Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The value of a nation's currency is influenced by many things, but the outlook for interest rates and economic growth play a big part.

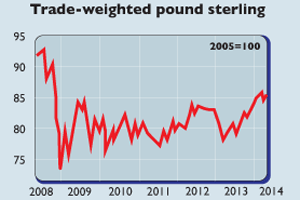

Last week, the sterling index (which measures the value of the pound against the currencies of our major trading partners) hit its highest level since the endof 2008 (see chart).The pound also was at its highest against the US dollar in four and a half years.

The reasons for this strength are fairly straightforward. The economy is growing strongly. The unemployment rate has fallen below the 7% threshold once put forward by Bank of England governor Mark Carney as a cue to consider raising rates.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Wages are (finally) growing faster than inflation if you use the headline Consumer Prices Index (CPI) measure at any rate. And house prices are rising at their fastest rate for years, albeit skewed towards a bubbly London market.

As a result of all this, some analysts believe the Bank will finally have toraise interest rates to cool the economy down. Economists at Nomura and Santander, for example, think the Bank base rate will hit 1.75% by the end of 2015, compared to just 0.25% now.

Just as savings accounts with higher interest rates are more popular, currencies with higher interest rates (assuming the economy is also doing reasonably well) also tend to attract investors, which explains why the pound has been rising.

CPI rose at an annual rate of just 1.6% in March, below the Bank's central target of 2%. The Bank is also keenly aware that many households still have very high levels of debt and could not cope with rates much higher than they are now.

Then there's the issue of the value ofthe pound itself. Several companies most recently, fashion brand Burberry are complaining that its strength is making their products more expensiveon world markets, and hitting their profits.

Minutes from the Bank's latest rate-setting meeting (in April) also highlighted the lack of inflationary pressure, while the vote to keep rates on hold was unanimous.

All in all, says Capital Economics, "it still seems unlikely that the Monetary Policy Committee will raise interest rates within the next year or so". A further rise in the pound is by no means certain.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.