Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

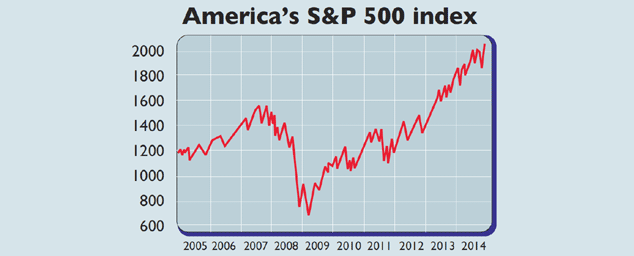

We've seen "a melt-up" in the US stockmarket, says Vito Racanelli in Barron's. After its brief October wobble, the S&P 500 is up by 12% in less than a month. It has notched up almost 50 record highs this year.

But storm clouds are gathering. For one thing, US economic growth looks increasingly solid. It may seem odd to describe this as a "headwind". But the stronger economy is also pushing up the value of the US dollar against other currencies. In turn, that hits the value of any overseas profits that American firms make that's around a fifth of profits made by S&P 500 firms.

Stronger growth also means lower unemployment and more demand for workers good news for staff, but bad news for profit margins. Margins are at their highest level in over 20 years, says Capital Economics. But a tighter labour market will see a previously compliant labour force demand a greater share, says John Authers in the Financial Times.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Secondly, share buybacks have played a big role in propping up earnings per share around 90% of earnings have been returned to shareholders via buybacks or dividends this year. In fact, "buybacks swamp the total invested by mutual funds and pension funds combined".

But how much more momentum can be squeezed out of buybacks? Record-low interest rates, which have encouragedfirms to borrow to buy back equities, have helped to fuel the trend. But interest rates are expected to rise next year, which will make the trade-off less attractive. That in turn will prompt investors to question whether share buybacks are really such a good use of their cash companies have an unfortunate historical tendency to buy their own shares at expensive rather than cheap levels.

On that front, the S&P 500 is already priced for perfection on a cyclically adjusted price-to-earnings ratio of 27.

Yet all these problems seem likely to slow the market down rather than cause it to slide. The main driver of the past five years endures: cheap or free money. The US Federal Reserve may have stopped its money-printing programme, but Japan is printing fast and Europe may soon join. China also appears to be loosening monetary policy. That money has to go somewhere, regardless of the fundamentals. "The music is playing," says Blue Marble Research's Vinny Catalano, "and you have to dance."

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how