The London property bubble’s days are numbered

London’s extreme property prices are seriously out of whack with the rest of the country. But this could be about to change, says Matthew Partridge.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

It's wrong to think of the UK property market as a single entity, as MoneyWeek editor-in-chief Merryn Somerset Webb has pointed out.

There are really two different markets. In most of the UK, house prices have yet to recover from the crash in nominal terms, and are still sharply down when you take inflation into account (in real' terms).

London by contrast, is in the grip of a property bubble, with the ratio of prices to average earnings at a record high.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The obvious trade if you live in the capital is to move. As Merryn points out, depending on where you start out and where you want to go, you can now swap a small London flat for a castle in the Scottish Highlands.

But the London premium' has grown so extreme that you don't even have to move that far out of the capital to get a lot more space for your money.

And that's yet another reason why the London bubble's days are numbered.

The London premium' hasn't always existed

For anyone under the age of 40, London property has always been more expensive than the surrounding countryside. We just take it for granted.

However, it wasn't always the case.

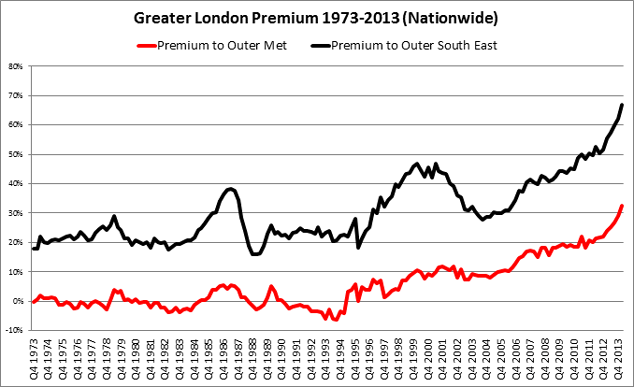

According to the Nationwide's regional indices, until the mid-1990s, the gap between Greater London house prices and those in the Outer Metropolitan' area (which includes areas such as central Kent, south Essex and the northern part of West Sussex) was very small. Indeed, from 1973 to around 1995, the commuter belt sometimes became slightly more expensive than London for prolonged periods.

In the case of the Outer South East' there was always a more substantial gap. That's not surprising, as these areas are a lot further away from the capital. Even so, apart from the late 80s bubble, the London premium still remained between 20% and 30%.

As the chart below shows, the mid-90s is when the gap really started to grow. But even as late as a decade ago, London property cost only 10% more than the Outer Metropolitan area, and 30% more than the Outer South East.

The gap today is an incredible 32% for the Outer Metropolitan, and 67% for the Outer South East.

Source: Nationwide

This isn't just a glitch in the Nationwide data. Data from Halifax only looks at the Southeast as a whole, rather than splitting it, but it tells a similar story. From 1983 to 1995, the London premium over the South East was typically less than 5%. Now it's a record 30%.

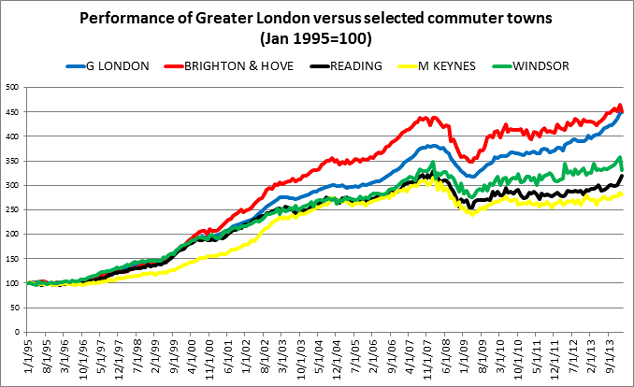

Of course, the South East' and Outer Metropolitan' are vast areas. They include many towns with poor links to the capital, which could be dragging down the average price. But the Land Registry includes more detailed data, which allows us to focus on the towns with the best links to London.

The Land Registry's price data is compiled using a different methodology (you can learn more about all the different indices here).

But it's still clear that prices in Greater London have risen by far more than in commuter towns such as Reading, Harrow, Slough and Milton Keynes (all of which are less than an hour away by train). Only Brighton and Hove (AKA London-on-Sea) has managed to keep pace.

Source: Land Registry

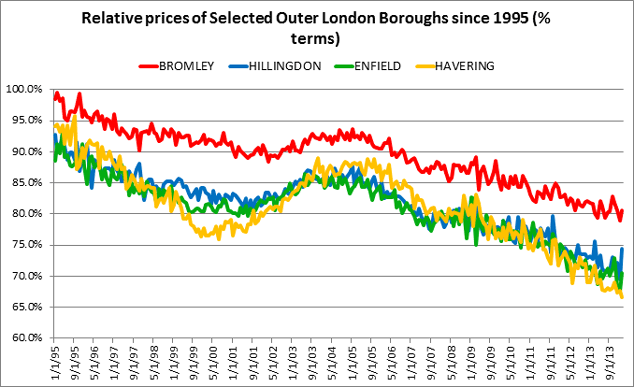

And it's not just the commuter belt that has been left behind by London's bubble.

London's outer suburbs have steadily fallen behind the rest of the city too. As the chart below shows, in 1995 prices in four outer boroughs (Bromley, Havering, Enfield and Hillingdon) were close to the average for Greater London.

But now the average property in Havering goes for about two-thirds of the London average. Even Bromley, which used to be only 0.5% lower than the average, is now 20% cheaper.

Source: Land Registry

The power of extreme prices

That's a lot of data to take in. But the crucial point is this: all of these areas are cheaper relative to the rest of London than at almost any point in history.

If there's one financial constant we believe in here at MoneyWeek, it's reversion to the mean'. In short, when a price trend gets way out of whack with history, you can bet that it will go back to trend at some point.

There's no telling when. But typically, the more extreme the move, the more extreme the eventual correction. That's because extreme prices stimulate changes in the real' world, and these ultimately push prices back into line.

For example, the record strength of the Japanese yen in the lead-up to 2012 was a big factor in forcing the Japanese central bank to embrace full-blown quantitative easing.

High and rising oil prices over the past decade or so have stimulated the development of everything from shale gas to electric cars.

And now there are signs that London's extreme prices are stimulating change.

As Merryn has pointed out, developers have rushed to cash in on high prices in inner London. According to the planning organisation New London Architecture, there are over 236 new tower projects in the pipeline. While some involve office space, most (just under 190) focus on providing residential flats. Overall, the aim is to build 42,000 new homes a year.

Meanwhile, councils are starting to crack down on buy to leave' landlords, who buy property only to leave it empty. Islington has announced plans for £60,000 fines.

At the same time, improved transport links, especially Crossrail, will cut journey times to the suburbs and nearby towns even further. This will expand the size of the commuter belt, effectively increasing the supply of property for London workers.

There are already some signs that people are starting to realise the price advantages of moving outside London. In their latest report, estate agency Savills claim to have found "the first signs of wealth beginning to flow out of the capital, and this has become even more evident so far this year". They expect "more London buyers will make the move out to the regions, and take advantage of the price gap.

Of course, reversion to the mean could be caused by London prices falling, or prices elsewhere rising or perhaps most likely, a combination of the two.

But I'd be very surprised if the London premium is still as wide by this time next year. If you're a Londoner thinking of trading down to the countryside, I'd start the hunt soon.

Our recommended articles for today

Is it time to buy Tesco?

Tesco shares are idling at the lower end of their trading range. Bengt Saelensminde finds out if that's the green light for investors to buy.

How to invest in a stocks and shares Isa

Ed Bowsher runs through the nuts and bolts of opening a stocks and shares Isa, and gives you some investment ideas to consider.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Can mining stocks deliver golden gains?

Can mining stocks deliver golden gains?With gold and silver prices having outperformed the stock markets last year, mining stocks can be an effective, if volatile, means of gaining exposure

-

8 ways the ‘sandwich generation’ can protect wealth

8 ways the ‘sandwich generation’ can protect wealthPeople squeezed between caring for ageing parents and adult children or younger grandchildren – known as the ‘sandwich generation’ – are at risk of neglecting their own financial planning. Here’s how to protect yourself and your loved ones’ wealth.