A fantastic investment weapon for private investors

Ed Bowsher explains the 'secret weapon' that could help private investors generate excellent market-beating returns.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

I came across a great piece of investment jargon last week.

Now, that's a pretty rare event for me. I think a lot of jargon just ends up confusing people and doesn't help anyone.

But this latest piece of jargon highlights a crucial advantage that private investors have. And this advantage means there's no reason why private investors can't generate excellent market-beating returns over the long-term.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

What is the jargon?

So what's this piece of jargon I like so much?

It's time arbitrage'.

You've probably heard of arbitrage before. It normally refers to a situation where an asset has different prices in two different markets. So if a company is listed in Paris and New York, and the share price is slightly lower in Paris, an investor can quickly buy in Paris and sell immediately for a higher price in New York. The investor is exploiting a price difference between two markets.

Time arbitrage is a bit different. It's exploiting a difference between the buyer and seller in a transaction their time horizons'.

Many professional investors operate on very short time horizons. In other words, they only anticipate keeping their investments for months, weeks, days or even seconds, in some cases. So in the super-short term, you have the high frequency traders' who use computer algorithms to spot fleeting opportunities. There's no way a private investor armed with a desktop can compete with these guys. Or at least, not if your time horizon is very short.

Your average fund manager isn't a high frequency trader. However, most fund managers' time horizons are too short in my view. That's because most managers are judged on their performance every three or six months. So if a company hits short-term problems, it's hard for your average fund manager to stay invested. Even if a manager is confident that the underlying prospects for the company are fine, the pressure to sell and cut his losses is very strong.

Use time arbitrage to your advantage

The good news is that private investors don't have to worry about any of this. If the value of my portfolio falls over the next year, no one but me is even going to know about it. And if that happens, I'll stay calm because I know I'm playing this game for the long-term.

So if I'm buying a share from a high-frequency trader, I'm exploiting a difference in our respective time horizons. I'm investing for the next 20 years; his horizon is seconds or minutes.

And if I buy a share from a professional fund manager, once again I'm almost certainly investing over a longer horizon than he is regardless of the marketing bilge you'll hear from the fund management company concerned.

As Morgan Housel writes on The Motley Fool:"There's something every mom-and-pop investor can do to gain an edge on the person on the other side of the trade: be willing to wait longer There are few things more powerful in investing than the realisation that the biggest gains tend to accrue to the person who waits the longest."

So if a company says that something has gone wrong, we don't need to panic. One recent example of this is GlaxoSmithKline (LSE: GSK). I've owned shares in this drugs giant for several years, so I wasn't best pleased when the company warned last month that its new respiratory drugs weren't doing as well as hoped. But I didn't stay irritated for too long, because I knew that this profit warning would probably be forgotten by just about everyone in five years' time.

Glaxo will recover, its share price will recover, and I'll continue to receive a great dividend while I wait for that recovery. In fact, I think now is a great time to buy into Glaxo while the shares are relatively cheap.

The other big attraction of time arbitrage is that it reduces the risk of investing in the stock market. Yes, the stock market is risky and volatile. But when you look at stock market history, it's clear that the longer-term trend is up. If you stay invested for ten years or longer, you'll almost certainly experience some sizeable ups and downs, but overall there's a strong chance that you'll make a profit.

And you don't even need to buy individual shares to benefit from this long-term growth. The simplest approach is just to invest in some low-cost index tracker funds that match the performance of a stock market index. So if the FTSE 100 index goes up by 20%, a FTSE 100 tracker fund should go up by roughly 20% too.

Even better, the charges for many index tracker funds are now extremely low. You can read about my favourite index tracker funds in my recent article: A guide to the all-new Nisa. (If you're not a MoneyWeek subscriber, sign up for a four-week free trialand you can read the article in our web archive.)

But whether you go for individual shares or index trackers, remember that time is the investor's best friend.

Our recommended articles for today

Deflation is exactly what Europe needs

Southern Europe is crying out for the money taps to be turned on. Bengt Saelensminde explains how he's lined up to profit when the European Central Bank caves in.

This is the bellwether stock for China

If you're planning to invest in China, you should keep an eye on this stock, says Lars Henriksson.

On this day in history

5 August 1858: the first transatlantic telegraph cable is completed

On this day in 1858, HMS Agamemnon and the USS Niagara completed the mammoth task of laying the first transatlantic telegraph cable.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Ed has been a private investor since the mid-90s and has worked as a financial journalist since 2000. He's been employed by several investment websites including Citywire, breakingviews and The Motley Fool, where he was UK editor.

Ed mainly invests in technology shares, pharmaceuticals and smaller companies. He's also a big fan of investment trusts.

Away from work, Ed is a keen theatre goer and loves all things Canadian.

Follow Ed on Twitter

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

Are GSK’s legal troubles a threat to the firm’s survival?

Are GSK’s legal troubles a threat to the firm’s survival?Analysis Pharmaceutical giant GlaxoSmithKline is facing legal action over heartburn drug Zantac that has seen billions wiped off its market value. Rupert Hargreaves looks at how it might affect the business's prospects.

-

GlaxoSmithKline’s first-quarter figures show the company is on track for the year

GlaxoSmithKline’s first-quarter figures show the company is on track for the yearAnalysis Latest results show that it's business as usual for pharmaceutical giant GlaxoSmithKline. Rupert Hargreaves casts his eyes over the numbers.

-

Why GSK should turn down Unilever’s billions

Why GSK should turn down Unilever’s billionsNews Unilever has offered GSK £50bn for its consumer division. But while the cash will be a temptation, the deal is not in the interests of shareholders or of anyone else, says Matthew Lynn.

-

Unilever slides and GSK bounces after GSK knocks back £50bn bid

Unilever slides and GSK bounces after GSK knocks back £50bn bidNews Unilever shares fell to their lowest level in around five years, after its £50bn takeover bid for GSK’s consumer health unit was rejected.

-

Shake-up at GSK won’t placate investors

Shake-up at GSK won’t placate investorsNews GSK has launched a radical shakeup of its operations, but that's unlikely to satisfy investors unhappy with the drugmaker's perennial underperformance.

-

A show of support for GlaxoSmithKline's hedge fund fight

A show of support for GlaxoSmithKline's hedge fund fightNews Several large shareholders have said that they will support GlaxoSmithKline in its battle with hedge fund Elliott Management.

-

Activist investor Elliott takes takes a stake in Glaxo

Activist investor Elliott takes takes a stake in GlaxoNews Elliott, s US hedge fund, took an undisclosed multibillion-pound stake in GSK last week, driving the share price up by 4.6%.

-

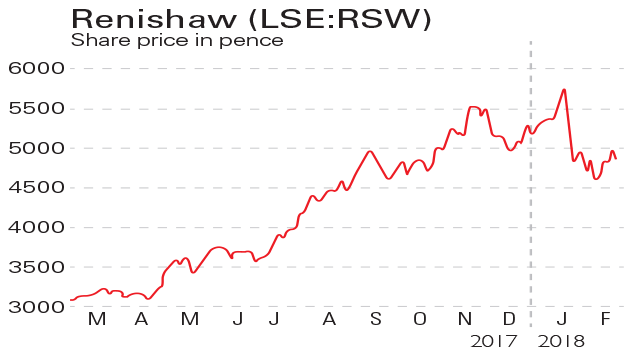

If you'd invested in: Renishaw and GlaxoSmithKline

If you'd invested in: Renishaw and GlaxoSmithKlineFeatures Measuring-equipment maker Renishaw has seen profits leap, but investors are sceptical about the prospects for drugmaker GSK.