Emerging markets: These three charts show we’re in a bull market

Early 2013 was a bad time for investors in emerging markets. But since then, they've been on a roll, says Lars Henriksson. And here's the proof.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Investing overseas takes guts.

Things go against you from time to time, that's the name of the game. And when it happens, you're on your own. Last year was one of those times. The MSCI Emerging Market Index lost 9% in the first few months of the year, and many observers came up with a long list of reasons why this was likely to continue.

It is always a lonely walk to go against consensus. But as Ghandi said, "First they ignore you, then they laugh at you, then they fight you, then you win."

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Since the dark days of last year, the MSCI Emerging Market Index has risen over 23% - making it eligible to be classified as a bull market.

Just back from summer breaks, hordes of fund managers and asset allocators in charge of many billions will be asked the question: what happens now?

Data will be studied, meetings and long lunches arranged with brokers and analysts, and support staff will be asked to finalise itineraries to far-flung places, where conferences or company visits will be attended.

After internal discussions and presentations to investment committees or boards, these investment professionals will know whether their arguments bullish or bearish will be adopted as the house view'. And all of those decisions will add up to the market's consensus on emerging markets for the coming year.

Around the world in three charts

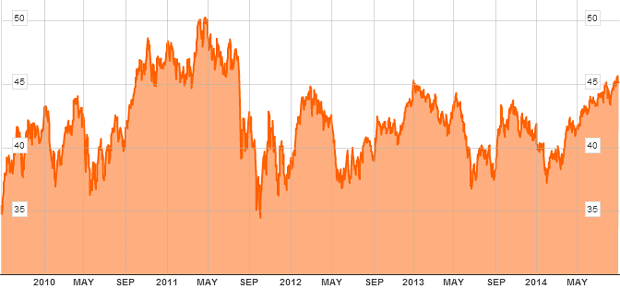

MSCI Emerging Market (EEM) is the global benchmark for investors. It tracks many trillions and is used by pension, sovereign wealth and insurance funds (and some hedge funds, particularly macro funds).

Source: Bloomberg

Over the last three years EEM has been on a roller coaster. It is trying to break above the crucial 1085 level out. If it succeeds, EEM could move another 12%, to test the the five-year high.

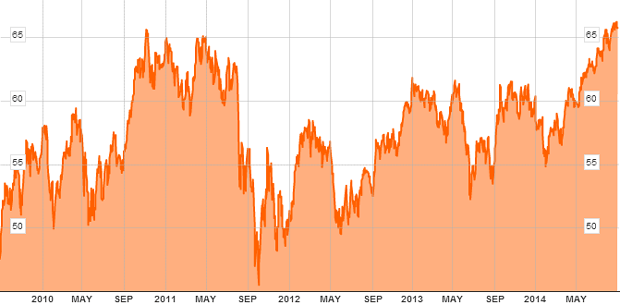

MSCI Asia ex-Japan (AAXJ) is an exchange-traded fund (ETF) used by most Asian funds and is often used by the press to define emerging Asia. Since Asia is the most important region for emerging market indexes, it carries a halo' value and influences how investors perceive the asset class as whole.

Source: Bloomberg

In contrast with the emerging market index, AAXJ is sitting at the edge of a five-year high (605). And, more tantalising, it is pretty close to the all-time high of 621.56 achieved on 31 December 2007.

That is really bullish and would mean that in spite of the problems faced by middle-income countries, the market is hinting that they can be resolved. We share this view, which we touched upon in the last issue of The New World.

The Ho Chi Minh Index (VNI) is the leading Vietnamese benchmark. It's often used a proxy for frontier markets'.

Source: Bloomberg

The VNI market is on fire, up 25% so far this year. And even more impressive, it is just above its five-year high. If that is successfully defended, the next target to challenge is 1,137.69 achieved on 28 February 2007 indicating a whopping 80% upside from current level.

I have quite a few friends involved in frontier market funds, mostly focused on Asia or Africa. This asset class is the last white spot to be filled for emerging market investors. At the beginning of this year we elaborated in greater detail why this area offered such an exciting investment case.

Will the bull or the bear come out as a winner?

Time will tell. Normally September and October have a long history of being crucial months for stock markets. I remain bullish.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Lars is an emerging-markets expert, with many years of 'on the ground' experience hunting down profit opportunities in Asia. Lars spent ten years living in Malaysia and Thailand, seeking out strategic opportunities, before moving to London to manage the Oracle Asia Absolute Fund. In short, Lars has real knowledge of where the opportunities in Asia are.

-

Early signs of the AI apocalypse?

Early signs of the AI apocalypse?Uncertainty is rife as investors question what the impact of AI will be.

-

Reach for the stars to boost Britain's space industry

Reach for the stars to boost Britain's space industryopinion We can’t afford to neglect Britain's space industry. Unfortunately, the government is taking completely the wrong approach, says Matthew Lynn