Gamble of the week: Is there more to come from this newspaper turnaround?

This newspaper publisher has come a long way in two years. So, should you stick with your shares, or is it time to sell? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

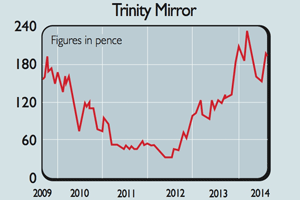

In November 2012, I tipped this newspaper stockas a potential recovery play. At 79p each, the company's shares were trading on a forward price-to-earnings (p/e) ratio of just 2.9 times, giving it a market value of just over £200m.

It had debts of £162m and a hole in its pension fund to the tune of £283m. It looked as though the market was pricing the shares for bankruptcy. Yet the firm was still producing lots of cash flow.

It had a new CEO, Simon Fox, who planned to cut costs and get its newspapers on to digital platforms. I thought at the time that if he was able to achieve this, then there was a good chance the cash would keep rolling in.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Fast forward to today and Fox seems to have done a pretty good job. The share price has soared to 212p and debt is down to £56m. Things have improved so much that it's even going to start paying dividends again. If you bought back in 2012, you should have made some big profits by now. So should you bank them? Or hope for more?

Trinity Mirror (LSE: TNI) still has a lot of problems. Sales of its key titles the Daily Mirror, Sunday Mirror, the Sunday People and the Daily Record are still falling, as are sales of its regional titles.

On the more positive side, both Mirror titles are growing their share of the print advertising market, and higher cover prices and cost cutting have helped to limit the fall in revenues.

Digital revenues grew by 47% in the first six months of 2014, although these remain a very small part of the overall business. There's more cost-cutting to come, and the price of newsprint has been falling, which should help profits this year.

But I'm not so sure now. The pension funddeficit has remained stubbornlyhigh at £272m and £36m of cash willhave to be ploughed into it for theforeseeable future in order to get itback on an even keel.

During the last year Trinity Mirrorproduced operating profits of £105.6m.Its enterprise value (market value plusdebt and pension-fund deficit) is £876m,giving it an earnings yield of 12%.

If profits can be kept at this level, a casecan be made for saying the shares arestill cheap. But cost-cutting can only goso far, and with newspaper circulationstill falling, maintaining profits is byno means going to be easy.

So if youhave made big gains from this share,you might want to take some money offthe table. It's going to be a lot harder tomake money from here.

Verdict: take profits

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how