Gamble of the week: Dart Group

This package holiday company is not for the nervous, but it could be worth a punt, says Phil Oakley.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The company owns budget airline Jet2.com and Jet2holidays, as well as a logistics business distributing prepared meals to supermarkets.Logistics doesn't make much money for Dart, so investors should focus on the future potential of its airline and packaged holiday business.

The company is led by Philip Meeson, a charismatic former RAF pilot who occasionally courts controversy with his plain speaking. Back in 2009, the police were called to Manchester airport after he lambasted his staff for not dealing effectively with a passenger queue.

Last month he announced that Dart Group did very well last year. It doubled the number of package holidays it sold, while the Jet2.com airline's profits increased by 17% to £31.2m.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

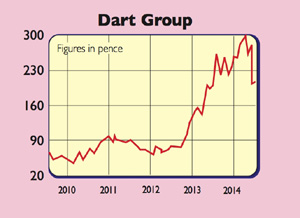

But that's where the good news ended. Sadly, Meeson said that things weren't going so well this year and he expected profits would not meet market expectations. Analysts didn't like this and predicted that earnings per share would fall by a third to 16.6p. The shares tanked by almost the same amount and have not recovered.

Investors often feel that profit warnings are an act of betrayal and head for the exit. Sadly, they are just a fact of business life. They can throw up decentopportunities for bargain hunters if there's a chance that profits willbounce back.

Dart's business model is based on selling package holidays and flights from airports across the north of the country. It has grown rapidly in recent years and now has a fleet of 55 planes. It's seeking further growth by expanding the number of destinations it flies to think sunny Mediterranean resorts and popular European cities.

The risk with travel and airline companies is that they put too much capacity onto the market and have to slash prices to fill it. Bigger companies, such as TUI Travel and Thomas Cook, have made this mistake. However, Dart has done well so far. It's kept its planes full (91% load factor) without slashing prices.

Analysts expect Dart's earnings per share to bounce back to over 25p in two years' time. At 208p, that would put the shares on a price-to-earnings ratio of 8.3 times. These shares are not for the nervous, but could be worth a punt.

Verdict: buy

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how