Share in focus: Will DIY make a comeback?

Phil Oakley looks at how the housing market has affected business for Kingfisher, and whether now is the time to buy into the home improvement group.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The B&Q owner isn't doing badly, but should you wait for a better entry point? Phil Oakley investigates.

Kingfisher is best known in Britain for its B&Q chain of do-it-yourself (DIY) stores and its Screwfix business. It is Europe's biggest DIY retailer and the third largest in the world.

A big expansion push over the last decade or so has seen it buy up French company Castorama in 2002, as well as entering emerging markets such as Turkey, China and Poland. Kingfisher's profits fell sharply when the financial crisis hit in 2008.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

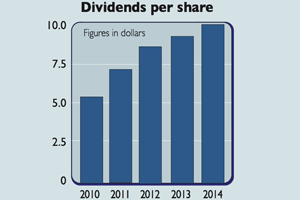

Burdened with debts of £2.2bn, it had to slash its dividend and get its house in order.It has done a good job in sorting itself out by cutting costs and implementing a sharper retailing strategy. Now the good times seem to be back, with a recovery in UK housing possibly boosting people's redecorating zeal.

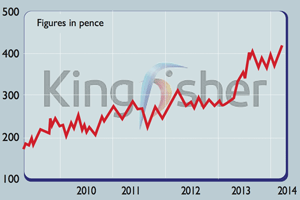

The share price has more than doubled over the last five years, while the dividend will probably exceed its pre-crisis level this year. So, has the easy money been made with Kingfisher shares, or is there more to go for?

The outlook

But now, with the UK housing market steaming ahead again, there could be good news for B&Q's sales and profits, right? Unfortunately, it's not as simple as that.

While people may once again be able to borrow money against the value of their property, it's fair to say that most of the activity in the housing market has to do with new houses. This doesn't tend to generate that much in the way of spending on DIY.

B&Q's sales have started growing again after a few years of decline, but it still faces a lot of challenges. Just like the big supermarket chains, B&Q has lots of large stores that need to be paid for, while more and more people want to buy goods over the internet.

Kingfisher therefore has to manage its stores carefully. One way it could do this is to focus them more on the increasingly popular "click & collect" method of shopping. A revamp of itsDiy.com website should be helpful here.

How is it faring globally?

With lotsof scope to open in more locations,the outlook for this part of the DIYworld is good. Sharing ideas with the B&Q business could bear fruit too. Screwfix is going to be tried out in Germany a notoriously difficult market and it will be interesting to see how it gets on.

The big problem for Kingfisher isFrance, where it makes most of itsmoney. France remains one ofEurope's struggling economies, with unemployment still high and where there is little sign of households deciding to spend more money on DIY.

Kingfisher is looking to invest more in this market by buying out Mr Bricolage, a competitor. This should help boost profits to some extent, but will not make that much of a difference to Kingfisher as a whole.

Elsewhere, its business in Poland is doing very well, with good growth in profits. However, its investment in China is not paying off and is still losing money. Kingfisher seems to have misread the potential for DIY in China and is looking for a partner for its business there.

Stores in Russia and Turkey are doing well, but at the moment are making only modest contributions to profits. As long as the economy stays sound, it would seem that Kingfisher is well placed to keep growing its profits and dividends. It is in good financial shape too.

However, because it rents most of its stores, it does have a lot of hidden debt in the form of future rent commitments. But even so, its current profit means that it can comfortably pay its rent bill for now.

The company is very proficient at generating surplus cash flow when times are good. After paying interest, tax and all its investment spending, it had more than £500m left over last year, which comfortably funded the £224m paid out in dividends.

Kingfisher's confidence in its cash flow is so good that it is going to pay more of it to shareholders, starting with £200m this year. It hasn't yet said how it will do this (share buyback or a special dividend), but whatever method it ends up employing will probably lend some support to the share price.

However, Kingfisher shares don't look particularly cheap right now, trading at over 16 times next year's earnings.

The dividend yield of 2.6% is respectable, but nothing to write home about.The relatively high price of the shares probably means that a share buyback is not really in the best interest of shareholders, as it will not generate a decent equivalent return, so a special dividend would be a better way topay them.

Kingfisher shares have gone up by 45% during the last year and it's difficult to see further strong gains from the current price in the short term. The business is doing reasonably well though and so selling the shares right now doesn't make sense unless you believe the stockmarket is due for a sharp fall.

That said, we wouldn't buy the shares either at the moment. 350p-375p looks like a better entry point.

Verdict: hold

Kingfisher (LSE: KGF)

Directors' shareholdings

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge