Shares in focus: A good time to be a landlord

Property company Segro has already rewarded investors, says Phil Oakley. Is there any value left in the shares?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Britain's commercial property market is in rude health so is it time to buy in? Phil Oakley investigates.

Real-estate investment trust Segro (formerly known as Slough Estates) specialises in owning, managing and developing warehouses, industrial properties, out of town offices and data centres. Its properties, mainly located in the UK, have a market value of £4.1bn.

It also has warehouses and industrial properties in Europe, mainly focused on France, Germany and Poland.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

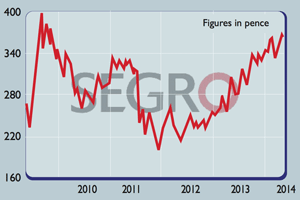

Over the past decade, Segro was a serial underperformer compared with other quotedproperty companies. It was seen to be unfocused with too many low-quality assets and too much debt. In 2011, it set about sorting itself out and has been quite successful in doing so.

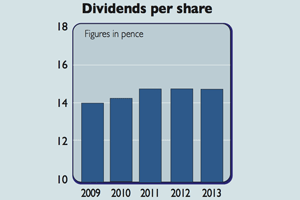

Weaker rental properties have been sold and debt has come down. This, combined with a buoyant UK commercial property market, has seen investors rewarded with a higher share price and a decent dividend income. So is there any additional value left?

The outlook

In a world of low interest rates, the higher yields offered by the rental income from offices, shopping centres and warehouses has attracted a lot of investor interest. But can values keep on rising?

In theory, building a more valuable property business looks to be relatively straightforward. You buy land and properties in the right locations to attract good quality tenants to fill them and pay their rent on time.

In practice this is easier said than done. Segro hasn't always been good at this, due to the fact that it has been weighed down by too many poorly located properties, which meant not enough companies wanted to rent them out.

The good news is that Segro has been getting rid of these poorly located properties, with £1.1bn of sales over the last couple of years. There's still around £400m worth to be sold, but Segro is undoubtedly in much better shape with a better quality property portfolio and lower levels of debt its loan to value ratio fell from 51% to 42% last year. This has made the business less risky for investors.

Segro needs to start growing its rental income again, and the outlook seems promising. With a large chunk of its portfolio located in the southeast of England (25% in Slough), it is well placed to profit from a recovering UK economy and growing investor appetite for high yielding property assets.

A key driver of growth is the increase in online shopping and retailers' need to have their goods close to the end customer. Segro has been buying up land to capitalise on this. It has done some of this speculatively (with no tenants signed up), but elsewhere it has developments that will give yields on investments of close to 10% when they are fully let.

Europe has been more problematic for Segro especially France, which has been a particularly depressed market. The company is looking to de-risk its European assets by going into partnership with a Canadian pension fund.

It has put most of its European warehouses and distribution centres €1bn of them into a joint venture and is looking to double this over the next three to five years. It has also already bought up a chunk of well located pre-let warehouses in Germany and Poland, where growth prospects and the outlook for property values are much more favourable.

Should you buy the shares?

However, the 4.2% dividend yield remains attractive. Segro has more work to do on filling up its properties. Its vacancy rate of 9% is too high and this needs to come down, with a target set nearer to 6%. Doing this will also help its cost ratio (costs as a percentage of rental income) come down from 24% to nearer 20%.

For investors to make money from owning the shares at the current price, the company is likely to need more valuation gains. This will come from what is known as yield compression where buyers of real estate are prepared to pay more for a rental income, pushing up the price of the property and lowering its yield.

Warehouses and industrial properties are arguably more exposed to the ups and downs of the economy than offices are, and therefore offer higher yields toattract investors.

Segro's properties have a yield of just over 7% at the moment, compared with West End offices offering 3.75%. While Segro's yields will not fall to West End rates, there is arguably more value in their properties and this could see further valuation gains.

With Segro shares trading at more than their net asset value, a lot of the good news is probably priced in. But with interest rates likely to stay low for the foreseeable future and with Segro'sself help and new investments likely to boost income, the shares could have further to run. For me, that makes them a buy.

Verdict: buy

Segro (LSE: SGRO)

What the analysts say

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge