Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

p {font: 0.928em verdana, arial, sans-serif;}

Legendary small cap investor Peter Lynch always says that the best ideas come from what you see around you everyday. I completely agree. My investment recommendations often start from seeing what shoppers are reaching for or leaving on the shelves or even what I'm buying myself.

This week's pick definitely falls into that category. It's an Asian consumer play that I first became interested in because I have something of an addiction to its products.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Every time I pop into a 7-Eleven or Circle K convenience store in Hong Kong I seem to leave with one of its distinctive cartons in my hand. I even happily pay the sizeable mark-up they fetch in the stores in London's Chinatown.

What am I talking about? The flavoured soy milk drinks chocolate, malt, red bean and many more made by Vitasoy, one of Hong Kong's oldest consumer brands. If you don't know Hong Kong, you probably won't be familiar with these but in it's home market, this company has the same kind of profile that you might associate with Coca-Cola or Pepsi. I have been following this company for years.

The good news is that there has never been a better time to invest in Vitasoy. Five years ago, this was a small company that sold its well-loved brands to a local market. Now it's a totally different animal a company undertaking a hugely successful expansion right across Asia.

So far the market has failed to notice this remarkable transformation. But not for long. Let me explain why I think you could make an 85% gain inside 3 years.

Asia's answer to Coca-Cola

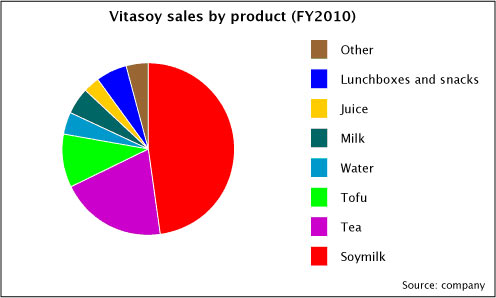

Vitasoy's core business is soy milk-based drinks, which account for around half its sales. Soy milk made by grinding up soybeans with water is a very popular drink in Asia, where large numbers of people have some degree of lactose intolerance.

Unlike in the West, where it's usually served plain, in Asia it's used to produce a huge range of flavoured drinks, both sweet and savoury. So this isn't just a health product, but a major soft drink market along the lines of coke.

Apart from soy milk, tofu another soy-based product makes up another 10% of Vitasoy's sales, while bottled tea drinks account for the same. The balance consists of various other non-alcoholic beverages and a school tuckshop and catering business in Hong Kong.

Vitasoy is a long-established business with a very strong brand in Hong Kong. It's a pretty solid, defensive stable business and given that it pays an attractive dividend, it initially looks like a good income play. But it's when we look where the firm is selling that its real attractions become clearer.

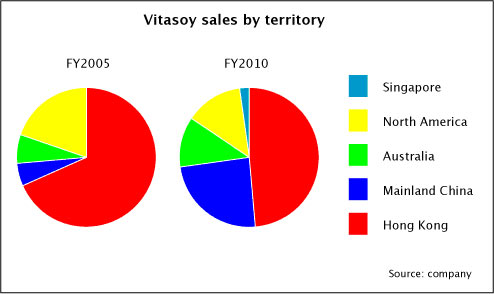

The chart below shows the breakdown of sales for the year just ended and five years ago. As you can see, Hong Kong and Macau is still the biggest single market but that's changing. There's an strongly-growing contribution from mainland China which is quietly transforming this mature stalwart into a powerful play on Chinese consumption and the market is only just catching on to this.

As with most consumer products, the Chinese business has a huge amount of potential growth. I'd advise always taking estimates like this with a large pinch of salt, but I've seen estimates that per capita soymilk consumption in China is around one-fifth of the level in culturally similar but wealthier Taiwan.

And when I visited Guangzhou last year, I noticed Vitasoy products taking over much more shelf space in the supermarkets.

At present, much of the Chinese market consists of dry soymilk powder, a segment dominated by a firm called Weiwei. Many consumers also make their own. But as consumers become wealthier, they're likely to increase consumption of the kind of prepared packaged drinks made by Vitasoy as part of a general trend to consume more flavoured soft drinks.

Sales are rocketing across China

So far, Vitasoy has focused on southern China, principally Guangdong province, which borders Hong Kong. It's followed a fairly conservative strategy which it calls "core business, core brand and core city", meaning that its focused on building awareness of a few key lines and the Vitasoy name in major urban centres. This has included products catering specifically to local tastes, including a saltier black bean flavoured drink which has apparently sold extremely well.

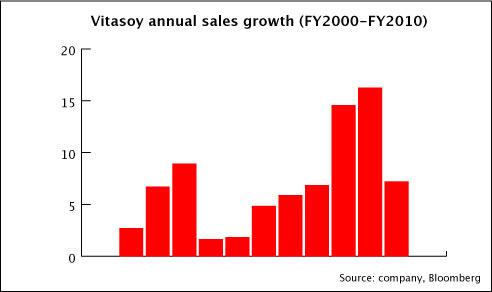

From here, it's expanding aggressively into eastern China. After average sales growth of almost 50% a year over the last three years, it's running up against capacity constraints in its current plants in Shenzhen and Shanghai and recently announced a RMB300-400m (HK$340-460m) investment in a new plant in Nanhai, which should double potential output. This should come into operation in 2011/2012.

The soymilk market remains fragmented and ripe for long-term domination by a couple of major firms. Vitasoy is one of the few big players and is by some way the market leader in its core southern China market. It has a solid position in eastern China, where it recently pushed Singaporean rival Yeo Hiap Seng into second place in the Shanghai market.

Three thriving ventures the market is ignoring

China is the key reason why we're interested in this stock, but one of its attractions is that it's a diversified business with a range of profitable divisions elsewhere. Hong Kong and Macau is a mature soft drinks market and one with tough competition, but Vitasoy has a strong position and a powerful brand. The long-term prospects are probably for low-to-mid single digit growth.

Australia and New Zealand is a relatively recent expansion where the soy milk market still has a lot of room for growth. Working in partnership with a local dairy firm, Vitasoy has taken around a fifth of the market. Sales growth has averaged over 20% a year over the last five years and should be capable of a decent pace for some time.

In Singapore, the main business is tofu manufacturing for the local market and export, following the purchase of local tofu producer Unicurd a couple of years ago. This is a small but profitable operation and the Vitasoy CEO has said the company would be interested in other acquisitions like this. Like Hong Kong, the growth prospects here are probably steady low-to-mid single digits.

The one blot has been North America. Vitasoy's brands such as Nasoya and Sansui are strong in their markets, but the division was still losing money for nine years. Last year, it took the decision to exit the local soy milk market and focus on markets like tofu. Local sales dropped 9% as a result, but the division finally turned a small profit again in the latest results and hopefully will continue to improve.

Vitasoy's sales has been expanding quickly in recent years (see chart below), thanks to the growth markets of China and Australia. With these accounting for an ever larger share of revenue, continued strong growth here will push up the headline rate of growth.

Mid-to-high teens growth should be common for a number of years to come. But at present the market continues to view Vitasoy more as an income play and less as a China growth story. As that changes, the stock should perform strongly.

A few risks to keep an eye on

So what are the risks? In addition to the usual warnings about emerging market investment, I'd emphasise the following:

As a food producer, Vitasoy is vulnerable to rises in the price of raw materials, such as soybeans. It's also exposed to higher labour costs, especially in mainland China where wages have been rising sharply in recent months. The strength of its brand should give it some ability to pass these on, especially in the long run. But there's always there's the possibility of some short-term hit to margins during a price spike.

Competition in most of Vitasoy's markets is fierce. Even in the high-growth market of China, it faces both other soy milk producers such as Yeo Hiap Seng and Weiwei and other firms such as Coca-Cola and Huiyuan aiming to establish a strong position in the soft drinks market. Chinese dairies, which saw sales plummet in the wake of the melamine contamination scandal in 2008, are now fighting to regain sales lost to soy milk and other drinks. In mature markets like Hong Kong, it needs to ensure that it's brand remains fresh and fashionable among consumers.

Vitasoy's ability to earn strong margins in the long term will depend on it establishing and maintaining a strong brand. So far this seems to be going well, but that often requires it to invest heavily in advertising and brand-building. And with brand being one of the most important assets for firms like this, there is always the risk of consumer trust being destroyed by problems like contamination (in the past, the firm has dealt well with any issues like this).

Continued rapid growth in China carries special risks, requiring investment in new production, bringing its products to consumer attention across a wide and diverse area and fighting off many competitors all keen to get access to this huge potential market. While it's starting from a good position and I believe that it has a strong chance of building the same dominant position on the mainland that it has in Hong Kong, there can be no guarantee of success.

Strong management with a great track record

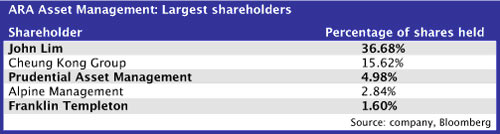

Finally, let's take a quick look at the management and shareholders. The business that later became Vitasoy was founded in 1940 by the late Dr KS Lo. It floated in Hong Kong in 1994 and is still very much a family business: his son serves as executive chairman and two daughters on the board. However, the family has brought in outside directors and management, including the current CEO.

Overall, management and directors have a history of running the firm prudently and well. There are no obvious issues of corporate governance and a number of respected independent directors. Outside shareholders have been treated well over the years.

Collectively, the Lo family and the KS Lo foundation are the largest shareholders, but a number of institutions have substantial stakes. These include Arisaig Partners, which is also a major shareholder in Hsu Fu Chi, my recommendation a fortnight ago.

The free float is around 40% and the stock is liquid, with average daily volume over the past year of more than one million shares. You should have no difficulty building any reasonably-sized position.

Why we could see an 85% return inside three years

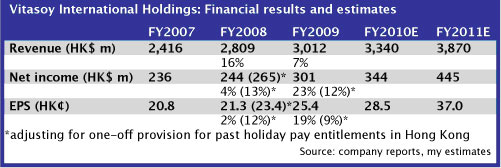

Vitasoy currently trades on a price/earnings ratio of 23.5 times last year's earnings. For FY2011, I'm assuming earnings in the region of HK28.5/share, which would put it on a forward p/e of just under 21.

Four analysts cover this stock at present and their estimates for the current year are around HK29-30/share. Mine are lower, since I suspect that competition may be tougher in China next year as the dairies try to regain market share. In addition, commodity prices may offer less of a tailwind. I may be pessimistic on this score; in any case I expect growth to pick up again strongly thereafter.

Vitasoy isn't as obviously cheap as Hsu Fu Chi, last week's Chinese consumer recommendation, but I still think it represents excellent value. As I've said before, I believe that the ability of dominant consumer companies to squeeze excess margins out of their brands over the long run makes them extremely good investments.

In this case, we have an attractive combination of a strong, stable low-risk business in a mature market that generates steady profits and extremely good growth potential in an emerging market that promises to transform the size of the business in the long run.

Very few people recognise the outstanding growth story here. Most investors view Vitasoy as an income stock. Given that the firm is a steady cash generator, has a track record of rising regular dividends and a large amount of spare cash on its balance sheet that's being returned to shareholders through special dividends, that's not surprising.

Vitasoy currently offers an attractive yield of 3.7%. I suspect that as the China business grows and requires more investment, excess cash will instead be diverted to this or to opportunistic acquisitions like Unicurd. But in the meantime, this high income is an attractive bonus for the portfolio.

The balance sheet is in excellent shape. Apart from the cash surplus, total debt to equity amounts to just 6%. That leaves plenty of scope for additional borrowing if needed to fund extra production capacity in China.

My base case valuation is for HK37/share in FY2012 and a slightly higher p/e of around 25, as the China growth story becomes more apparent. That would point to a value of HK$9.25/share in two years' time, or around 55% upside from here.

Discounting that back at a minimum required rate of return of 15% a year gives me a buy limit of HK$7.00 now. In a more bullish scenario, I think the stock could reach around HK$11 over the next two-three years, offering around 85% upside.

Recommendation

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.