Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

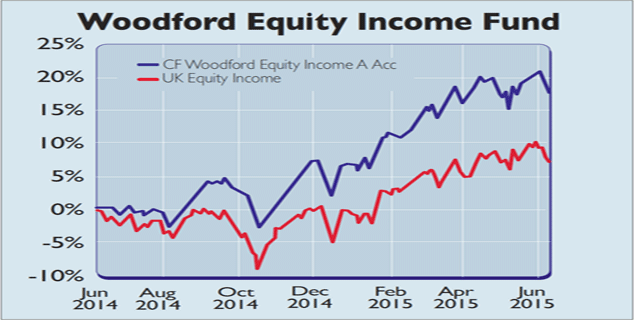

Since last June, the fund has delivered a 19.6% return. Over the same period the FTSE All Share returned just 7.8%, while the UK equity income sector returned 10.7%. In fact, says Richard Evans in The Sunday Telegraph, Woodford generated the best returns in his peer group of 85 funds.

Meanwhile, his old fund, the Invesco Perpetual High Income Fund, managed 12.9% still creditable, but well behind Woodford.The fund's remit is to deliver income and capital growth by investing in UK companies. The annual management fee is 1% fordirect investors with minimum investment of £150,000, otherwise it is 0.75%. Investors have "flocked" to it, says Evans it boasts £6.2bn of savers' cash. Most holdings are blue chips, with a focus on tobacco (which might be a problem in the future), defence and pharmaceuticals.

The strong performance was down to a mix of exposure to healthcare and consumer goods, and avoidance of oil and gas, says Shane Hickey in The Guardian. Laith Khalaf of Hargreaves Lansdown adds that Woodford's small caps selection generated 40% of the outperformance, despite accounting for only 15% of the fund.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Other picks include Royal Mail, Babcock and Drax, with 4%-5% of the fund invested in early-stage unquoted firms. Stock picking will continue to be key, as Woodford reckons UK growth will be "modest at best" in the next five years.

Contact: 0870-870 8482

| AstraZeneca | 7.03% |

| Imperial Tobacco | 6.54% |

| GlaxoSmithKline | 6.23% |

| British American Tobacco | 5.78% |

| BT | 4.33% |

| Allied Minds | 3.60% |

| Capita | 3.57% |

| Reynolds American | 3.08% |

| BAE Systems | 3.07% |

| Rolls-Royce | 2.92% |

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how