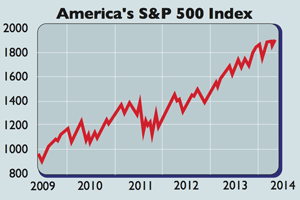

Stocks march to record highs

Stock markets have reached new highs, pushing the gold price down to a three-month low.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

US stocks, which tend to set the tone for world markets, hit a new record this week, as the S&P 500 index climbed above 1,900.

Meanwhile, European stocks hit a new six-year high (measured by the FTSE Eurofirst index).And Japan's Nikkei perked up to its highest level since April. The good news pushed gold down to a three-month low, below $1,300 an ounce.

What the commentators said

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Markets also focused on the positive aspect of the European elections: Italy's reformist government held out against the populists.

Yet this good cheer could evaporate quickly a correction looks overdue.In the last few years, stocks haven't been driven by profit growth but by valuations in other words, investors have been willing to pay more for a given pound of earnings. The fundamentals need to catch up, says Stephanie Deo of UBS. Yet, first-quarter results haven't been great.

So, earnings disappointments look inevitable, especially with overoptimistic forecasts. Profits for companies in Germany's DAX index, for instance, are expected to jump by 20% in the first quarter of 2015.

Any escalation in Ukraine could also damage the rally, while analysts may also be underestimating the impact of the end of China's property bubble. Throw in alarming levels of insider sales in Europe and the US, notes Wirtschaftswoche, and the rally looks ever more precarious.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how