Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

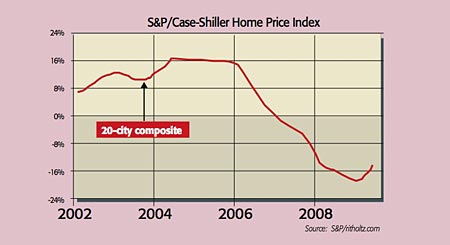

We are seeing "a turn in the UShousing market", says Gary Wolfer of Univest Wealth Management. Bullish sentiment has mounted amid recent signs of stabilisation. Sales of existing homes rose for the fourth month in a row in July, leaving them 5% up year-on-year. The widely monitored Case-Shiller index tracking prices in 20 cities has now risen for two successive months after falling for 34.

But the recovery looks shaky. For starters, the sales picture isn't as healthy as it looks; around 30% are "distressed sales" of houses that have been foreclosed on. Then there's the supply overhang. In July the number of homes on the market rose by 7.3%. So at the current pace of sales it would take 9.4 months to sell off existing stocks far above the 7.5 months' supply historically consistent with stable prices, says Capital Economics. "The inventory overhang needs to reduce much further before prices can start rising on a sustained basis."

Yet that inventory looks set to rise as repossessions increase. The proportion of residential mortgages in foreclosure, or at least one payment behind, hit a record 13.2% in the second quarter, a trend unlikely to reverse until unemployment peaks next year. Meanwhile, according to Zillow.com, 23% of homes with mortgages are in negative equity. This is also fuelling foreclosures as it prompts homeowners to give up on property.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

On the demand side, a tax credit for first-time buyers, which expires in November, has recently bolstered sales. But this just brings forward future demand. Not that there is likely to be much of that around. High unemployment and falling wage growth are a "pretty substantial headwind", says Keith Hembre of First American Funds. And tight credit control, plus ongoing losses on mortgages, suggest banks "will remain tight-fisted for some time", says The Economist.

Not only is the demand-supply outlook uninspiring, but the slide in house prices since the peak has still left prices around 10% above the long-term trend line, says Louis Basenese on Investmentu.com. But markets tend to overshoot on the downside and fall below their long-term trend lines, especially after massive bubbles. Given all this, "the recent pop in prices will probably fizzle", as The Economist puts it. Don't count on the housing slump being over just yet.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.