Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

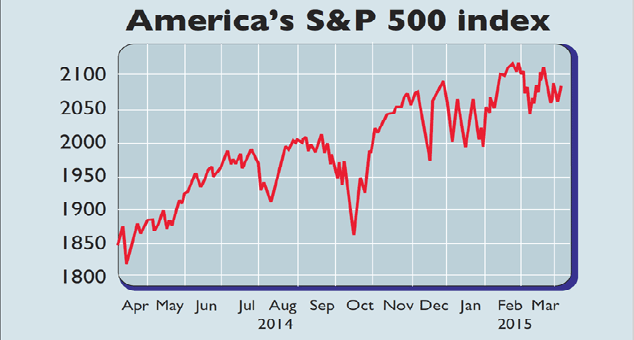

One reason for this is the stronger dollar, which reduces multinationals' foreign profits when converted back into greenbacks. Lacklustre growth in emerging markets and Europe's slow recovery aren't helping either. Meanwhile, the plummeting oil price also undermines sales because the energy sector comprises around 10% of the index.Investors have also noticed that large US firms have relied on cost-cutting and buybacks to spur earnings growth in recent years. With margins at record highs, there is scant scope for squeezing out cost reductions, especially with a tighter labour market implying higher salaries. So boosting revenues has become all the more important. Yet with the economy having softened slightly in recent weeks, that looks unlikely for now. Indeed, sales are expected to slide by almost 3% in the first quarter.

Given the approaching headwind from higher interest rates, "there will need to be real' growth in earnings and top-line revenue for equities to move higher from here", says Oliver Pursche of Bruderman Brothers. Valuations also look far too high, making the market vulnerable to a setback. The cyclically adjusted price/earnings (Cape) ratio is 68% above itslong-term average.

Even on a rolling forward p/e basis taking the next 12 months' earnings-per-share estimates the p/e is 17.4. Beyond a brief foray above this level in 2004, it has only been higher in 1998-2003, says Longview Economics. That period marked the tech bubble and subsequent collapse. No wonder investors are leaving America for Europe and Japan while the S&P has barely budged his year.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how