It's time to get back into property - Asian property

You may well think that investing in property just now is a crazy idea. But Asian real estate investment trusts (Reits) may offer a good deal for patient, long-term investors, says Cris Sholto Heaton. Here, he looks at a selection of Singapore-based Reits.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

"You can't beat bricks and mortar." Or so the property touts told us over and over again in the last few years. We all know how that turned out Britain is now a nation of reluctant landlords wishing they'd put their savings on the 4:15 at Doncaster instead.

So it might sound odd if I say I think there may now be value in property. But bear with me. A couple of weeks ago, I talked about the difficulty of investing when it's unclear if inflation or deflation is the bigger threat (How to invest for inflation or deflation). As I noted then, well-chosen real estate could be part of an inflation/deflation portfolio. It will pay a decent rental yield, attractive in a low rate world. Or, if we have severe inflation, hard assets such as property should rise in line with it.

Before you think I've gone totally insane, I'm not talking about snapping up a buy-to-let flat in central Manchester. In fact, I think it will be at least five years before I'd consider buying property in Britain.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Unsurprisingly, I'm talking about Asian property and in particular, real estate investment trusts (Reits) which may now offer a pretty good deal for patient, long-term investors

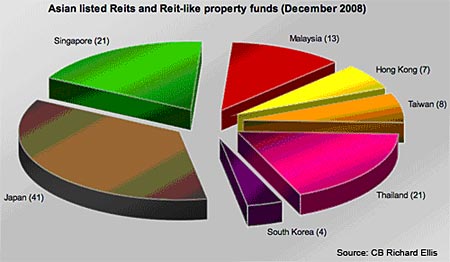

Reits are relatively new in Asia the first one listed in Japan in 2001. But since then, the industry has boomed. There are currently 115 Reits listed on Asian markets, with the majority in Japan, Singapore and Thailand (as the pie chart below shows).

The last year hasn't been kind to the sector many Reits have fallen 40% or more. Much of that was down to fears about refinancing. Most Reits roll over their debt every three years or so. With credit markets in turmoil, investors were worried whether some might not get new financing, and indeed, Japan's New City Residence had to file for bankruptcy in October for just this reason.

Another fear is that yields might not be sustainable. In a recession, vacancy rates rise and rents on new contracts fall. Since Reits pay out virtually all their profits, any fall in income is quickly passed on as a dividend cut there's no reserve to protect the dividend when times get tough.

Finally, if property prices fall, that cuts the book value of a Reit's assets. Investors who hold Reits as a bet on rising property prices and future rents (rather than for the current income) quickly bail out. What's more, both lenders and regulators often impose leverage limits on Reits, meaning that if their net asset value falls too low relative to their borrowings, they will have to deleverage (cut their borrowings). In a falling property market, this will usually have to be done by raising cash through rights issues rather than asset sales.

All these risks remain. But after the sell-offs that we've seen, the best of the Reit sector now looks like a good deal. At these yields, there's a lot of scope to cut dividends and raise borrowing costs and still emerge with a solid income.

Singapore property: not too much of a bubble

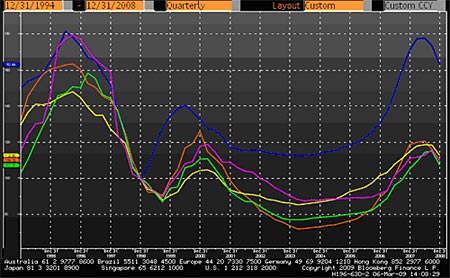

If you're shopping for Reits, Singapore is a good place to start. It's an easy market to access and the property bubble there wasn't too severe. As you can see in the chart below (which measures Singapore property prices between 1995 and 2008), property prices rose during the boom for every class of property (blue is residential, orange is office, green is factory, yellow is retail and pink is warehouse). But only residential ever got back to its pre-Asian crisis heights. Some didn't even get back to 2001 levels.

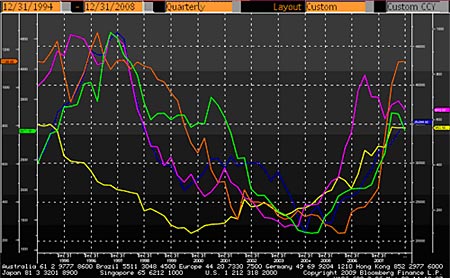

Supply is more of an issue. As you can see below, there's been a big rise in the amount of new property under construction in the last couple of years. So a substantial amount of new space will become available in the next year or so (colour key is the same as for the first chart).

This has been typical of most Asian property markets in this cycle the bubble has been more in construction than in prices. Long-term, excess construction really isn't an issue for Singapore, which is one of the few places in the world where the property bulls' cry of "they're not making any more land" has a grain of truth to it. This property will be quickly occupied when the global economy comes back.

But in the near term, it will increase vacancies and weigh on rents. So I'd focus on Reits with stronger portfolio of good quality assets and avoid the more marginal ones.

Don't just look at yield

The table below shows every Singapore-listed Reit (S-Reit), together with some key metrics. Yield is important, but also look at gearing (the debt to asset ratio). And at times like this, the short-term portion of debt (what needs refinancing soon) becomes very important.

TABLE.ben-table TABLE {BORDER-RIGHT: #2b1083 3px solid; BORDER-TOP: #2b1083 3px solid; FONT: 0.92em/1.23em verdana, arial, sans-serif; BORDER-LEFT: #2b1083 3px solid; BORDER-BOTTOM: #2b1083 3px solid}TH {PADDING-RIGHT: 5px; PADDING-LEFT: 5px; BACKGROUND: #2b1083; PADDING-BOTTOM: 10px; BORDER-LEFT: #a6a6c9 1px solid; COLOR: white; PADDING-TOP: 10px; TEXT-ALIGN: center}TH.first {PADDING-RIGHT: 2px; PADDING-LEFT: 2px; PADDING-BOTTOM: 5px; BORDER-LEFT: 0px; PADDING-TOP: 5px; TEXT-ALIGN: left}TR {BACKGROUND: #fff}TR.alt {BACKGROUND: #f6f5f9}TD {PADDING-RIGHT: 2px; PADDING-LEFT: 2px; PADDING-BOTTOM: 5px; BORDER-LEFT: #a6a6c9 1px solid; COLOR: #000; PADDING-TOP: 5px; TEXT-ALIGN: center}TD.alt {BACKGROUND-COLOR: #f6f5f9}TD.bold {FONT-WEIGHT: bold}TD.first {BORDER-LEFT: 0px; TEXT-ALIGN: left}

| Ascendas | AREIT | 13.55% | 42% | 39% | Industrial |

| Ascendas India | AIT | 12.83% | 6% | 51% | Office (India) |

| Ascott Residence | ART | 24.11% | 37% | 19% | Serviced Apts(Asia) |

| Cambridge | CREIT | 26.72% | 38% | 100% | Industrial |

| CapitaCommercial | CCT | 17.74% | 37% | 27% | Office |

| CapitaMall | CT | 11.00% | 42% | 21% | Retail |

| CapitaRetail China | CRCT | 11.57% | 31% | 15% | Retail (China) |

| CDL | CDREIT | 23.60% | 18% | 100% | Hotels |

| First | FIRT | 16.93% | 15% | 100% | Healthcare (Indonesia) |

| Fortune | FRT | 15.69% | 26% | 0% | Retail (Hong Kong) |

| Frasers Centrepoint | FCT | 12.67% | 29% | 19% | Retail |

| Frasers Commercial | FCOT | 43.79% | 54% | 65% | Office |

| Indiabulls | IPIT | 0% | 6% | 20% | Office (India) |

| K-Reit Asia | KREIT | 25.82% | 28% | 0% | Office |

| Lippo-Mapletree | LMRT | 30.27% | 12% | 0% | Retail (Indonesia) |

| MacArthurcook | MIREIT | 44.05% | 40% | 100% | Industrial |

| Mapletree Logistics | MLT | 20.39% | 38% | 19% | Industrial(Asia) |

| Parkway Life | PREIT | 9.49% | 23% | 13% | Healthcare |

| Saizen | SZREIT | 49.16% | 46% | 70% | Residential (Japan) |

| Starhill Global | SGREIT | 17.28% | 31% | 3% | Retail/Office |

| Suntec | SUN | 20.23% | 34% | 44% | Retail/Office |

| * as at 31/12/08 ** If not predominantly Singapore Source: Bloomberg |

Also take into account any sponsor - a firm that injected assets into the Reit originally and still holds a large stake in it. A strong sponsor will make it easy for its Reit to raise debt or carry out a rights issue. (Many Singaporean Reits are sponsored by government-controlled property groups such as Capitaland.)

Check the portfolio. How diverse are the assets? What are its tenants like? When do current leases expire? Also take into account the Reit's size. The recession is likely to bring about consolidation in the S-Reit sector and it will probably be better to own a well-run predator than cheap prey. At these prices, any merger and acquisition activity is likely to take place at deep discounts to book value. In the long run, that's likely to mean buyers get better value from deals than sellers.

Which Reit should you buy now?

There are plenty of Reits worth investigating, including Ascott, First, Parkway and Suntec. But since I only have space to look at one, I'll focus on the Ascendas Reit (A-Reit), a large, well-run Reit with a major backer in the form of government-owned property group Ascendas.

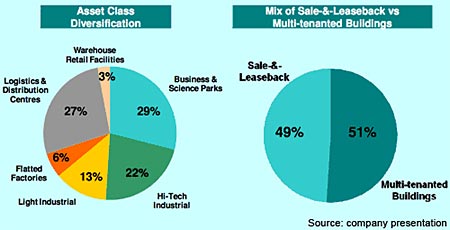

A-Reit has a diverse, high-quality portfolio of industrial property, split fairly evenly between different classes. The split between long-term sale and leaseback properties where a firm has sold its property to A-Reit and rents it back as sole tenant and multi-tenanted buildings on individual contracts is almost even.

Sale and leaseback properties should be relatively immune to rising vacancy rates, with only 5% of these leases expiring in the next two years. Rents for these typically increase in fixed amounts each year, with around one-third having increases linked to inflation.

The other half of the portfolio will undoubtedly see vacancies rise and rents fall. Around 15% of the portfolio is coming up for renewal each year the next two years; however, the current weighted average rents on these leases is around 15-20% below current market rates, suggesting that overall income is unlikely to fall much on renewal.

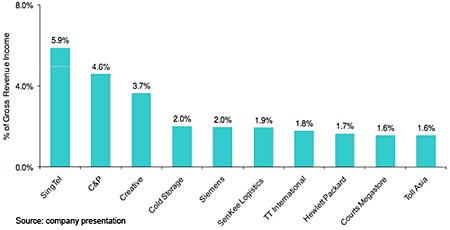

The tenant base is broad. Only one tenant accounts for more than 5% of income and that's SingTel, the governmentcontrolled telecoms firm. In contrast to some other Reits, there are no reasons to worry that the portfolio is too concentrated.

The balance sheet is solid. A-Reit carried out a rights issue in January, raising S$400m, which will go towards repaying maturing debt and funding development projects. As a result, gearing has fallen from 42% at the end of the last quarter to around 33% now, and will rise back to around 36% as the firm funds committed development projects.

How does the dividend stand up?

Overall, A-Reit looks pretty good, especially given the yield of 13.5%. But it's worth applying some simple stress tests to see what might happen to that dividend if credit markets remain frozen and vacancy rates soar.

Like most firms, A-Reit doesn't break down its debt maturity beyond one year. But I'll assume most of it needs to be refinanced in the next three years. Further, I'll assume that credit remains extremely tight for that entire period.

Cambridge recently refinanced its entire debt at a new rate of 7.2%. For A-Reit, rates would not be anywhere near that but let's be very conservative and assume they are. Based on management's guidance, that would lift its average funding cost to around 4.5% (after allowing for interest rate hedges).

Secondly, let's assume a 15% fall in rental revenue. That's equivalent to a 20% vacancy and bad debt rate on its multi-tenanted buildings (up from around 3% now) and a 10% non-renewed leases and bad debts on its sale and leaseback portfolio.

This is highly simplistic. I'm taking no account of security deposits (these typically account for about 11 months of rent and provide a big buffer against non-payment of rent). And I'm assuming A-Reit would not be able to cut costs at all. So this is extremely conservative as well.

On those crude assumptions, income available for distribution would fall to around 60% of current levels. That would cut A-Reit's yield to around 8%, which still looks pretty attractive in this low-rate world.

Now bear in mind, you do have to be selective. Not every S-Reit is a bargain: for example, Saizen's yield is an illusion since it's proposing to pay the dividend in shares. But as a hard-asset inflation hedge with a good yield during deflation, a well-chosen one like A-Reit looks hard to beat.

Turning to this week's news

| China (CSI 300) | 1,990 | +3.8% |

| Hong Kong (Hang Seng) | 13,256 | -7.8% |

| India (Sensex) | 9,324 | -0.9% |

| Indonesia (JCI) | 1,364 | -3.8% |

| Japan (Topix) | 818 | -4.3% |

| Malaysia (KLCI) | 896 | -2.5% |

| Philippines (PSEi) | 1,950 | -1.8% |

| Singapore (Straits Times) | 1,730 | -4.2% |

| South Korea (KOSPI) | 1,135 | -3.9% |

| Taiwan (Taiex) | 4,354 | -3.3% |

| Thailand (SET) | 435 | -5.2% |

| Vietnam (VN Index) | 306 | -2.2% |

| MSCI Asia | 78 | -8.6% |

| MSCI Asia ex-Japan | 272 | -4.9% |

China disappointed investors by not including any increase to its stimulus plans in Premier Wen Jiabao's speech at the start of the annual National People's Congress. Details of the 2009 budget also suggested little increase in central government investment spending, implying that the bulk of its already-announced stimulus will have to come through local government and state-owned corporations.

Chinese indicators were mixed, but overall suggest that the economy is not yet steaming ahead again. The manufacturing Purchasing Managers Index rose although it still indicates that manufacturing is in recession and loan growth is reported to have remained strong in February. However, steel prices have fallen back again and metal stockpiles in Shanghai have risen sharply, implying the hoped-for demand recovery has not yet materialised.

India's Vedanta Resources is to pay $1.7bn to buy bankrupt US copper miner Asarco. London-listed Vedanta walked away from an original agreement to buy Asarco for $2.6bn in October as commodity prices collapsed. The deal will be done through Vedanta's separately-listed Sterlite Industries unit.

Signs of financial strain are emerging among listed Chinese property developers as the real estate market there remains depressed. Neo-China Land Group missed a payment on its debt, while a number of other firms have been downgraded by ratings agencies over fears they may not be able to refinance expiring debt. Smaller, unlisted developers have been failing in large numbers for over a year.

This article is from MoneyWeek Asia, a FREE weekly email of investment ideas and news every Monday from MoneyWeek magazine, covering the world's fastest-developing and most exciting region. Sign up to MoneyWeek Asia here

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

How to navigate the inheritance tax paperwork maze in nine clear steps

How to navigate the inheritance tax paperwork maze in nine clear stepsFamilies who cope best with inheritance tax (IHT) paperwork are those who plan ahead, say experts. We look at all documents you need to gather, regardless of whether you have an IHT bill to pay.

-

Should you get financial advice when organising care for an elderly relative?

Should you get financial advice when organising care for an elderly relative?A tiny proportion of over 45s get help planning elderly relatives’ care – but is financial advice worth the cost?