Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

What's happened?

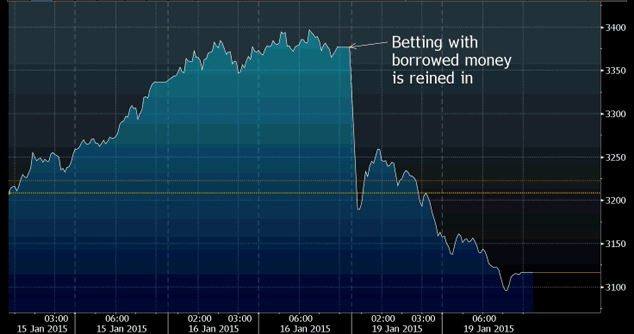

The Shanghai Composite fell 7.7% to close at 3,115.09, after China's securities regulator, CSRC, collared three top brokerages for allegedly breaking certain rules governing trading on margin, banning them from opening new margin accounts for three months.

What is margin trading?

buying stock with money borrowed

The investor must maintain a minimum level of cash or securities (margin) in the account as collateral. If the balance of a margin account falls below the minimum maintenance amount, the broker makes a margin call' to the investor, demanding the funds needed to restore the margin.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The benefit of trading on margin is that the investor is able to magnify their gains. If you buy £1,000 worth of stock with a deposit of £100, and the underlying value rises by 10% to £1,100, then you've doubled your deposit to £200. Trouble is, it magnifies your losses too. In this example, if the value of the underlying stock fell by 10% to £900, you'd lose all of your capital.

The other risk is that if a lot of players in a market are trading with borrowed money, falls in the market can become self-fulfilling. A market drops, so that over-leveraged traders are faced with margin calls, and they then have to sell to raise cash, which pushes prices lower, and sparks more margin calls.

Why has the Chinese regulator cracked down on margin trading?

The regulator believes such aggressive purchasing of stocks on borrowed money has been responsible for fuelling previous rallies, potentially creating asset bubbles that will eventually burst. The Shanghai Composite has soared by nearly 70% in the last 12 months and, according to the FT, outstanding margin loans standing as of Friday stood at a whopping 767bn ($123bn), up from 444bn at the end of October.

What are the pundits saying about Chinese stocks now?

Commenting to the FT about the CSRC's action, Liu Jun, financials analyst at Changjiang Securities in Wuhan, says: "We think this is an incremental adjustment. The fast growth potential for margin financing and other emerging business areas at the brokerages hasn't changed, but it's developed too quickly. The regulators see risks in certain areas."

The FT also notes that before the clampdown, David Cui, a strategist at Bank of America Merrill Lynch, had warned in a report last month that the "fast and furious" rally in the Chinese stock market of late was "unsupported by fundamentals, and when the tide turns, we think the sell-off will likely be fast and furious as well".

Meanwhile, Hao Hong, a strategist at Bocom International in Hong Kong, told Bloomberg: "Regulators are concerned that shares have run too hard, too fast... They want a measured increase in the stock market."

"In the near term", says Mark Williams at Capital Economics, "the potential for further falls is high." That said, "over the medium term, development of a healthy equity market would help wean Chinese firms off their dependence on credit for funding". Meanwhile, if share prices stagnate, interest rate cuts in China will be "much more likely".

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Kam is a former deputy editor at Hemscott Invest and online editor, City A.M and he was also previously the Digital Editor at IFA Magazine. Kam is currently a senior journalist at The Global Treasurer and contributes to MoneyWeek. Kam shares expertise on the FTSE 100, investing and global stocks.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how