Gamble of the week: a throwback to the old days

There's a lot to like about the approach of this Midlands metal basher, says Phil Oakley.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

This Midlands metal basher is a throwback to the days when companies just got on with their own business and spent little time wooing the suits in the City.

For over 50 years, the maker of castings that end up in big heavy trucks has been under the influence of executive chairman Brian Cooke by all accounts a no-nonsense kind of man who apparently prefers paper records to computers and doesn't like talking to the City that much.

There's a lot to like about this what you see is what you get' approach. The company also has a reputation for being very prudent with its accounts, which is always welcome. However, when it comes to investing, it all boils down to whether a company is any good at serving its customers and if you can buy its shares for the right price.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

That said, Castings remains a risky business for investors. It's very good at what it does, but the demand for trucks tends to fluctuate a lot, depending on the economy. For Castings, this primarily means the European economy, which has been struggling for some time now. The other factor is the increasing clampdown on emissions from truck engines. This has been very helpful recently as a new standard (known as Euro 6) introduced this year saw a surge in orders for late model trucks before it was introduced.

Manufacturing companies such as Castings have a lot of fixed costs bills that have to be paid whether the foundries are running at full capacity or have plenty of slack. This means that their profits are very sensitive to small changes in sales levels.

Castings grew its profits nicely last year as it had lots of work to do. This year is a little less easy to predict as orders from truck makers have slowed down a bit. However, Castings expects demand to pick up in the autumn and winter months. The strength of the pound is another concern.

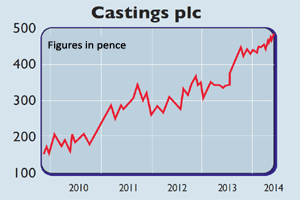

The shares have done well over the last couple of years and are certainly not depressed, trading on just over 12 times next year's earnings. However, despite some uncertainties, I expect Castings' profits to benefit from a recovering European economy, which means its shares could still go higher over the next few years.

Verdict: buy at 472p

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how