Warren Buffett’s best advice – and two stocks to go with it

Ed Bowsher explains the idea behind Warren Buffett’s '20-stock punchcard' investment theory, and highlights two companies that fit the bill nicely.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Around 30,000 investors will flock to Nebraska this weekend to hear Warren Buffett's latest words of wisdom at the Berkshire Hathaway annual meeting.

I'd love to be there myself; Buffett is often pretty funny. More importantly, I'd almost certainly learn something from the world's top investor.

This weekend's meeting has prompted me to think a lot about Buffett in the last few days. And my mind keeps going back to what I see as one of his best ideas the 20-stock punchcard'.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Today I want to explain what this idea is all about. I'll also highlight a couple of companies that I think would be good punchcard' stocks.

What is the investment punchcard?

"I could improve your ultimate financial welfare by giving you a ticket with only 20 slots in it so that you had 20 punches representing all the investments that you got to make in a lifetime. And once you'd punched through the card, you couldn't make any more investments at all.

"Under those rules, you'd really think carefully about what you did, and you'd be forced to load up on what you'd really thought about. So you'd do much better."

Now I should say straight away that Buffett has made more than 20 investments in his lifetime.

So have I. Way more.

But I like the punchcard idea. Because I know that I've made too many investments on a hunch' in the past, without doing enough thinking or enough research. Sadly, many of these whim-driven investments didn't work out well for me.

I'm not suggesting that you literally can't invest in more than 20 shares during your lifetime. I just think it's a good mindset to be in. You could pretend to yourself that you really don't have many opportunities to invest.

Equally importantly, following this approach won't just help you avoid disasters. It should also force you to invest for the long term and keep your trading costs right down.

An imaginary punchcard should encourage you to focus on your best investment ideas and back them heavily. Of course, you need to diversify I certainly wouldn't recommend you pile all your money into, say, just two stocks that you're convinced are sure things.

But studies suggest that if you go much beyond a portfolio of around 16-20 stocks, you're almost as well to simply invest in a tracker fund. The best active fund managers also tend to run very concentrated portfolios compared to their peers.

So as you get more experienced, I think you can start to back your best ideas more heavily. This is an especially attractive strategy if you invest in some passive funds at the same time to give you some broad stock market exposure.

Two investments for my punchcard

My first choice is Starbucks (Nasdaq: SBUX). I like Starbucks because it's a very powerful brand with plenty of potential for further growth.

You might think that's a ridiculous statement, given the number of Starbucks cafes that already exist in North America and the UK. But there are two things I'm particularly excited about.

Firstly, I think that Starbucks' current programme to improve its food offer will deliver a significant boost to sales. You just need to look at the winners and losers in the pub sector to see what a huge difference better food can make to sales.

Secondly, I'm also excited by Starbucks' Teavana business. Teavana is a chain of cafes and stores that sell high-end teas in North America. I visited a couple of Teavana outlets last month while on holiday and I was pretty impressed. Teavana teas will soon to start to appear in some Starbucks cafes.

If you're wondering "who's daft enough to shell out for a fancy cup of tea?" then you just need to remember that people were saying exactly the same thing about coffee a decade ago.

I also liked Starbucks' recent second quarter results. Same-store sales rose by 6% while total sales went up by 9%. Even better, earnings per share rose by 17%. That was partly due to a rise in the operating margin to 15.1%.

Admittedly, Starbucks trades on a high price/earnings ratioof 26. But I'm happy to pay a full price for a global success story that should continue to perform well for many years to come.

This Big Pharma stock is a keeper

GlaxoSmithKline (LSE: GSK)

The crucial point is that Glaxo has an attractive drug pipeline. That means its prodigious cash flow should be sustainable in the long term. As Glaxo's current drugs gradually lose their patent protection, new products should come through to replace them fairly smoothly.

Glaxo's recent deal with Novartis is another plus point. Basically, Glaxo is swapping its cancer division in return for the Novartis vaccines division. It makes sense for Glaxo to focus on its strengths, and boost its profits as a result.

In case you're wondering, I doubt that any pharmaceutical firm will launch a bid for Glaxo as has happened with AstraZeneca (LSE: AZN). Glaxo is a fair bit bigger than Astra, and it would be tough for any company to absorb such a large firm.

But Pfizer's bid for Astra does highlight that there is a lot of hidden value in the pharmaceutical sector, and that should eventually boost Glaxo's share price.

So if I had a punchcard, I'd buy shares in Glaxo and Starbucks as my first two selections. Then I'd have to resist the temptation to buy anything else for some time to come.

By the way, if you like the idea of a 20-investment punchcard, then you should maybe take a look at our Dividend Letter investment strategy. It's not explicitly based on Buffett's principles, but the overall point is to build a low-stress, diverse but compact portfolio, that delivers a healthy income over the years. You can find out more about it here.

Our recommended articles for today

These guys are the Navy SEALs of IT nerds

Tap in to water stocks

As water supplies dwindle and demand increases, firms addressing the problem will profit handsomely. John Stepek and Matthew Partridge look at the best ways to profit.

The Dividend Letter is a regulated product issued by Fleet Street Publications Ltd. Your capital is at risk when you invest in shares; never risk more than you can afford to lose. Past performance is not a reliable indicator of future results. Please seek independent financial advice if necessary. Customer Services: 020 7633 3600.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Ed has been a private investor since the mid-90s and has worked as a financial journalist since 2000. He's been employed by several investment websites including Citywire, breakingviews and The Motley Fool, where he was UK editor.

Ed mainly invests in technology shares, pharmaceuticals and smaller companies. He's also a big fan of investment trusts.

Away from work, Ed is a keen theatre goer and loves all things Canadian.

Follow Ed on Twitter

-

Are money problems driving the mental health crisis? MoneyWeek Talks

Are money problems driving the mental health crisis? MoneyWeek TalksPodcast Clare Francis, savings and investments director at Barclays, speaks about money and mental health, why you should start investing, and how to build long-term financial resilience.

-

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change looms

Pensioners ‘running down larger pots’ to avoid inheritance tax as rule change loomsChanges to inheritance tax (IHT) rules for unused pension pots from April 2027 could trigger an ‘exodus of large defined contribution pension pots’, as retirees spend their savings rather than leave their loved ones with an IHT bill.

-

Are GSK’s legal troubles a threat to the firm’s survival?

Are GSK’s legal troubles a threat to the firm’s survival?Analysis Pharmaceutical giant GlaxoSmithKline is facing legal action over heartburn drug Zantac that has seen billions wiped off its market value. Rupert Hargreaves looks at how it might affect the business's prospects.

-

GlaxoSmithKline’s first-quarter figures show the company is on track for the year

GlaxoSmithKline’s first-quarter figures show the company is on track for the yearAnalysis Latest results show that it's business as usual for pharmaceutical giant GlaxoSmithKline. Rupert Hargreaves casts his eyes over the numbers.

-

Why GSK should turn down Unilever’s billions

Why GSK should turn down Unilever’s billionsNews Unilever has offered GSK £50bn for its consumer division. But while the cash will be a temptation, the deal is not in the interests of shareholders or of anyone else, says Matthew Lynn.

-

Unilever slides and GSK bounces after GSK knocks back £50bn bid

Unilever slides and GSK bounces after GSK knocks back £50bn bidNews Unilever shares fell to their lowest level in around five years, after its £50bn takeover bid for GSK’s consumer health unit was rejected.

-

Shake-up at GSK won’t placate investors

Shake-up at GSK won’t placate investorsNews GSK has launched a radical shakeup of its operations, but that's unlikely to satisfy investors unhappy with the drugmaker's perennial underperformance.

-

A show of support for GlaxoSmithKline's hedge fund fight

A show of support for GlaxoSmithKline's hedge fund fightNews Several large shareholders have said that they will support GlaxoSmithKline in its battle with hedge fund Elliott Management.

-

Activist investor Elliott takes takes a stake in Glaxo

Activist investor Elliott takes takes a stake in GlaxoNews Elliott, s US hedge fund, took an undisclosed multibillion-pound stake in GSK last week, driving the share price up by 4.6%.

-

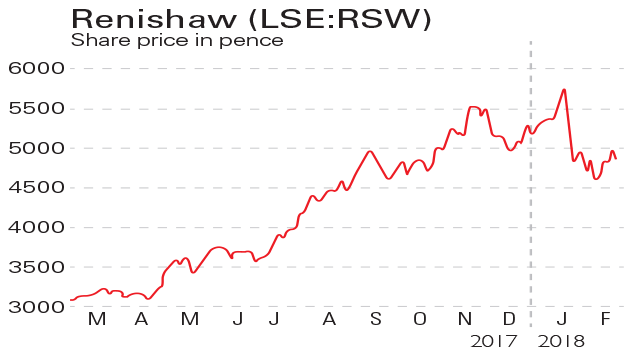

If you'd invested in: Renishaw and GlaxoSmithKline

If you'd invested in: Renishaw and GlaxoSmithKlineFeatures Measuring-equipment maker Renishaw has seen profits leap, but investors are sceptical about the prospects for drugmaker GSK.