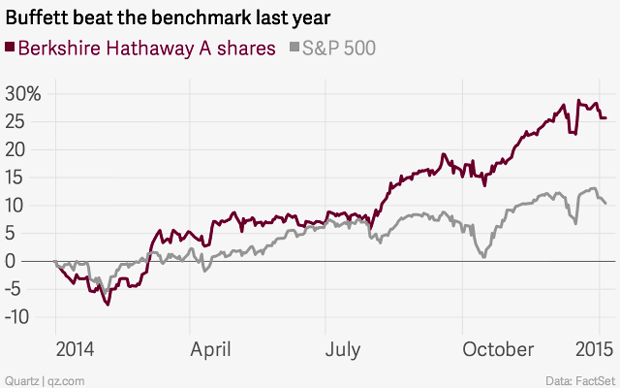

Chart of the day: How Warren Buffett beat the S&P 500 last year

Warren Buffett’s investment vehicle, Berkshire Hathaway, performed more than twice as well as America’s S&P 500 index last year. Mischa Frankl-Duval explains how.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

What happened?

Berkshire Hathaway (BRK/A:US)

Chart source: Quartz

How did Buffett do it?

"Not too long ago, Berkshire was seen as a way to buy into the billionaire's skill picking stocks", said Bloomberg. "These days, it's primarily a bet on his ability to make acquisitions and distribute funds among the dozens of businesses he bought over the past five decades."

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

These hard assets really worked for Buffett in 2014. Profit from the BNSF railroad rose about 5 percent to $1.035bn, while Berkshire Hathaway's holdings in utilities and energy, saw profits rise from $472 m to $697m.

"There are some line items in here that just scream operating success," said Bill Smead, chief investment officer of Smead Capital Management in Seattle.

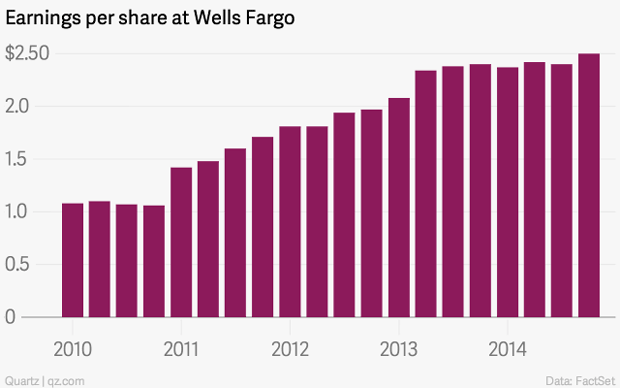

Buffett's successful investment in large cap companies meant major mistakes among them a $678m loss on Tesco (down 43.47% in 2014) and a pounding for IBM (down 14%) didn't dent performance. Some of Buffett's equity holdings performed phenomenally. Wells Fargo Berkshire Hathaway's largest holding rose 21% last year. Gains on successful equities and hard investments were enough to absorb losses elsewhere.

Chart source: Quartz

What next for Berkshire Hathaway?

The company's move towards company acquisition is designed in large part to bulletproof its performance in a post-Buffett world. Berkshire Hathaway's enormous cash reserves currently over $63.2bn have encouraged investors, who believe the company will continue to buy hard assets in 2015.

"It would come as no surprise to see some kind of significant acquisition or investment in the near future", said Nasdaq.

"The question is: Where?"

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Mischa graduated from New College, Oxford in 2014 with a BA in English Language and Literature. He joined MoneyWeek as an editor in 2014, and has worked on many of MoneyWeek’s financial newsletters. He also writes for MoneyWeek magazine and MoneyWeek.com.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn