Gamble of the week: A classic cyclical stock

Place your bets on the global recovery with this electronic components company, says Phil Oakley.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

This is a classic cyclical stock. The company distributes electronic components that are bought by design engineers across the world to go into pretty much any product that relies on electronic technology.

As a result, this stock's fortunes are closely tied to the ups and downs of the world economy and the pace of innovation in new electronic products. The theory goes that as the economy picks up, more customers should be buying components from it. This in turn means moreprofits, bigger dividends and a rising share price.

On top of this, it should also benefit from the ongoing pressure on companies to be as lean as possible. Piling up stocks of components in warehouses burns cash ideally companies should be ordering them in from distributors for delivery at one day's notice.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

This is the role that Premier Farnell (LSE: PFL)tries to fill, and it seems to do a pretty good job of it. It currently sells more than 500,000 products sourced from over 3,500 suppliers to customers all over the world. It is beefing up its business so that more of it takes place online, which makes it easier for customers to source.

The plan is for Premier Farnell to become a global go-to company for all customers' component needs. If it can achieve this goal , it will take a bigger slice of the market from smaller local distributors and make more money.

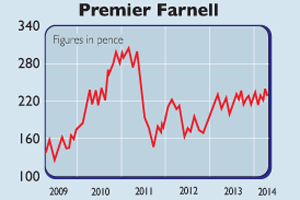

However, it's been a rocky ride for shareholders in recent years. The share price is very sensitive to changes in sentiment about the health of the globaleconomy. Any disappointments in salesand profits have been punished hard bythe market.

Having bounced at the end of 2013, thecompany's shares now seem to be stuckin a bit of a rut. Some investors aredisappointed that profit margins are notincreasing. The company says this isdue to extra investment and that theywill go up if markets are kind to them.

That leaves us with the share priceof 226p, which equates to 14.7 timesexpected earnings. That's not dirt cheapby any means, but if business picks up,then profits and the share price couldmove higher from here.

Verdict: a risky punt

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.