Shares in focus: Can N Brown raise its game?

Clothes retailer N Brown Group has great prospects, but are the shares cheap enough to buy now? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The shares aren't cheap, but could theybe a good buy for the long run? Phil Oakley investigates.

When thinking about clothing retailers, N Brown Group probably isn't the first name that springs to mind. It doesn't have a high profile and there's a good reason for this: it is plying its trade in a more specialised area: clothes and footwear for larger people. Its core brands trade asJD Williams, Jacamo and Simply Be.

The company started out as a catalogue retailer and has now successfully shifted over to the internet. It occupies a very profitable niche and does not have lots of competition. As most of its sales are made on credit, it is also able to charge interest on outstanding balances.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

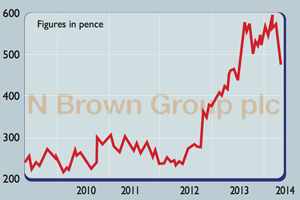

A good track record for growing sales and making decent returns on its investments has seen the stock market place a much higher value on the company's shares over the last couple of years.

But there is a worry among some City analysts that sales in the years ahead won't grow as quickly as previously expected. This has led to a sharp fall in the share price over the last fortnight. So, should you give the shares a miss, or is N Brown a solid long-term investment?

Who buys from N Brown?

It has proved popular with older women looking for larger dresses and men looking for big shoes the kinds of products that are difficult to find in mainstream fashion shops. It has also built up a sizeable home products business focusing on items such as bedding, homeware and family gifts.

The outlook

It has made its websites easier to use and has cut delivery times. However, a key part of its strategy in the UK has been to boost its presence on the high street at a time when other retailers are looking to scale theirs back.

Sales over the internet accounted for 58% of sales last year, with the company aiming to get this up to 70% over the next few years. That said, N Brown believes that a high-street presence will help boost the number of customers on its books.

It is putting a lot of investment behind its Simply Be brand, which specialises in fashion for younger women, and Jacamo (TV advertisements for which star cricketer Andrew Flintoff), which sells larger clothes and footwear to men.

These two brands tend to be found under the same roof. There are nine stores open at the moment, with a target of 25, including one in Oxford Street. These shops are not currently helping to grow N Brown's profits, but with sales growing rapidly, it won't be long before they do. The stores also help to attract more customers who want to pay with cash rather than take credit.

A foray into the American market is at an early stage. The company has had some teething troubles with deliveries to customers, but these are being sorted out. Losses went up last year, though, and it could be a while before profits are made.

The company's roots are with itsJD Williams womenswear business,selling larger fashions to older women. This has not been doing too well in recent years, with sales on a downward trend. That said, chief executive Angela Spindler is upbeat about the prospects for this part of the business.

She reckons that the combination of an ageing population, larger dress sizes and the growth in internet shopping should see this business do well. It is being relaunched later this year and has the potential to boostN Brown's profits.

Pitfalls to look out for

This requires strong finances, as growing sales usually means growing credit and receivables, which means N Brown has to wait for its cash. Not that this company is under any financial strain, with the interest payments on its debts covered more than 15 times by its trading profits.

Bad debts are also an issue and currently amount to 8% of sales. That is a big number, but it is coming down after tighter credit terms have been introduced. This should boost profits. Should N Brown succeed with its strategy, then it reckons that sales will be growing by more than 10% in its 2015/2016 financial year.

In the meantime, City analysts are forecasting that earnings and dividends should grow by around 8% this yearand next.

It's true that on 15 times next year's earnings, shares in N Brown are no bargain. However, the company'sbusiness model and favourable demographics suggest that it could bea decent home for your money over the long run.

Verdict: a long-term buy

N Brown Group (LSE: BWNG)

Directors' shareholdings

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Japanese stocks rise on Takaichi’s snap election landslide

Japanese stocks rise on Takaichi’s snap election landslideJapan’s new prime minister Sanae Takaichi has won a landslide victory in a snap election, prompting optimism that her pro-growth agenda will benefit Japanese stocks

-

Alphabet 'is planning a 100-year bond': would you back Google for 100 years?

Alphabet 'is planning a 100-year bond': would you back Google for 100 years?Google owner Alphabet is reported to be joining the rare century bond club