How to play the surging dollar

As the Fed prepares to stop its QE programme, the dollar is spiking upwards. John Stepek looks at how you can profit.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

As the Fed prepares to stop its QE programme, the dollar is spiking upwards. John Stepek looks at how you can profit.

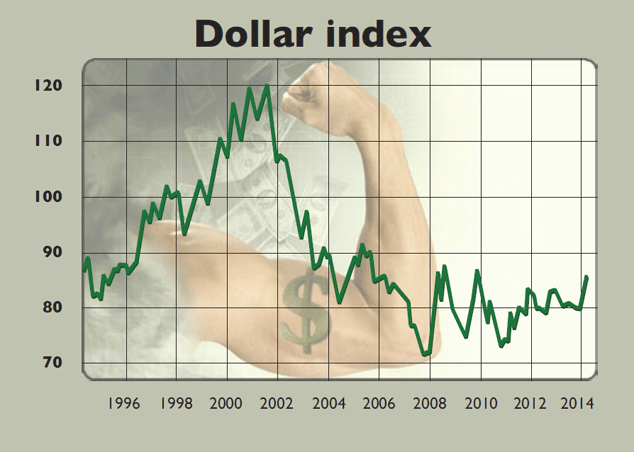

The US dollar has been on aroll recently.As the chart belowshows, the dollarindex (which measures the US currency against a basket of its biggest trading partners' currencies) is near a five-year high, after enjoying a record 12-week winning streak, and putting in its best quarterly performance since 1992 (excluding the market panic of 2008), according to Barron's.

What's behind the surge? The market is getting ready for the Federal Reserve to finish quantitative easing (QE money printing) this month, and to start raising interest rates, probably from around the middle of next year.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

After such a rapid run-up, you might expect the dollar to slip back in the short term. And with the investment crowd all embracing the strong dollar' arguments, a correction seems likely. But in the medium term it's hard to see how the dollar can resist going higher.

Last week, we learned that nearly a quarter of a million Americans found jobs in September, and the unemployment rate dropped to 5.9%. You can argue and many do about the quality of the jobs involved, and how much of the gain is about people simply giving up looking for work. But it's worth remembering that back in 2012 the Fed suggested it would raise rates when unemployment hit 6.5%.

It scrapped that idea as outdated' in April this year, but the point stands whatever precise state the US economy is in, it doesn't justify hanging on to emergency monetary policy. With the trump card of shale oil and gas in its back pocket (which is not only helping the economic recovery, but is also reducing America's trade deficit sharply), the US has at least one significant, fundamental advantage over its developed rivals.

As a result, regardless of complaints about the fragility or otherwise of the US recovery, it's still doing better than most other economies. The eurozone seems to be heading for Japan-style deflation, with European Central Bank governor Mario Draghi still struggling to convince a sceptical German political class of the need for QE.

Japan itself has embarked on a QE programme of epic proportions, but is still struggling to maintain the growth momentum, meaning the prospect of even more QE remains firmly on the cards.

As for the UK, the Bank of England has stopped printing money and, like the Fed, looks set to raise interest rates next year. But the UK recovery rests on a rather unstable combination of rising house prices and delayed austerity plans, while political uncertainty ahead of the May 2015 election and Britain's strong trade links with the floundering eurozone all point to potential trouble ahead.

In short, when it comes to the major global economies, the US is streets ahead of the rest. That in turn suggests the dollar's relative strength is likely to continue. During previous up cycles the dollar's strength has taken it a lot further than most pundits expected at the time in the early 1980s the dollar index jumped by nearly 80%, while in the mid-to-late 1990s it rose by around 45%. So it could have some distance to climb.

For a global economy that seems increasingly fragile with weakness stretching from the eurozone to China this is not good news. Because the US dollar is the world's reserve currency (the most important, widely used currency in the world), it's always in demand.

So in effect, a rising dollar amounts to a tightening of global monetary policy. That might not be such a problem if other regions were ready to step up and replace the US as the liquidity provider to the world, but so far both Europe and China seem reluctant to do so.

The casualties

So what does this mean for investors? For a start, don't pile into US stocks. That might sound counter-intuitive, but a strengthening dollar could be the very thing to make US markets come down to earth from their current historically expensive levels. That's partly because markets have risen alongside QE and stalled when previous money-printing programmes have ended so its withdrawal is hardly bullish for stocks.

But it's also worth noting that almost half of the revenues generated by S&P 500 firms come from outside the US. A strong dollar is likely to put a dent in those sales because it makes US exports more expensive, and because it means sales made in foreign currencies are worth less when translated back to dollars and so dent record-high profit margins.

If you also have a tightening labour market, then that suggests more competition for workers, and eventually rising wages which in turn is bad news for corporations that have kept profit margins high by squeezing workers' pay.

Throw in a drop-off in the level of share buybacks being done by US firms (another factor that's propped the market up so far) and it's no surprise the US market is looking green around the gills.

Two closely linked asset classes that also typically suffer from a stronger US dollar are emerging markets and commodities. In fact, according to research group CrossBorder Capital, about three-quarters of the movement in each "can be linked back to the US dollar".

We've already seen commodities take a hammering across the board. Among the more notable casualties are the precious metals gold and silver iron ore and crude oil, but the weakness has been widespread.

And the falling price of oil in particular while welcome for consumers around the world could add to geopolitical tension and instability in various countries that depend on a high oil price to balance their books (Russia certainly looks like a potential casualty if the oil price stays around these levels for long).

Emerging markets are also on the slide. That's partly because many of them are dependent on commodity exports, and partly because of investors favouring investments in a recovering US over riskier emerging economies. In the past month or so, the MSCI Emerging Markets index has fallen by 10%.

One thing that has changed compared to past strong dollar' periods is the relative importance of China to emerging markets, notes CrossBorder Capital. Looser monetary policy there, particularly if the government wants to boost exports at a time when growth is slowing and it can no longer rely on infrastructure spending, could help to alleviate some of the pain felt by emerging markets and potentially commodities too.

Charles Dumas of Lombard Street Research argues that China will have to weaken its currency, the yuan renminbi, by allowing more capital to leave the country and invest abroad, which could do the trick.

Also, as always, valuation matters many commodity-related stocks and certain emerging markets look cheap, or are getting there, so even in the least promising environments it may be worth buying markets that represent good value and holding them for the long term. However, investors will have to be picky and avoid the most vulnerable markets.

The biggest risk of all, meanwhile, lies in perhaps the most overvalued market the bond market. If this marks the start of a lasting cycle of interest-rate rises, then that's got to be bad news for bonds they've rarely, if ever, been more expensive.

However, even if it's not (and there's a good chance that we haven't seen the last of QE in America yet), we could still see some serious turmoil in parts of the bond market as investors in areas affected by a strong US dollar all try to bail out at once (see the column on the right for more).

QE infinity?

Given all this, the question has to be what is the Fed's likely reaction to be if any of these problems materialise? Fed boss Janet Yellen and her colleagues certainly have room for manoeuvre.

The declining commodity prices and falling import prices that go alongside a stronger dollar also help to keep inflation down, which takes some of the pressure off the Fed to raise rates right away.

Indeed, the more dovish' Fed members (those who object to raising rates any time before inflation is already letting rip) are already dismissing the surprisingly healthy employment figures. New York Fed president William Dudley argued this week that "it is still premature to begin to raise interest rates... the labour market still has too much slack and the inflation rate is too low".

CrossBorder Capital reckons that more QE in America the next bout would take us up to QE4 is very likely.

"Low US inflation and those structural forces giving the US dollar upward impetus may allow, or even force, a renewed US policy easing some time in 2015." In fact, "every time that the US QE programme has been suspended,

the fragile real economy has wobbled... thus we do not rule out an eventual QE5 and QE6".

In the longer run, that suggests that the big-picture outlook is for central banks to do as much money printing as it takes before we see inflation take off, leaving them well behind the curve in terms of interest rates.

However, in the shorter term, it's hardly going to beeasy for the Fed to justify printing more money without some sort of fresh scare in global markets. That means the chances are we're in for more turmoil up ahead.

Trouble ahead in the bond market?

One emerging concern as the Fed stops QE and raises interest rates is the impact on the bond market. In a recent report on corporate bonds, highlighted by the FT's John Dizard, asset manager BlackRock doesn't pull any punches. "The secondary trading environment for corporate bonds today is broken."

No one is paying much attention yet because "the extent of the breakage is masked by low interest rates and low volatility, coupled with the positive impact of QE on credit markets". But when "any of these factors change", we'll find out just how broken credit markets are.

What's the problem? In short, tighter rules on bank solvency have made it tougher for banks to act as market makers in the bond market the market has become a lot less liquid. Meanwhile, thanks to strong demand, the corporate bond market is much bigger than it was before the financial crisis.

And already relatively illiquid assets such as emerging-market debt, which are particularly vulnerable to a rising US dollar, have proved popular as investors hunt for yield. So if the market turns, and lots of once-bullish investors suddenly want to sell, it'll be very hard to find willing buyers, which means plunging prices.

In turn, this could then force holders of suddenly illiquid bonds to sell their most liquid assets to raise cash as we saw during the subprime crisis. So you'd see a drop in the highest-quality assets, such as big, blue-chip stocks and gold.

Of course, in extremis, the market is assuming that the Fed would step in to provide liquidity via more QE indeed a bond market crash could be the trigger for QE4 (see main story for more).

So, as Jame DiBiasio puts it in Asian Investor: "the likelihood of illiquid secondary markets creating a true disaster in fixed income is remote but the odds of it generating temporary seizures in specific sectors around the world are high, and increasingly in line with investor expectations of a rise in US interest rates".

It's a threat we'll keep a close eye on the market was rather too blas about subprime mortgages, and we know how that turned out.

The eight investments to buy now

How can you profit from a stronger US dollar as a sterling investor? One option is to buy UK blue chips that rely on the US for a substantial proportion of their revenues.

The FTSE 100 is full of such companies more than half of their net income is reported in dollars and on a yield of around 4.8% the index itself is not overvalued, so you could consider a cheap FTSE 100 tracker, such as the Vanguard FTSE 100 ETF (LSE: VUKE).

Clearly, the FTSE 100 has a heavy weighting towards miners and oil stocks, which have suffered badly amid the strengthening dollar and concerns about Chinese growth.

That said, mining giant BHP Billiton (LSE: BLT) is now priced at levels last seen in 2009 (see chart) and offering a dividend yield of around 4.4% which either suggests that the worst of the damage has been done to the sector, or that we're in for a far bumpier ride than many investors currently expect.

If you want to be more specific, then the defence sector would benefit from both the rising US dollar and the current geopolitical instability one stock to consider is BAE Systems (LSE: BA) on a yield of around 4.4%. Or there's troubled big drugmaker GlaxoSmithKline (LSE: GSK), which offers a yield of around 5.5%. (I own shares in GSK.)

As far as overseas equity markets go, CrossBorder Capital points out that "equity markets with weak currencies should perform better in local terms" in other words, the falling yen and euro should help markets in those regions "but here we prefer Japan over the eurozone because of better cost restructuring potential and Japan's more determined attitude to creating inflation".

We'd agree that Japan is worth buying (we've recommended plenty of trusts in the past on Moneyweek.com Baillie Gifford Japan (LSE: BGFD) is one straightforward option), but we also remain keen on cheap eurozone economies, such as Italy iShares FTSE MIB (LSE: IMIB) is one way in.

If you're tempted to try your hand at shorting the US market the S&P 500 then it is possible to do so using exchange-traded funds (ETFs). You can get inverse' ETFs, which rise when the underlying market falls, and you can also get leveraged' versions, which rise by twice or three times as much.

Examples include the db x-trackers S&P 500 Inverse Daily ETF (LSE: XSPS) or XT21, which is the leveraged version. Just remember that if you do decide to use a short ETF, it might be less risky than spread betting, but you could still lose a lot of money quickly(particularly if you are using leverage), so have a target in mind and stick to it.

Also bear in mind that they are rebalanced daily, so keep a close eye on the trade. Another interesting US option for sterling investors is US index-linked Treasury bonds. You can access them via the iShares $ Tips ETF (LSE: ITPS).

If sterling keeps weakening against the US dollar, you get the currency uplift (the reverse is true too, of course), and in the long run, if QE raises inflation concerns, you'll benefit from that too.

The stronger US dollar has not been great news for gold, and the technical picture (for all the chartists out there) looks quite ugly at the moment, with most analysts agreeing that a fall through the $1,180 an ounce mark would send gold falling a lot further.

However, as noted in the main story, there's certainly a risk that with the US being weaned off QE we might see some major impact on the bond market and the wider financial system, which in turn would make gold more attractive to investors again. We'd certainly be holding onto it as an insurance policy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?

-

Governments will sink in a world drowning in debt

Governments will sink in a world drowning in debtCover Story Rising interest rates and soaring inflation will leave many governments with unsustainable debts. Get set for a wave of sovereign defaults, says Jonathan Compton.

-

Why Australia’s luck is set to run out

Why Australia’s luck is set to run outCover Story A low-quality election campaign in Australia has produced a government with no clear strategy. That’s bad news in an increasingly difficult geopolitical environment, says Philip Pilkington

-

Why new technology is the future of the construction industry

Why new technology is the future of the construction industryCover Story The construction industry faces many challenges. New technologies from augmented reality and digitisation to exoskeletons and robotics can help solve them. Matthew Partridge reports.

-

UBI which was once unthinkable is being rolled out around the world. What's going on?

UBI which was once unthinkable is being rolled out around the world. What's going on?Cover Story Universal basic income, the idea that everyone should be paid a liveable income by the state, no strings attached, was once for the birds. Now it seems it’s on the brink of being rolled out, says Stuart Watkins.

-

Inflation is here to stay: it’s time to protect your portfolio

Inflation is here to stay: it’s time to protect your portfolioCover Story Unlike in 2008, widespread money printing and government spending are pushing up prices. Central banks can’t raise interest rates because the world can’t afford it, says John Stepek. Here’s what happens next

-

Will Biden’s stimulus package fuel global inflation – and how can you protect your wealth?

Will Biden’s stimulus package fuel global inflation – and how can you protect your wealth?Cover Story Joe Biden’s latest stimulus package threatens to fuel inflation around the globe. What should investors do?

-

What the race for the White House means for your money

What the race for the White House means for your moneyCover Story American voters are about to decide whether Donald Trump or Joe Biden will take the oath of office on 20 January. Matthew Partridge explains how various election scenarios could affect your portfolio.

-

What’s worse: monopoly power or government intervention?

What’s worse: monopoly power or government intervention?Cover Story Politicians of all stripes increasingly agree with Karl Marx on one point – that monopolies are an inevitable consequence of free-market capitalism, and must be broken up. Are they right? Stuart Watkins isn’t so sure.