Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

A good way to make money from shares is to invest in what are known as turnarounds. These are companies that have got themselves into trouble and are looking to get out of it by following a plan of action. The shares of troubled companies initially get hammered when there is bad news, but can soar if profits eventually recover.

This can often be a better investment strategy than buying quality blue-chips, but it comes with significant risks if the turnaround plan fails.

This insurance company, whichfits into this category quite well, sells its insurance products under the brand name More Than. The share price of RSA Insurance Group (LSE: RSA)was hammered by an accounting scandal in its Irish business, which led to its dividend being scrapped.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The company had to go cap in hand to its shareholders for more money a hefty £773m to shore up its finances.Stephen Hester the man who tried to fix Royal Bank of Scotland, with some success has been brought in to get the company back on an even keel.

He's cleaning the company up by slashing costs and selling off smaller overseas businesses. He's also getting out of less profitable insurance contracts in areas such as car insurance so that RSA can focus on what it does best.

The company makes good money in places such as Scandinavia and Canada and has decent growth prospects in Latin America, but it really needs to do better in the UK.

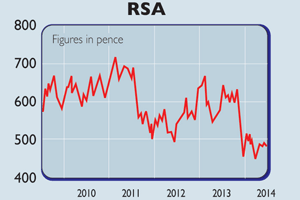

RSA's share price has stabilised in recent months, but is still 25% lower than it was a year ago. Insurance is a very competitive business and investmentreturns are low, so Hester will have hiswork cut out to get RSA's profits growingagain.

If his strategy succeeds, then RSA will bea much better and less risky business.After losing money in 2013, RSA istargeting a return on shareholders'equity of between 12% and 15% over themedium term.

That would be a decentresult. Shareholders won't see much ofa dividend in 2014, but could see a bigincrease in dividend payments to over20p per share by 2016 if Hester's planworks that would give a yield of about4.3% on the current share price.

RSA's shares are not deeply depressedat the moment. At 468p, they tradeat 1.14 times their expected book (netasset) value of 410p. Rival Aviva tradeson 1.6 times.

If RSA becomes less riskyand its book value gets bigger, there's adecent chance the stock market will putthe shares on a higher multiple of bookvalue. If so, you could make money bybuying the shares at 468p as long asyou are prepared to be patient.

Verdict: worth a punt

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how