Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

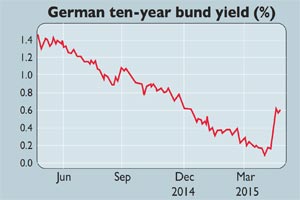

By mid-April the yield on the ten-year bund reached a record low of 0.05%.Then, within three weeks, the yield soared more than tenfold as prices slumped. Early this week, the ten-year bund yield was trading just below 0.6%. That marked the biggest bund rout since 1994 in total-return terms. Yields in other European countries, as well as in the UK and America, have also leapt. So what's going on?

"My feeling is that there has been a shift away from deflation worries towards some kind of reflation story," says Frederik Ducrozet of Crdit Agricole. Inflation expectations reflected in bond markets known as break-even inflation rates have risen in recent weeks as inflation figures have improved. Investors are now factoring in low inflation, rather than falling prices. In particular, oil prices appear to have made a major contribution to ending the deflation scare. Brent crude has rebounded to $70 a barrel, a 50%increase on its multi-year low inJanuary.

To compound matters, a flood of eurozone debt is hitting the market, with €60bn of net issuance expected in the next four weeks. "It's a form of indigestion," says HSBC's StevenMajor. "There just isn't the same appetite for bonds at ultra-low yields." Government bonds have been in a bull market since the early 1980s, and yields are now vanishingly small, or negative. So the major question is whether the multi-decade bond bull market is finally over.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't count on that, says Deutsche Bank. The "seemingly interminable" decline in Japanese bond yields since the early 1990s has been punctuated by 18 spikes in yields. The absolute low in yields may have been reached, but with European money printing continuing, inflation low and central banks in no hurry to raise interest rates, they may not slide much further. But whether they stay at ridiculously expensive levels or take a further tumble may not matter. Either way, they are not an attractive investment.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn