Investing in water: Profit from liquid gold

The world is rapidly running out of water – back firms pioneering ways to recycle what’s left and you stand to make big gains, says Matthew Partridge.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The world is rapidly running out of water back firms pioneering ways to recycle what's left and you stand to make big gains, says Matthew Partridge.

The world famous Rio Carnival ended on Sunday night with the traditional parade of Samba champions. The five-day party was an opportunity for Brazilians to forget about the political and economic problems plaguing the nation, however briefly yet the parade very nearly didn't take place at all.

As well as corruption scandals and a slowing economy, Brazil is in the grip of a severe drought. And while the main carnival in Rio de Janeiro managed to go ahead, scores of smaller festivals in nearby towns and cities were cancelled or curtailed.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

In the hardest-hit areas, mains supplies have been turned off and water is strictly on ration. Already, the incidence of diseases such as dengue fever is starting to spike due to mosquitoes breeding in water improperly stored in stagnating tanks.

Brazil is far from being the only country to experience these problems. During the Great Depression, drought and soil erosion produced vast dust storms, which drove millions of Americans in the midwest and plains areas out to other, more hospitable parts of America, most notably California.

Yet now, 80 years later, California is enduring the fourth year of the worst drought the state has seen for more than a thousand years. This is having a devastating effect on the state's $43bn agricultural sector, with many farms shutting down. Some of the poorest communities in the southern part of the state also now have to rely on bottled water for washing.

The extent of California's problems may be exceptional. However, growing demand for water (as populations grow), combined with a warming climate, means that the United Nations (UN) expects demand to exceed supply by 40% by 2030. By then, half the world's population could be experiencing "water scarcity" defined as having access to less than 1,000 cubic metres of "potable", or drinkable, water per person per year.

Security experts worry that we could routinely see "water wars" as countries fight over these scare supplies. Last year, disputes over a proposed dam nearly led to a conflict between Egypt and Ethiopia, although the problem was eventually resolved. Even in America, litigation is ongoing between several states over the course of rivers and lakes.

The good news, however, is that this worsening problem of scarcity means that governments are having to do something about it largely by investing money in infrastructure.

For example, once seen as the last resort of desert regions, desalination plants which turn salt water into potable water are being built in a wide range of places and considered in many others. Some companies arealso tapping into underground water supplies and transporting them hundreds of miles to where they are needed.

Even once unthinkable solutions, such as water recycling and the reuse of "grey water" (from waste) are on the agenda. All of these solutions offer investment opportunities.

Desalination plants

Since most of the earth's surface is covered by water, the obvious way to deal with shortages is to take this water from the seas and ocean and convert it into freshwater. Desalination is not a new technology by any means in fact, primitive desalination devices were used in ships from the 16th century onwards as an emergency source of water on long voyages.

However, it was not until the late 19th century that more sophisticated methods (adapted from sugar refining) began to appear. As a result, desalination began to be used more widely, including in some parts of Africa.

In the last 60 years or so the technology has leapt forward. The 1950s and 1960s saw the construction of bigger, more efficient plants, allowing communities to take advantage of economies of scale. At the same time a new method of desalination reverse osmosis, which involves pumping seawater through a membrane was developed, creating an alternative to the traditional methods of boiling and condensing. While the two techniques have coexisted, recent developments in materials science, especially the use of graphene, mean that filtration is now the preferred method.

China whose water supply is under particular pressure is aggressively embracing this technology. In northern China a long-running drought has left Beijing's 22 million residents getting by on tiny amounts of water.

The Chinese government is investing heavily in conventional measures to help with this, such as dams and canals. But it has also commissioned several desalination plants and expanded others. The centrepiece is a giant $1.1bn coastal plant that will take a million tons of seawater a day, and pipe it 170 miles inland to the capital. The aim is to use it to provide a third of Beijing's water needs by 2019.

There are still drawbacks to desalination. It's a lot more expensive than regular freshwater, and it comes with serious environmental concerns. Objections range from fish eggs being sucked up into the system, to concerns that dumping large amounts of leftover salt into the ocean may poison and kill marine life. There is also the problem of generating the vast amounts of energy required.

However, things are so desperate that even California's environmental bodies some of the most stringent in the world are reluctantly allowing new plants to be built in the state. According to BNP Paribas, 15 plants have been proposed.

While the main role of desalination is to make seawater drinkable, it's also playing a key role in America's energy boom. One of the biggest complaints about hydraulic fracturing ("fracking") is that it uses a lot of water. This water ends up being contaminated with the chemicals used to drive out the oil and gas from underground seams.

Desalination can remove chemicals from the surplus water, ensuring that local supplies do not become tainted. Not only does this save water, but it ensures that drilling can go ahead, helping to keep energy prices down. Overall, research group Global Water Intelligence estimates that the desalination industry will grow in size by 20% a year.

Transporting water

One big problem is that while there is enough water to go round on a global basis, it just isn't where it's needed. So another approach to shortages is to transport water from elsewhere. Again, this is hardly new the ancient Romans built elaborate networks of canals and aqueducts, for example.

And during World War II the British government seriously considered a network of canals that would transport water from Scotland to the southeast of England during recent droughts in the southeast, London Mayor Boris Johnson suggested that the plans be dusted off.

While experts dismissed the idea as too expensive, a revised version (which would cost £14bn) has been endorsed by the former Scottish first minister, Alex Salmond, and is being looked at by Whitehall.

Meanwhile, in California, one listed company is trying to develop a project that would extract groundwater from under land it owns near the Mojave Desert, and pipe it to an aqueduct that supplies Los Angeles. Cadiz Inc currently owns water rights to 70 square miles of land.

While there is local opposition to a plan that could lower the water table and have a knock-on impact on local lakes, the company argues that most of the water will simply evaporate if it isn't transported. Cadiz has the support of a local water authority in Orange County, which it is partnering with.

Aqueducts and pipelines are not the only options, however. Tankers are increasingly used to transport water across international boundaries. Stricter safety rules, designed to prevent oil spills, mean that many single-hulled tankers which can't be used to ship oil are now available to shift water at cheap rates.

A related approach is to use huge plastic membranes known as "Medusa bags". Because freshwater is lighter than seawater, they float on the surface of the water once filled, enabling them to be easily towed by larger ships.

However, this approach is very expensive. A high-profile project to ship water from Alaska to India collapsed in 2010 because of the cost. Another high-profile project to transport 50 cubic metres of water a year from Turkey to Israel by either tanker or Medusa bag fell victim to high energy costs and political tensions between the two nations.

However, more modest projects remain viable. Turkey transports water to Northern Cyprus, while Israel moves water to Jordan (as required by peace treaty). Both countries also sell to Europe.

Water recycling

The most radical solution, and one rapidly gaining acceptance among experts, is to recycle water. This may seem like a bad joke, but the idea is repeatedly to filter and treat sewage, removing all waste and impurities, until it is fit for drinking. Since all but 5% of urine is water, a large proportion of it can be recovered.

And because water from toilets and drains usually contains farless salt than seawater, this is a much cheaper solution than desalination.

A 2008 study by Orange County suggested that recycling is up to 75% cheaper (it now recycles 70 million gallons a day). Of course, even though the process removes all impurities, people are understandably reluctant to drink something that came from human waste.

Indeed, in the past, several cities, including Los Angeles, have had to scrap plans to use recycled water. Even today, most American states have laws on the books banning the use of recycled water for drinking.

However, the prolonged drought seems to be shifting public opinion, with recent polls suggesting the public is much more receptive. For example, San Diego had abandoned plans in 1999 and 2004 due to opposition, before approving a $3.5bn plant last year.

One way to get around any lingering objections is to inject the recycled water into groundwater or rivers before taking it back into the drinking supply. While this is less efficient (because the water needs to be filtered again), studies show that the water is perceived as being more "natural".

Even where opposition to its use as drinking or washing water remains too great, recycled water can be used for less controversial purposes, such as irrigation and toilet flushing (which accounts for half of all water usage in the US). Israeli agriculture has been a pioneer in this regard, with 44% of its supplies coming from reclaimed sources.

While water recycling, like desalination and conventional water treatment, is typically carried out on an industrial scale, US space agency Nasa has put a lot of time and money into producing smaller systems. This is because as you can imagine water supplies and waste disposal have always been serious problems on long space missions.

Aid agencies around the world now use adapted versions of these systems to produce clean water in places where drinking water is unavailable. To give an idea of how effective these systems are, they were able quickly to turn a pool of sewage into drinkable water in post-tsunami Indonesia.

One Swedish company, Orbital Systems, has taken Nasa's technology and used it to devise a real-time home filtration system that cleans and recycles shower water. The company claims that the OrbSys Shower can recycle 90% of water, slashing utility bills by around €1,000 a year, while improving quality and pressure.

While other experts dispute these figures, they accept that it could save at least €200 a year. Having successful tried the product in nursing homes and swimming pools, Orbital is now taking pre-orders from customers who want to install one in their homes.

The seven investments to buy now

As noted in the main text, Cadiz Inc (Nasdaq: CDZI) is involved in locating reserves of underground water in the Mojave desert and then attempting to pipe them to cities in California. It's an intriguing company with a lot of potential if everything goes smoothly, but it's clearly high risk if the project fails to play out the way that management hopes it will if you decide to invest, don't bet the house on it.

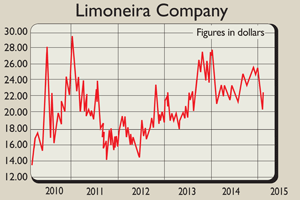

Another interesting option in the same area is Limoneira Company (Nasdaq: LMNR). Limoneira, which already leases land from Cadiz, has a profitable agricultural business, and is also involved in real-estate development projects.

However, the real potential lies in the fact that it owns a huge amount of water rights for thousands of acres. While it trades at 29.2 times 2016 earnings, its core business is growing fast, while the water rights present big potential upside.

Moving away from water rights, engineering firm Tetra Tech (Nasdaq: TTEK) is involved in several desalination projects, most notably plants in San Antonio, Texas and San Diego, California. It is also developing technology, including better membranes and ultraviolet light disinfection, to expand the capacity of water recycling plants.

Last year Tetra Tech won a $650m contract from the US Agency for International Development to improve infrastructure in developing countries, including water and sanitation systems. It is also working with mining companies to reduce the levels of pollutants. At the moment it trades at 13.9 times 2016 earnings and offers a dividend yield of 2.8%.

A purer desalination play is Consolidated Water Company (Nasdaq: CWCO). Its main focus of operation is running desalination plants in the Caribbean, including the Bahamas and the Cayman Islands.

However, it is expanding into Latin America and is currently trying to develop (through a subsidiary) a project in the Mexican coastal town of Rosarito. At the same time, Consolidated Water is making substantial progress inits quest to cut operating costs by becoming more efficient.It trades at 18.3 times 2016 earnings.

One interesting small-cap company listed in London on Aim is Modern Water (Aim: MWG). Modern Water specialises in membrane technology. It is one of the pioneers in "forward osmosis" technology. This relies on pushing the membrane through the water, drawing out the salt, rather than pumping water through the membrane (which is what happens with reverse osmosis).

The big benefit is that this requires far less energy, making it less expensive and wasteful. Delayed orders have hit revenue and the firm currently loses money, making it a risky investment. But turnover growth is expected to accelerate, and there is plenty of cash on hand and very little debt.

If you'd rather buy a fund, there are a several water-related exchange-traded funds (ETFs). However, most have a large part of their portfolios allocated to conventional water utilities, which aren't really plays on scarcity.

Two funds that focus more on water technology and related manufacturing and electronics stocks are PowerShares Water Resources Portfolio (NYSE: PHO) and First Trust ISE Water Index Fund (NYSE: FIW). PowerShares Water Resource has a total expense ratio (TER) of 0.62% and a 1.2% dividend. First Trust Water Index has a TER of 0.6% and yields 1.24%, and owns a greater proportion of small-cap shares.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.