is unhappy with ATI'sperformance, it could chose to move Alliance's money into an external fund, parting ways with Garrett-Cox. As David Oakley and Miles Johnson note in the FT: "people familiar with the matter say it is all down to performance. Garrett-Cox must improve returns and narrow the wide discount."

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

So is it worth investing in this new-style Alliance Trust? The improved accountability is a step in the right direction, and was certainly welcomed by shareholders the trust's shares are up 6% on the news. The trust is targeting £6m in cost cuts, partly by selling off "non-core" assets (such as bond holdings and alternative assets) to focuson global equities, and plans to bring the trust's ongoing charge down by the end of 2016 are welcome.

However, given that ultimately it's the same team that is in charge of the trust's investment performance which is what matters at the end of the day we'd be inclined to hold back for now and wait to see what happens. It's pretty clear, for example, that Elliott isn't just going to sit back. As FundWeb reports (from an "anonymous source"), "only time will tell if the shake-up will actually boost performance", while as Numis analysts point out, if these changes don't "deliver a sustained improvement in performance, it will become increasingly difficult for the board to ignore calls for more radical action".So hold off for now we wouldn't be surprised to see more change at Alliance in the months ahead.

Time-honoured trust with a lacklustre yield

Alliance Trust (LSE: ATST) is the largest investment trust in Britain, with £2.7bn in assets under management and an unusually high following among private investors it has at least 50,000 individual shareholders. The Dundee-based company can trace its history back to April 1888 and companies formed to lend money to migrants heading for America from Scotland. Elliott isn't its first brush with activist investors an approach from Laxey Partners in 2012 was repelled.

Almost half of its assets are currently invested in the US stockmarket, with the UK in second place at around 23%, and Europe a close third at around 18%. Around a quarter of the fund is invested in the financial sector, around 18.5% in information technology and 16.2%health care. Its largest holdings are all listed in America payments giant Visa; drug firm Pfizer; and pharmacy chainCVS Health Corp. On paper the share price has performed well, beating its global sector benchmark over a one-year, three-year and five-year time span.

However, the growth in its net asset value (NAV) in other words, the underlying portfolio has been less impressive. Overall, its performance is middling compared to the rest of its sector neither leading the league tables nor coming in at the bottom, according to data from Citywire.

The trust has managed to increase its dividend for 48 years in a row, and remains committed to this progressive dividend policy under the new structure (see above), but the current yield of around 2.1% hardly qualifies it as a must-have income play. The total expense ratio is around 0.72%, which is set to fall by 2016. The trust currently trades at a discount of around 10%, which sounds wide but is actually lower than the 13.5% average seen over the past five years.

| Visa Inc | 3.6 |

| Pfizer Inc | 3.3 |

| CVS Health Corp | 3.2 |

| Walt Disney | 2.9 |

| Prudential | 2.8 |

| Accenture | 2.7 |

| Wells Fargo & Company | 2.5 |

| Blackstone | 2.3 |

| Amgen Inc | 2.1 |

| Legal and General | 2.1 |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Sarah was MoneyWeek's investment editor. She graduated from the University of Southampton with a BA in English and History, before going on to complete a graduate diploma in law at the College of Law in Guildford. She joined MoneyWeek in 2014 and writes on funds, personal finance, pensions and property.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how