Not even QE can pump up the British housing market

Most asset classes are getting a boost from the latest round of quantitative easing. But UK property prices are falling at their fastest rate in 18 months. So what's happening? John Stepek examines what's going on in the housing market.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The new improved batch of quantitative easing (QE2) has been pushing up asset prices almost across the board.

Stock markets took a breather yesterday as the dollar bounced against the euro, as fears continue to grow over Ireland's debt woes. But gold continued to rise.

However, there's one market that it seems not even QE2 can pump up.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

And that's the British housing market.

Both supply and demand for houses are falling

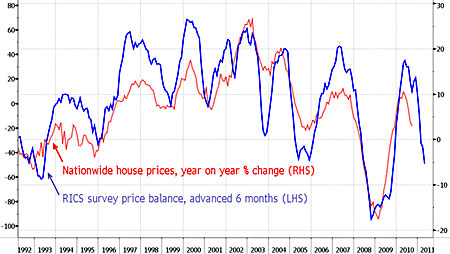

House prices are falling at their fastest rate in around 18 months, according to the latest survey from the Royal Institution of Chartered Surveyors (Rics). In October, 55% of estate agents surveyed said house prices had fallen in the past three months. Just 4% reckoned they had risen. That's a much gloomier result than September's, and also worse than economists had expected.

It bodes ill for house prices in general, as the chart below (thanks to my colleague David Stevenson) demonstrates. It compares the annual change in house prices on the Nationwide index, with the Rics survey results.

The whole market seems to be going into suspended animation. This is normally a time of year when sales pick up after the summer lull. But the number of buyer enquiries dropped for the fifth month in a row. And it's not just the buyer side. The number of new properties coming to market is also slowing down.

So it's perhaps little wonder that the number of completed sales fell to 15.2 per surveyor in the three months to October, from 16.7 last month. That's barely a sale a week. It's the worst level of sales seen since June 2009. And "with both supply and demand falling, transaction activity is set to remain at relatively flat levels for the foreseeable future," said Rics spokesman Jeremy Leaf.

Now it's worth remembering that sales have been pretty poor ever since the credit crunch kicked off. Prices recovered rapidly after the Bank of England (BoE) effectively bailed out any struggling homeowners by slashing the bank rate (or the 'base' rate as we used to call it). But actual sales have been trogging along at less than half the level they were pre-crisis.

However, recent data has shown sales deteriorating even further. Just 47,474 new loans for house purchase were written in September compared to 55,761 the year before, according to BoE figures.

So what exactly is causing this renewed caution?

Rics is pinning the blame for the slump on the continued lack of easy access to home loans. However, I'm not sure this can be the whole story. It's been difficult to get a home loan ever since the credit crunch kicked off.

Special FREE report from MoneyWeek magazine: Don't be fooled - house prices will fall again!

- Why UK property prices are set to collapse by 30%

- When it will be time to get back in and buy up dirt cheap property

If anything, it should be very slightly easier now to get a loan. Sure, things haven't improved much. But according to financial website Moneyfacts, the proportion of home loans requiring at least a 25% deposit has fallen from 66% last year to 51% now.

What it seems to come down to is a simple case of stalemate. Most 'forced' sellers have already been shaken out of the market following the crunch. Those who are left might 'want' to sell, but they don't necessarily 'need' to.

As Charles Puxley of estate agency Jackson-Stops Staff said in the Rics report, there are "few motivated buyers and also not nearly as many motivated sellers as there should be. We are in for a frustrating winter with vendors' expectations of value very unlikely to be met."

In other words, both buyers and sellers can afford to play the waiting game. The employment market is hardly buzzing, so fewer people need to move for work. If the direction of house prices is uncertain, there's no psychological pressure on would-be buyers to buy. But if sellers are still convinced that they should be able to double their money on their home sale, then they can stubbornly dig in their heels too for now at least.

My betting is that sellers will have to give way first. A would-be buyer is never forced to buy a house they can always choose to rent instead. But sellers face a number of potential hazards ahead. The big threat is that interest rates rise more rapidly than anyone expects, and householders get hammered that way.

What's next for house prices?

It's easy to forget, but we're in a very precarious situation here. If the economy recovers, rates will have to rise. But if we end up in stagflation or deflation, then unemployment will probably pick up, and that will hurt the housing market too. And with new, sensible lending rules being proposed by the FSA (see my colleague Merryn Somerset Webb's blog for more on this), we're unlikely to see another lending boom in the near future.

We recently had a group of property experts in to chat about the housing market over a bottle of wine. They gave their five-year forecasts for house prices you can read the story from MoneyWeek magazine here: What next for property prices? If you're not already a subscriber, subscribe to MoneyWeek magazine.

Our recommended article for today

How to ride the quantitative easing bandwagon

Quantitative easing may not revive the economy, but it could give investors a thrilling ride as it inflates little bubbles everywhere. Just be careful what you buy. Merryn Somerset Webb explains how to join in the fun without losing too much when it all goes wrong.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how