Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Investing in Asia at the moment may seem foolhardy following the market crash. However, Japan's investment story remains intact, says Kate Beioley in the Investors Chronicle.With share prices lower and a quantitative-easing programme in full swing, the market remains attractive.

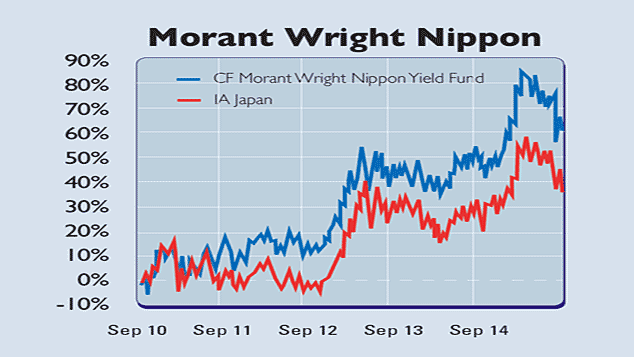

One way to exploit it could be through the CF Morant Wright Nippon Yield Fund, which offers a "defensive way to play the Japanese domestic recovery" as well as providing income, says Beioley. The open-ended investment company is one of the few Japanese funds focused on income, and at 2.3% offers the sector's highest yield, says Money Observer. Its remit is to generate absolute returns by investing in undervalued Japanese stocks.

The six-person management team, headed by Stephen Morant and Ian Wright, looks for solid balance sheets, attractive dividend yields and "sound business franchises". Recent performance is impressive, beating its benchmark with returns of 7% over one year, 46.4% over three years and 61% over five years, according to Trustnet.com. Around 40% of the portfolio is invested in mid-cap firms, with 35% in small-caps.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

While Japanese firms have not been known in the past for generous dividends, attitudes are changing. Six holdings, including Fuji Photos, recently unveiled share buyback schemes, while other holdings, including Japan Wool Textile, have enjoyed large unrealised gains on their property portfolios. Meanwhile, the fund's management says that the recent stockmarket falls have created "some interesting stock opportunities".The ongoing charge is 1.21%.

Contact: 020-7499 9980.

| Kuraray | 2.9% |

| Mitsubishi UFJ Financial | 2.9% |

| Sumitomo Mitsui Financial | 2.8% |

| Paltac Corp | 2.7% |

| Kyowa Exeo | 2.6% |

| Mizuho Financial | 2.6% |

| Sekisui House | 2.6% |

| Sumitomo Mitsui Trust | 2.6% |

| Aoki | 2.5% |

| Fuji Media | 2.5% |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how