Game-changer: UK inflation just sank even lower than anyone predicted

UK consumer price inflation slid to 0.5% in December, equalling its lowest ever level. Mischa Frankl-Duval explains what that means.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

What happened?

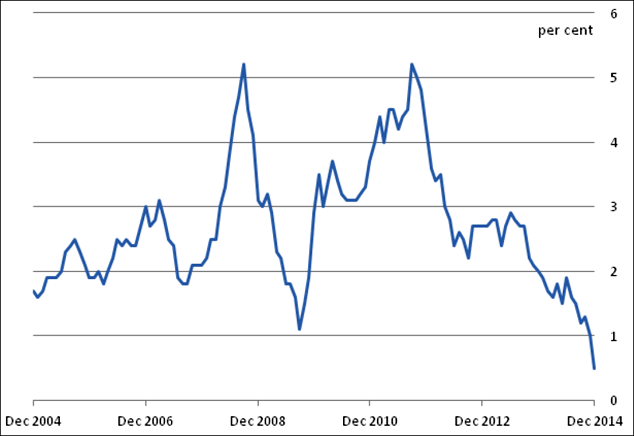

CPI 12-month inflation rate for the last ten years

Source: Office for National Statistics

Sterling was trading at a low of $1.5083 following the announcement, down from $1.5119 immediately before it. The yield on five-year gilts also fell, to below 1%.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

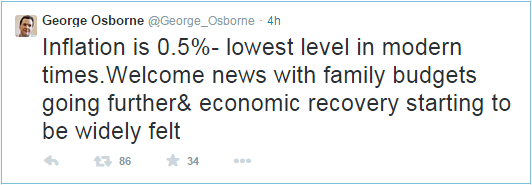

The figures released this morning by the Office for National Statistics (ONS) fell well short of the government's official target of 2%, though George Osborne did his best to put a positive spin on the results:

"Inflation is 0.5% - lowest level in modern times", the Chancellor tweeted. "Welcome news with family budgets going further & economic recovery starting to be widely felt."

So what does this mean?

1: Earnings are rising faster than prices, so real wages are growing.

2: There's less chance of the Bank of England raising interest rates this year.

What's next?

"Most economists expect inflation to continue to fall over the next few months, with oil prices at a near six-year low amid concerns of a bigger oil surplus in coming months." said the Financial Times.

"The rapid fall in crude prices is likely to deliver a spending boost to hard-pressed consumers."

What should I do right now?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Mischa graduated from New College, Oxford in 2014 with a BA in English Language and Literature. He joined MoneyWeek as an editor in 2014, and has worked on many of MoneyWeek’s financial newsletters. He also writes for MoneyWeek magazine and MoneyWeek.com.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how