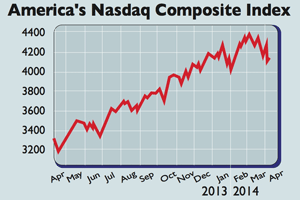

Equities run out of steam

Heavy selling has seen stock markets fall from their multi-year highs.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

No sooner had stock markets climbed back to record or multi-year highs late last week than they had another US-induced attack of vertigo. Technology stocks led the sell-off, with America's tech-heavy Nasdaq index losing almost 5% in three days. The world's 14 biggest internet companies have now lost 20% of their value in little more than a month.

The S&P 500 slipped into the red for the year early this week. Britain's FTSE 100 suffered its worst day in a month on Monday. Three UK e-commerce stocks, recently-listed Just Eat and AO World, plus Asos, fell by 6%-14% in two days.

What the commentators said

But tech bubble 2.0' isn't the only factor spoiling investors' risk appetite. China's slowdown, the increasingly tense stand-off in eastern Ukraine, and the US Federal Reserve's ongoing tapering aren't helping. Earnings forecasts have fallen, with S&P 500 first-quarter earnings expected to come in 3% below last year's tally.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

At the start of the year, 2% profit growth was expected. A rapid jump is unlikely any time soon. A key problem is that profit margins are already at a record high, leaving sales growth to power profits, and the US and global economy are only recovering gradually.

In cyclically adjusted terms (which takes a longer view of earnings), it is more than 50% overvalued compared to the long-term average.

Be afraid, said Lahart. Market sell-offs typically have an identifiable trigger, such as the release of a lousy piece of economic data. "Share prices crumbling just because prices have reached a point where investors can no longer stomach them can signal real trouble."

When the big bear market began in March 2000, after the first tech bubble burst, there was "no compelling cause".

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.

-

How to navigate the inheritance tax paperwork maze in nine clear steps

How to navigate the inheritance tax paperwork maze in nine clear stepsFamilies who cope best with inheritance tax (IHT) paperwork are those who plan ahead, say experts. We look at all documents you need to gather, regardless of whether you have an IHT bill to pay.