Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

P {FONT: 0.92em verdana, arial, sans-serif}

Welcome back to the latest issue of Asia Investor. This week's letter is all about money and the serious opportunity for profits as Asia learns to invest it for the first time.

Right now hundreds of millions of people across Asia still live completely outside the modern financial system. Many have no bank account. Many more have never taken out a mortgage or called a stock broker.

Article continues belowTry 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But that all changes as society becomes wealthy. Higher incomes in Asia are likely to have two effects on investments over the next decade. First, greater wealth will push up asset prices. As incomes escalate, local buyers will seek out and drive up the price of everything from stocks to new build apartments.

Second, more widespread wealth creates huge demand for assets. The very poor keep cash in a tin under the bed. But beyond a certain level of wealth, people begin putting some of their savings in non-cash assets shares, funds, real estate in the hope of earning a return on their money, rather than just keeping it safe.

Much of Asia will cross that threshold for the first time in the years ahead. And this will create a great opportunity for one sector: asset management. As people latch onto asset investing, managers enjoy a double whammy. More people with more money to invest will both increase demand for investment products and push up the price of the underlying assets.

And since these managers earn fees as percentage of the assets under management, they benefit twice over. They make more sales and earn higher profits on each investor.

That's why the likes of Fidelity, Dreyfus and Franklin did so well in the US during the bull market of the 1980s and 1990s. Not only were stocks going up, but more and more investors were switching from holding stocks directly to investing in funds, having being convinced by the industry that this was safer and better to entrust their money to professional managers.

I expect to see a similar shift to happen in Asia in the years to come. And this week's recommendation is in a perfect position to capitalise on it. Over the last four years, it's seen assets under management more than double and there's enormous scope for future growth. Let me explain why I think this group could more than double your money over the next three years.

Why investors are flocking to this property kingin

The firm is ARA Asset Management, a Singapore-listed manager of real estate funds. This is a useful sector to be in, because many investors in Asia tend to regard real estate as sounder and a better long term bet than stocks investing in stocks.

The investment case for ARA is more about its ability to build a fund management franchise and earn high fees from that than about the individual funds it manages at present, so I'll be relatively brief with the background about these.

At present, the firm manages five real estate investment trusts (reits), which are publically listed and open to all investors. Reits are popular income plays with both retail and institutional investors.

Two of ARA's reits Fortune Reit and Prosperity Reit are Hong Kong funds, investing in retail and office property respectively. Suntec Reit includes prime retail and office property in the heart of Singapore, together with a stake in the Suntec convention centre. While the recently launched Cache Logistics Trust holds logistics facilities in Singapore. AmFirst Reit is a vehicle for commercial property in Malaysia.

In addition to the listed funds, ARA also manages three private equity real estate funds. The Asia Dragon Fund is a pan-Asia investment vehicle, mostly funded by institutions. The Harmony fund is a single asset fund invested the Suntec convention centre, marketed to high net worth individuals. And the smaller Asian Asset Income Fund is a fund of funds that invests in reits and infrastructure and utilities trusts.

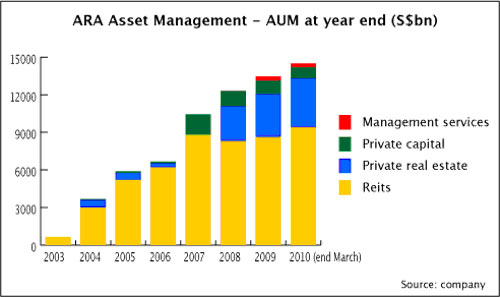

There's also a smaller division that provides management services to properties outside its funds. Overall, assets under management have risen at an average of 30% a year since 2004.

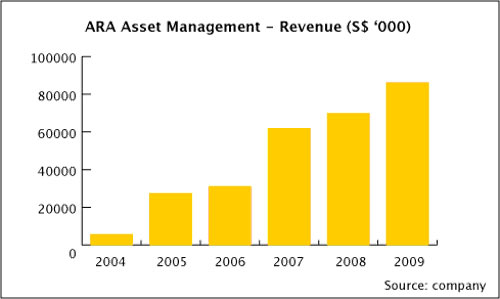

Revenues have risen similarly rapidly. Even in the teeth of the global crisis, ARA managed to maintain relatively stable revenues. There are at two reasons for that.

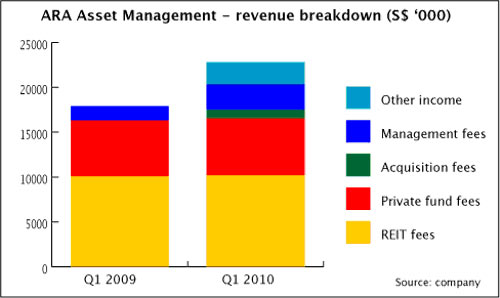

First, the group had been enjoying a very healthy year-on-year increase in assets under management (AUM). This was already in place before the worst of the crisis hit. But it also reflects the fact that ARA's income is based on the funds asset values and the revenues they bring in. That tends to be more stable than the listed market value of the Reits. Performance fees and acquisition/disposal fees are a relatively low proportion of revenue, as the latest quarterly figures below show. This gives ARA fairly stable and robust earnings.

More important than the existing portfolio though is the pipeline: new funds that ARA can list or market to increase AUM and fees.

A $2bn pipeline is just the start for ARA

At present, ARA working on a $1bn Reit with Qatar's Regency Group that will be compliant with Shariah (Islamic law) in order to tap into the growing demand for Islamic investments. ARA recently set up, ran and divested a Shariah-compliant real estate fund, Asia's first, so it has a track record in this promising sector. And once the Asia Dragon Fund is fully deployed, ARA will be aiming to raise $1bn for Asia Dragon Fund II.

This pipeline will give a substantial boost to earnings in the next 1-2 years. The firm should also be able to earn acquisition and management fees when its existing reits acquire new assets (Cache in particular seems likely to acquire assets across the region). It can also earn a fresh round of revenue from its existing asset base by floating assets from the Asia Dragon private equity funds as reits when those funds reach the end of their terms and need to divest properties, wind up and return money to shareholders.

But the growth potential for property funds is much greater than this $2bn+ pipeline. We can see this most easily by looking at the extremely rapid development of Asia's reit market, where Singapore has the leading role.

The first S-Reit listed in 2002. Today the market has grown to 23 funds, with a handful more in the pipeline. But demand both within and outside Asia mean there's huge scope for further growth. As ever, growth forecasts should be taken with a large pinch of salt. But for example, the head of HSBC's Asia real estate advisory division recently said that he expects the number of Reits in Asia to double over the next three or four years, with Singapore seeing the most activity.

So ARA seems very well positioned: in the right sector and the right place at the right time. Its funds came through the global crisis in good shape, which has helped cement its reputation. The firm says that a number of new partners have approached it to work on establishing new Reits: logistics firm CWT was one, resulting in the recent float of the Cache Logistics Trust.

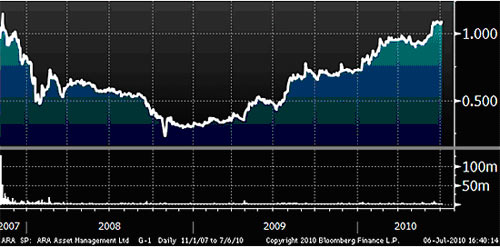

As you can see above, ARA's AUM has more than doubled over the last four years. Together, the favourable tailwinds for Asian real estate investing, rising valuations and ARA's growing profile suggest to me that it should equal or beat this growth in the years ahead.

So that's the outlook. As usual, let's take a look at the business history, management and shareholders and risks.

A few risks to consider

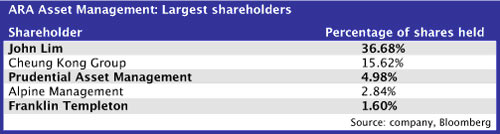

ARA was set up in 2002 by John Lim, an experienced Singaporean real estate executive, and a subsidiary of Cheung Kong, the conglomerate and real estate developer controlled by Hong Kong billionaire Li Ka-shing. It listed on the Singapore stock exchange in 2007 and Lim and Cheung Kong remain the two largest shareholders. There are no other similarly sized shareholders, but a number of institutions have smaller positions.

The stock is still fairly small the market cap is S$760m but liquidity is adequate at an average of more than a million shares per day over the past year. I don't anticipate that Asia Investor readers would have any trouble taking positions in it. The company is aiming to increase liquidity through issuing bonus shares (effectively a form of stock split) regularly; this is useful in that higher liquidity make the stock more attractive to institutions and will make them more likely to invest once as the firm's profile grows.

In addition to the usual Asia Investor risk warnings, I'd flag up the following risks for this stock.

First, there is a significant 'key person' risk with top management personnel. In a business like ARA, much depends on the reputation and contacts of a handful of experienced individuals. The loss of some of these in particular founder John Lim could be very difficult to cope with. This risk should diminish as the firm grows, but for now it remains significant. In addition to management, ARA's relationship with the Cheung Kong group is also important, since this underlies the two Hong Kong reits and the prospect of establishing reits based on Cheung Kong assets.

Second, ARA's revenue comes from the fees it earns on real estate asset values and rents, with a proportion of them coming in the form of units in the reits, which it then sells.

In addition, ARA provides seed capital for some of its private funds and holds long-term stakes in AmFirst Reit (12.5%), Suntec Reit (1.9%) and Cache (1.9%).

Thus it's dependent on conditions in the real estate market and a prolonged downturn would hit ARA's existing revenues (the evidence of 2008 suggests that it's relatively resistant to short-term problems) and the value of its direct investments. In addition, this would probably cause a souring of investor sentiment on Asian real estate, making it difficult for ARA to raise new funds or float new reits.

Obviously I don't anticipate this happening: I think most Asian real estate markets are likely to perform well in the long run. And on the plus side, this gives ARA considerably upside exposure to any bubble that develops in Asian markets. But if such a bubble were to develop, we would need to be prepared to get out before it bursts; this is not a stock to hold through a major real estate slump.

Third, the fund management business is competitive. The actual level of fees tends not be much fought over: there are certain standard fee levels and firms don't tend to compete that much on price. Instead, the difficulty is acquiring investors in significant numbers and assets at a price that will give good returns, in order to grow AUM to as large a size as possible.

Success in this will be dependent on ARA's contacts and reputation, which in turn is dependent on key staff as mentioned above. Initial barriers to entry in this business are low and we can expect to see a large number of new funds and management companies setting up in years to come. In order to grow profits as quickly as I expect, ARA will need to distinguish itself from the crowd and continue establishing itself as a leader in its sector.

Finally, there are risks connected with specific funds and reits. These could run into trouble through problems with underlying assets, with their levels of borrowing or other factors. ARA could be removed as the fund manager either because of performance issues or because shareholders think another firm offers a better deal. Since ARA has a relatively small number of funds, the loss of one would have a noticeable affect on its earnings.

Why you could make 74% inside three years

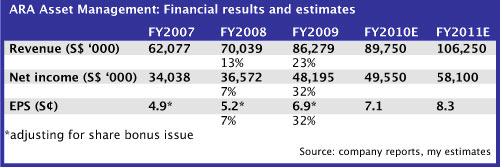

Revenue and profit growth at ARA has been rather lumpy, as you can see below. Partly this reflects the global recession, but also the fact that each individual new fund is relatively large compared to the existing AUM and don't arrive in a steady and predictable manner. So while I anticipate strong profit growth in the years ahead, it may well be of '1% one year', '30% the next' type.

The firm is under coverage at four brokers. For comparison, their estimates are 7 to 7.6 Singapore cents per share for FY2010 and 7.4 to 8 Singapore cents per share for FY2011.

ARA currently trades on a price/earnings ratio of 15 times my FY2010 estimates. Given its growth potential, this seems very reasonable. And because the business is asset-light and highly scalable, the need to reinvest profits is very limited and growth will put little strain the balance sheet. Total debt to equity stands at 14.5%, and that almost entirely consists of a loan from AmInvestment Bank used to buy the 12.5% stake in AmFirst Reit.

Consequently, the firm is able to return most of its profits to shareholders. The dividend payout ratio is around 60-70%, putting it on an estimated yield for FY2010 of about 4.5%. Management guidance indicates the firm intends to keep the per share dividend relatively constant for now, while issuing bonus shares to increase liquidity as noted above.

Thus the dividend that each shareholder receives and the value of their holding should increase steadily, although the per share price may not change that much as long as the bonus issues continue. (I'll be adjusting the figures for bonus issues as we go along so that the portfolio reflects the actual return we receive as investors.)

So what about valuation? For my base case, I'm going to assume that assets under management and earnings roughly double from 2009 year-end levels by 2013. On current margins, that points to earnings of around 12.5 to 13 Singapore cents per share by 2013.

In the absence of an obvious catalyst for rerating, I'd assume that the stock remains on a forward price/earnings ratio of 15. That equates to a share price of around S$1.9 then, which would be a potential gain of around 74% on the current price, even ignoring what should be a fairly solid stream of dividends. (In practice, the bonus issue policy may mean that this translates into us holding a larger number of shares at a lower price than this, but the net effect on our profits will be the same.)

For an initial buy limit, I'll set my usual minimum required return of 15% a year. Discounting back at that rate gives a buy limit now of around S$1.35.

As you know, I also usually sketch a bull case for my recommendations, based on more optimistic assumptions for valuations. They're never intended to be used as a buy price or as targets, just an indication of the potential if all goes well. Not every recommendation will achieve this potential, but if just a few do, our returns should look very healthy.

With ARA, the business is extremely scalable and has minimal capital requirements of its own, because the capital involved is other people's. Thus growth of 50% in a year is as viable as growth of 5% it all depends how many investors it can pull in.

As I discussed above, I think a doubling of assets in the next three-four years or so is quite likely based on historical trends and forecasts for the sector. But it could easily be substantial more than that, especially when it comes to demand from European and US investors: Asian real estate assets offer a good combination of yields and growth at a time when developed world rates are likely to stay low for a long time.

So revenues tripling or quadrupling over a few years is not completely out of the question and so ARA could well have significant further potential, since the majority of that flows straight into profits. And that's one of the major attractions of the stock. It offers good core growth, reasonably robust earnings, a strong dividend and essentially unrestrained upside exposure to any bubble that develops in its sector. That's an unusual package and as such I think it's a valuable addition to the portfolio.

Recommendation

Two encouraging updates

There are a couple of short updates on the portfolio. Eredene Capital was a member of the winning consortium for a bid to build and operate a container terminal at Ennore Port in Tamil Nadu, a state in southern India. This is a big project; the total value is £207m and Eredene's stake of 22% is equivalent to an equity commitment of £23m over four years, its largest single investment yet. It will undoubtedly have to raise capital to cover this at some point, although there are few details yet.

I'll wait until the company's results are out in a couple of weeks and we can see what progress has been made on other projects before fully factoring this into my recommendation. But it's clearly encouraging that Eredene can partner with major firms to win large projects, and reinforces the fact that the value of the company's expertise could add considerable upside to its existing portfolio of investments, attractive though these are on their own merits.

Second, Silverlake Axis announced the second part of its special dividend to clear out spare cash following the group restructuring. It will pay 0.5 Singapore cents per share, with the book closure date being 13th July and payment date being 30th July.

In addition, the stock recently regained analyst coverage, being added at broker CIMB-GK. While this has no impact on my view of whether the company is a good investment or not, broker coverage is helpful for raising its profile and increases the chance of it being rerated at point. Based on previous years, the full year results are likely to be out around the end of August and will hopefully show that banks' investment plans are continuing to recover.

My plan for Asia Investor

Finally this week, I've had a few emails from readers asking about the overall strategy and how I'll be building the portfolio. Essentially, I'm looking to invest in 20-30 stocks that are plays on key long-term themes that should do very well from Asia's development. These include consumer goods, infrastructure, financial services, healthcare and education among others.

These are mostly the kind of companies that are underrepresented in local indices (although financial services is usually pretty well represented, but often through poor-quality state-backed companies). So the goal of Asia Investor is to build a portfolio of stocks that you typically won't have much exposure to in the average Asia fund, but where there is good reason to believe they're likely to outperform.

We're going to be quite concentrated in a small number of sectors. For example, I've already recommended two food and beverage firms and we'll definitely be adding more. That's because I believe there's a limited numbers of sectors that genuinely add value for investors over the long run: most destroy value through mismanagement or through competition.

In particular, I look for industries where top firms have some protection from competition. That might be regulatory barriers, a shortage of capital for investment, ownership of a top brand, unusual expertise or contacts, or valuable intellectual property rights, among other things.

My strategy is focused on long-term investment. If a recommendation shoots up a long way very quickly and we can realise a large profit, that's excellent. But because I'm looking at small to medium sized firms, often unglamorous and with a low profile, we can't rely on that happening.

So I always assume that we will hold some of these investments for some time. Thus I look for good quality firms where I'm comfortable doing this and I favour those that pay a reasonable dividend, since this ensures that we're still be rewarded while waiting for capital gains.

And just one last thing before I go. If you're a new reader and you're looking for details of the recommendations so far, you can download my 'Hidden Seam Stocks' report here. It includes all four of the previous Asia Investor recommendations.

That's all for this issue. I'll be back in a fortnight with a new idea; I'm currently looking over a couple of retail plays, some education and healthcare ideas and a way in which it might still be possible to make some money from the rather overhyped emerging market auto story. In the meantime, if you have any queries, please let me know at asiainvestor@moneyweek.com.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.