Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

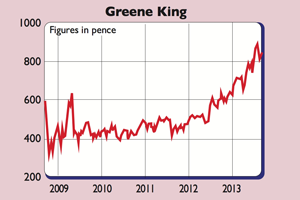

Last week was grim for the quoted owners of tenanted pubs such as Enterprise Inns (LSE: ETI), Punch Taverns (LSE: PUB) and Greene King (LSE: GNK). MPs passed a bill to get rid of the tied pub where tenants are tied into deals to buy beer from their pub group landlords.

The tenants have typically paid preferential rents, but inflated beer prices (compared to negotiating separately with a brewer). The profit margins on beer sales have made up a big chunk of the income pub groups get from their tenanted pubs. So how will they cope?

They may just jack up rents to make up for the shortfall, or close and sell more pubs. But whatever they do, EnterpriseInns and Punch are already struggling with crippling debts and this development is not helpful.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

There are also implications for Greene King. It has been selling parcels of tenanted pubs and focusing on its managed pub restaurants business, which makes up the bulk of its profits. However, it is in the process of buying the Spirit Pub Company, which will bring 430 more tenanted pubs on board, giving it nearly 1,300 in total.

The combined business will have just over £2bn of debt and its finances will be quite tight until the targeted cost savings come through. So it doesn't need the hit to its cash flow that the end of the beer tie might bring. I think Greene King is a decent business but its shares look a little less attractive now.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how

-

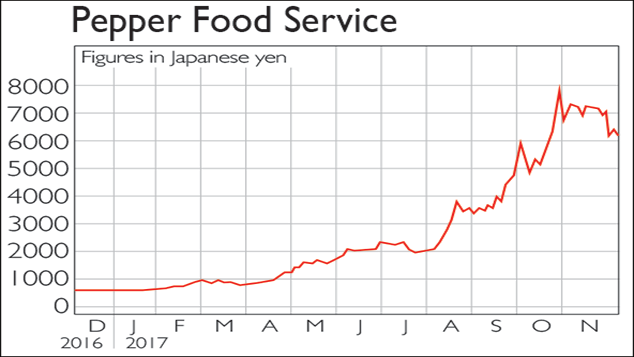

If you’d invested in: Pepper Food Service and Greene King

If you’d invested in: Pepper Food Service and Greene KingFeatures Pepper Food Service operates franchise and directly run steak-restaurant chains throughout Japan. Shares in the firm have risen 924% since January.

-

Shares in focus: Does Greene King have a future?

Shares in focus: Does Greene King have a future?Features Greene King is one of Britain's best pub chains, and the shares are not cheap. Should you still buy in? Phil Oakley investigates.