How to invest for inflation or deflation

Deflation looks like it will be around for a year or two. But what about further ahead? Will it linger, or will we see the return of high inflation? Cris Sholto Heaton looks at how different assets might cope with the twin threat of both inflation and deflation.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Diversification is once again in the doghouse. Investment theory tells us that a balanced portfolio of assets should reduce risk and smooth out returns. But the brutal truth is that almost all markets have been in a race to the bottom. Government debt is pretty much the only major gainer over the last year.

This shouldn't be too surprising. In a crisis, most assets collapse together as fear sends investors fleeing into cash. That goes double when many assets are bought using debt and the lender starts calling in the loans.

But you shouldn't give up on diversified portfolios. In fact, right now they are probably more important than before. A year or so ago, almost everything was severely overvalued and a bubble was about to burst - but today, there is plenty of value.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

However, there are also two big risks. The difficulty is protecting yourself from them...

In the near term, the outlook is fairly clear. Deflation will persist for a year maybe even two. But what about further ahead?

On the one hand, we have a huge overhang of debt, which is deflationary: consumers, companies and investors will choose to pay this down, reducing the supply of money in the system. On the other hand, policymakers are trying to overcome this through fiscal stimulus, low interest rates and quantitative easing.

My optimistic view is that these two forces will more or less net out, leaving us with moderate inflation. But I may be wrong. There's a risk that deflation will be persistent and attempts to keep money circulating won't overcome the sudden desire to save. Or they may work too well, and we end up with severe inflation.

The only solution for investors is to take a long view, while trying to ensure that your portfolio does okay even if you get the inflation/deflation call wrong. For this, we need to think about how different assets would cope with deflation and inflation.

Rising inflation is best for gold

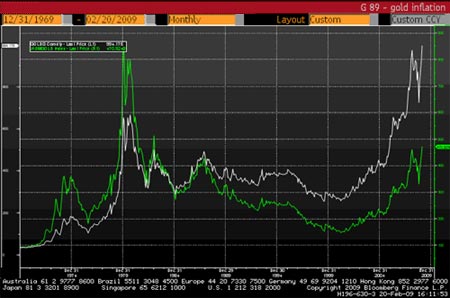

Take gold. Despite its reputation, gold has not really been a very good inflation hedge, as you can see below it steadily lost value throughout the late eighties and nineties (white is the nominal price, green is inflation-adjusted).

But it has been extremely useful at times when people are worried that inflation is on the rise. During the inflationary seventies, gold soared more than 2,300% in a decade, against consumer price inflation of 110%. More recently, gold rose 290% from its low in 2001 to its peak (so far) a year ago, against inflation of 22%.

What about deflation? Bullion merchants like to tout the fact that it rose almost 70% (in dollar terms) during the 1930s. But at this time, the dollar was on a gold standard the rise was due to Roosevelt revaluing it from $20 to $35 (as an early form of quantitative easing). I'd be reluctant to read anything into this as to how gold might behave under today's fully fiat-currency regimes.

To my mind, the most useful role for gold in a portfolio is as a severe inflation defence (from these levels, I'd expect it to perform badly under deflation or moderate inflation). The good news is that you don't need to hold much gold to get this benefit. If severe inflation threatens, the gold mania would be likely to enormously (if briefly) outstrip the actual inflation problem, as seen in the seventies.

US TIPS offer deflation protection

Index-linked bonds are another inflation defence. In most cases, these bonds pay you a regular coupon payment, which is quite low, while increasing the principal which you get back when the bond matures in line with inflation.

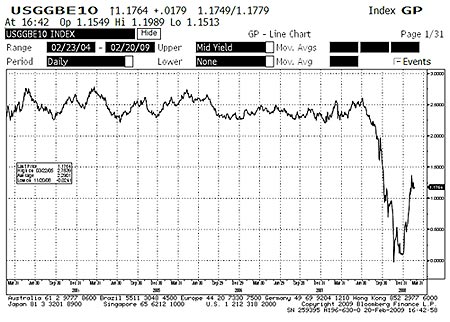

US Treasury Inflation Protected Securities (TIPS) are no longer pricing in zero inflation over the next ten years, as they were in November and December. But they still expect an exceptionally low level, as you can see in the chart below. I think it's unlikely inflation will average as little as 1% in the next decade, making bonds like these potentially quite attractive.

But what happens during deflation? It depends. In some cases US TIPS and some European bonds the principal has a deflation floor. Others, such as UK and Japanese bonds don't. So with these, sustained deflation could mean that your principal falls in value.

Linkers (inflation-linked bonds) with a deflation floor could be useful as an inflation hedge with deflation protection. However, investors following this strategy need to be careful which issues they buy: the deflation floor only applies to the initial principal, not to any accumulated inflation that's rolled up on it. Only relatively recently-issued TIPS have sufficiently little accumulated inflation that this floor would be likely to come into effect, even if we have a sustained bout of deflation.

Hard assets do well in inflation

Hard assets should respond well to inflation, suggesting that commodities could be part of an inflation-protected portfolio. But they have little downside protection in a deflationary depression, prices would tumble further as demand falls. So you should focus on those commodities with good long-term demand stories and/or supply threats: oil, copper, uranium and cocoa are among those I'm watching most closely.

Also in the hard asset category, real estate has the advantage of paying a yield at the same time. The time to pick up UK and US property is still a long way off, but there's probably good long-term value in some markets where the bubble was smaller, such as Singapore.

In a deflation scenario, the attractive yields that many Singaporean real estate investment trusts (Reits) offer would be cut as vacancy rates rise, rents fall and Reits try to reduce their leverage. But the best are still likely to offer an attractive income compared to anything else on offer. I'll take a detailed look at the sector in a future issue of MoneyWeek Asia.

Income is key when it comes to stocks

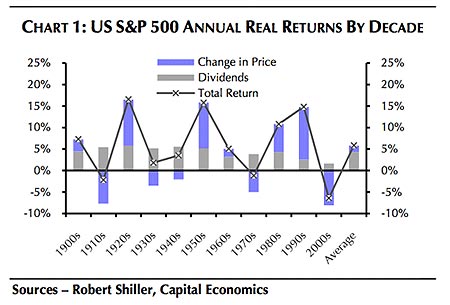

Income is also the important thing to think about when it comes to equities. The chart below shows how dividend income, not capital gains, has been the main component of real returns in most decades this century.

How equities behave in deflation depends on the economy. During the deflationary boom of the 1920s prices soared, but in the deflationary depression of the 1930s, they fell sharply. Yet even although dividends were cut heavily early in that decade down 55% in nominal terms and 47% in real terms they remained high enough and recovered well enough to eke out a positive real return for the overall decade.

When it comes to inflation, equities are a fairly decent long-term hedge against inflation, but perform poorly during inflation shocks such as the seventies. High uncertainty means investors reduce the valuation multiples they're willing to apply, causing share prices to fall even as earnings continue to rise: real earnings rose 35% between 1976 and 1979, yet the S&P 500 fell slightly.

In both scenarios, equities would be unlikely to produce capital gains. The key will be to have a portfolio that can continue to pay dividends although these will fall in real terms, it will still be a useful income stream. Once the economy improves, share prices should then recover strongly.

Junk bonds are called junk for a good reason

The asset class that seems to me to have the biggest risk is the one that many retail investors are suddenly rediscovering bonds.

Most government bonds now offer such low yields that they provide no defence against inflation. Yes, sustained deflation would produce further capital gains on longer-dated government bonds in a real deflation panic, you might expect to get the same kind of mania in these as you would in gold in an inflation panic. But the downside risks are so great that I wouldn't want more than a tiny weighting in them.

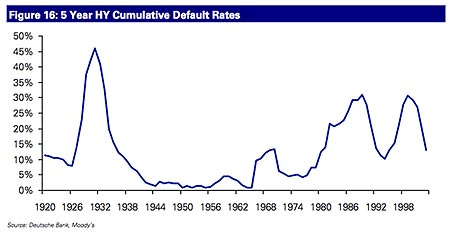

Many investors are now talking up yields on high-yield corporate bonds (riskier debt, also known as junk or speculative). The Merrill Lynch High Yield Master index is now yielding more than 18%, which looks like it should give a lot of protection against the rise in corporate defaults over the next years. Yields like this are pointing to a five-year cumulative default rate of 50%-70%, according to Deutsche Bank analysts - a higher rate of defaults than we saw in the Great Depression.

Even after allowing for losses on defaults, this sounds like it should provide a pretty good income under either deflation or moderate inflation. The snag is that default rates could easily be higher than the Great Depression, even though the current recession is highly unlikely to be that bad.

Why's that? Because the junk bonds issued in the last cycle were the junkiest junk in history. Default rates are likely to be much higher and recovery rates much lower than in any previous cycle. There will clearly be value in some high-yield debt at these prices but investors will need to be very careful.

On the plus side, returns from investment grade debt could be pretty decent. Not all investment grade debt will turn out to be as solid as it's currently rated, but with the Lehman Brothers US Corporate indices yielding 5.5% for AA-rated debt and 9% for BBB-rated debt, there's scope for good returns for investors who pick carefully.

The biggest problem with bonds is that severe inflation would devastate returns and unlike equities, there'll be no scope to make this up afterwards. Anyone with a large bond portfolio will need to be ready to get out if the runes start pointing to high inflation.

Hold cash and don't put all your eggs in one basket

Finally, there's nothing wrong with holding a substantial amount of cash in the short-term. In the event of a global depression which is extremely unlikely - most markets will tumble much further (we're talking 50%+ rather than another 15%). Having the firepower to buy at the bottom will more than offset any losses you incur on the way down.

It's also vital to be diversified across different markets. It's perfectly possible that we could have inflation in some countries and deflation in others, fairly decent growth in some and a Japan-style lost decade in others. It makes sense to avoid the worst sectors I wouldn't touch Eastern Europe or most Western financials yet but don't have too much in any one asset class. As we've seen, there's no single asset guaranteed to do well in deflation, inflation and everything in between.

Turning to this week's other news...

table.ben-table table { border: 3px solid #2b1083;font: 0.928em/1.23em verdana, arial, sans-serif;}

th { background: #2b1083; padding: 10px 5px;color: white;font-weight: bold;text-align: center;border-left: 1px solid #a6a6c9;}th.first { border-left: 0; padding: 5px 2px;text-align: left;}

tr {background: #fff;}

tr.alt {background: #f6f5f9; }

td { padding: 5px 2px;text-align: center;border-left: 1px solid #a6a6c9;color: #000;vertical-align: center;}td.alt { background-color: #f6f5f9; }

td.bold { font-weight: bold; }td.first { border-left: 0; text-align: left;}

| China (CSI 300) | 2,344 | +2.3% |

| Hong Kong (Hang Seng) | 12,699 | -6.3% |

| India (Sensex) | 8,843 | -8.2% |

| Indonesia (JCI) | 1,297 | -3.1% |

| Japan (Topix) | 74 | -3.3% |

| Malaysia (KLCI) | 890 | -2.2% |

| Philippines (PSEi) | 1,881 | -2.0% |

| Singapore (Straits Times) | 1,595 | -6.5% |

| South Korea (KOSPI) | 1,066 | -10.6% |

| Taiwan (Taiex) | 4,437 | -3.4% |

| Thailand (SET) | 435 | -2.5% |

| Vietnam (VN Index) | 253 | -8.0% |

| MSCI Asia | 70 | -6.9% |

| MSCI Asia ex-Japan | 255 | -8.3% |

China again used its deep pockets to take advantage of cash-strapped resource producers. Following Chinalco's investment in Rio Tinto last week, China Development Bank will lend $25bn to Russian oil company Rosneft and pipeline operator Transneft, in return for 300,000 barrels a day of oil for 20 years equal to less than $12 a barrel.

Economic data was again grim. The Japanese economy contracted 3.3% q/q in the fourth quarter, led by a 13.9% q/q fall in exports. Taiwan's GDP fell a record 8.4% y/y, with exports, investment and private consumption all contracting sharply. Singapore's exports fell 38% y/y in January, with shipments to the US and China down by more than 50% y/y.

An end to the export decline is clearly crucial to Asia, but there's no sign of a recovery in trade so far this year. Container through-put in Singapore's ports fell 19% y/y in January and Hong Kong was down 23%. Chinese coastal ports were down 15% y/y and 10% m/m. The BOXi index of container shipping rates hit a new low in mid-February.

This article is from MoneyWeek Asia, a FREE weekly email of investment ideas and news every Monday from MoneyWeek magazine, covering the world's fastest-developing and most exciting region. Sign up to MoneyWeek Asia here.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Cris Sholt Heaton is the contributing editor for MoneyWeek.

He is an investment analyst and writer who has been contributing to MoneyWeek since 2006 and was managing editor of the magazine between 2016 and 2018. He is experienced in covering international investing, believing many investors still focus too much on their home markets and that it pays to take advantage of all the opportunities the world offers.

He often writes about Asian equities, international income and global asset allocation.

-

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economy

New PM Sanae Takaichi has a mandate and a plan to boost Japan's economyOpinion Markets applauded new prime minister Sanae Takaichi’s victory – and Japan's economy and stockmarket have further to climb, says Merryn Somerset Webb

-

Plan 2 student loans: a tax on aspiration?

Plan 2 student loans: a tax on aspiration?The Plan 2 student loan system is not only unfair, but introduces perverse incentives that act as a brake on growth and productivity. Change is overdue, says Simon Wilson