Two biotech stocks to buy in the arms race against bugs

With antibiotic resistance costing the US healthcare system $20bn a year, there's profit in battling bugs. Matthew Partridge looks at the problem and picks two biotech stocks to buy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Antibiotics are a miracle of the modern era. Without them, we would be plunged back into a world (and a world within living memory, at that) where a small cut could turn into a death sentence and surgical procedures that we now consider routine would be highly risky. The huge public availability of the drugs after 1945 helped to treat once-deadly diseases like tuberculosis. By enabling hospitals to quickly treat infections, they also increased survival rates even from complicated surgery. More controversially, they are also used in food production to reduce the spread of disease among animals in the cramped conditions on modern farms and to boost crop yields.

But there's a problem. Very occasionally the bacteria that causes an infection mutates in such a way that makes it resistant to the antibiotic. This is particularly likely if a course is not completed (that's why the doctor tells you to take the whole bottle, even if you feel better) or if they are used when they are not needed. This resistance issue has always been a problem, but the routine use of antibiotics even for ailments they can't help with has greatly increased the problem, while their use in agriculture has made things worse by continually exposing people to low doses.

As a result, it is increasingly common for people with serious infections to contract disease strains that are resistant to one or more of the most popular antibiotics. In some cases, doctors have even had to face the death of patients because a treatment couldn't be located in time.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Antibiotic resistance is already thought to cost the US healthcare system around $20bn a year, while scientists are pondering what a world without antibiotics would look like currently common procedures, especially in the elderly or those with weak immune systems, would have to be curtailed, because they would just be too risky.For now, doctors are being asked to prescribe fewer antibiotics, in the hope that this will slow the evolution of drug-resistant bacteria, but it's not a long-term answer. Similarly, efforts to cut the use of antibiotics in US agriculture have foundered in the face of the influential farm lobby and the drug companies.

So in the medium term the only solution is to develop new antibiotics and hope to triumph in the arms race against resistance. That's going to take time unfortunately for doctors and patients, while individual drugs have trickled onto the market, the last major group of antibiotics was discovered in the late 1980s. Even worse, the large drug companies have been moving away from this area for quite some time. For example, four years ago Pfizer closed down its antibiotic development unit. As a result, there are a relatively small number of potential antibiotics in the pipeline.

To increase the number of drugs in development, the US government is trying to make it more lucrative for companies. Not only has the government reduced the time needed to get an antibiotic approved, it has also extended the period of time under which an antibiotic can enjoy patent protection, making it potentially more profitable. The good news for investors is that the departure of the drug giants means that 80% of new antibiotics in the pipeline come from smaller biotechs, making it much easier to find pure plays as we see below.

The two stocks to buy now

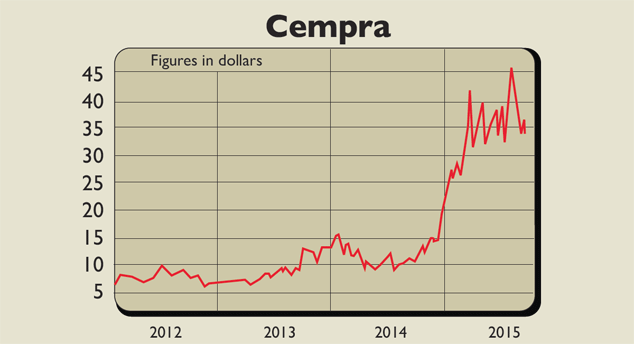

Cempra (Nasdaq: CEMP)

Taksta, meanwhile, is at an earlier stage of development. This drug targets infections that occur around prosthetic joints, a major area of concern given the ageing population. Although Cempra isn't making any money, it has a partnership agreement with Japanese company Toyama and more than enough cash to bring the drug to market.

Tetraphase Pharmaceuticals (Nasdaq: TTPH) is another drug company with some promising products in its development pipeline. The most advanced of these is broad-spectrum antibiotic eravacycline. Early results suggest that it performs better than existing drugs on the market for several conditions, including urinary tract infections.

However, experts are also excited about TP-271 and TP-6070, two antibiotics in the early stages of development that could be used to treat respiratory infections. Like Cempra, Tetraphase hasn't brought any drugs to market, so it is still losing money. However, for now, it has solid cash reserves to see it through. Obviously, these are both risky stocks, but they have great potential if they deliver the goods.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?