France is a mess – but it might not be as bad as you think

France’s economy is struggling. But there are some glimmers of hope, says Ed Bowsher. And that could spell opportunity for investors in Europe.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

It's no secret that France is struggling.

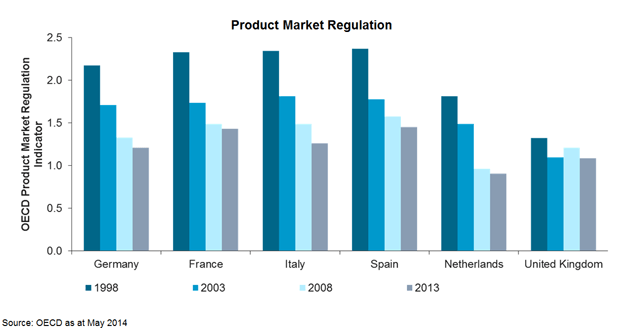

The public sector is too big. Regulation is too tight. In fact, it's one of the only countries in Europe to have become even more heavily regulated in the last 20 years or so.

Given that it's the eurozone's other most important economy alongside Germany that doesn't seem to bode well for Europe's future.

Article continues belowTry 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But there could be some glimmers of hope and that could spell opportunity for investors in Europe.

It's even worse than I thought

Last week, I went along to a presentation on France from Legal & General. I was surprised to learn that the country at least in some ways is in an even bigger mess than I'd thought.

One big problem is there isn't enough competition in the French economy. There are too many monopolies and cartels, so it's very hard for new businesses to compete against established players.

To use the jargon, France's product market is too heavily regulated. In fact, if you look at the chart below, you can see that of the major EU economies, France has the most heavily regulated product market. Spain is the only country that comes close.

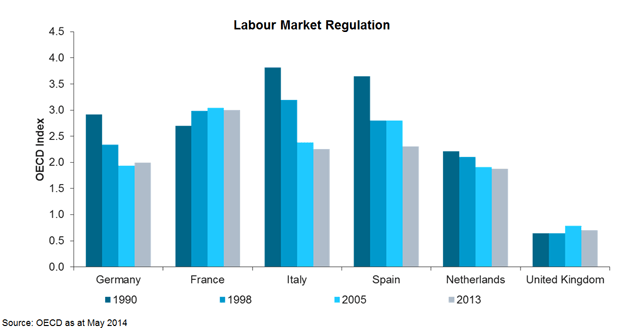

France's labour market is just as sclerotic. The regime offers strong protection for those who have jobs. But as a result, many employers are reluctant to take on extra staff unless it's absolutely essential for their business.

Here's just one example that explains why: redundancy can be contested on the basis that an employer is in the black. In other words, if your business turns a profit, it's hard to lay off staff, regardless of the reasons for doing so.

Rich country think tank the OECD reckons that France has the tightest regulation of all the major economies. That might not surprise you. But the OECD also points out that regulation is actually tighter now in France than it was in 1990.

Now, I knew already that France had a heavily regulated labour market, but I was surprised that regulation has actually tightened over the last 24 years. France has gone completely against the trend in other developed markets.

Britain is the only other country that has tightened labour market regulation since 1990. But as the chart above shows, the overall level of regulation is way lower than in France (or anywhere else for that matter).

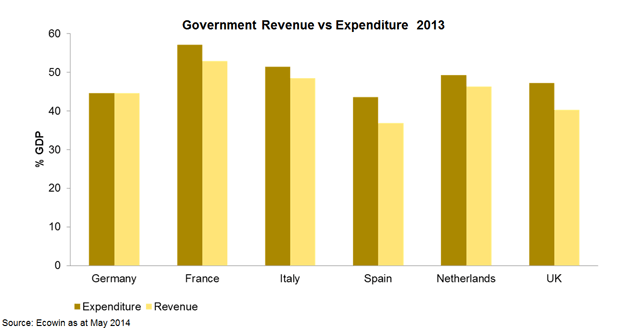

France has a long history of generous welfare provision and a large public sector, but the chart below really underlines the level of public sector dominance across the channel.

As you can see, tax revenue is swallowing up more than half of French GDP, but that's still not enough money to cover all government spending France has a sizeable budget deficit.

It's hard for the private sector to flourish with such high levels of tax. That's one reason why private sector output in France is still below pre-crisis levels, even although overall GDP has recovered.

There are glimmers of hope for France

That's all pretty gloomy. But there are some glimmers of hope that suggest things could start to improve for France.

In the short term, French president Franois Hollande has proposed some market reforms, such as a system of flexi security'. Companies would be given more leeway to reduce working hours when times are tough; in exchange, they would retain more staff.

That might not sound like much. But French governments have backed down from previous reform attempts in the face of public opposition. So if Hollande can actually drive through these reforms, it will be a watershed.

And rightly or wrongly, Legal & General thinks that French public opinion is moving in this direction.

There's also a glimmer of hope for the long-term: demographics.

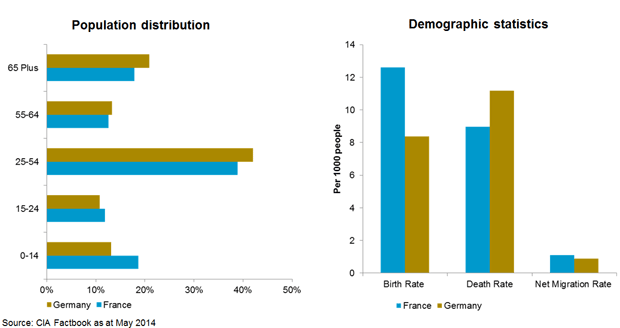

You can see French (blue) and German (mustard) population trends in the charts below. Germany has a bigger population in all age groups from 25 upwards, but it's a different story among the under-25s. France also has a higher birth rate.

In short, France has a sustainably younger population than Germany. And in the long run, this should be good news for France especially if a more liberal labour market enables French businesses to employ this young workforce properly.

This could be good news for the eurozone as a whole

So do these two glimmers of hope mean we should all pile into French shares? Perhaps via the Lyxor ETF Cac 40 (France: CAC)?

I'm not going to do that not yet at least. The glimmers of hope are still glimmers. If the French market was especially cheap, that might be enough to get me buying. But it's hardly trading at bargain levels right now it's not mega-expensive, but it's not a screaming buy either. So I don't see any reason to focus on the French stock market on its own.

But I do still feel slightly more positive on France than I was, and that just strengthens the case for investing in the eurozone as a whole.

We've been bullish on eurozone stocks for a while now, particularly the dodgy' troubled markets, such as Italy. And share prices could get a real kick upwards if the European Central Bank decides to print money' via quantitative easing (QE) this year. You can read more about this theme in our recent cover story in MoneyWeek magazine: Merkel's victory will give a boost to European markets(If you take out a trial subscription, you'll get four free editions of the magazine, plus full access to our web archive, including this article.)

But more importantly, if France does implement serious economic reforms, there will be all the more reason to hold your eurozone investments for the long term not just to take advantage of the things aren't as bad as expected' trade.

Our recommended articles for today

Why AstraZeneca should reject Pfizer's takeover bid

Dr Mike Tubbs explains why a takeover of AstraZeneca would be bad for British research and development and why Pfizer can't be trusted.

The pension big bang

In his latest video tutorial, Ed Bowsher looks at what the 'pension big bang' is all about, and how it might affect you.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Ed has been a private investor since the mid-90s and has worked as a financial journalist since 2000. He's been employed by several investment websites including Citywire, breakingviews and The Motley Fool, where he was UK editor.

Ed mainly invests in technology shares, pharmaceuticals and smaller companies. He's also a big fan of investment trusts.

Away from work, Ed is a keen theatre goer and loves all things Canadian.

Follow Ed on Twitter