Gamble of the week: Money printer falls on tough times

Investors have turned their backs on this money printer, says Phil Oakley. The shares look better value now.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

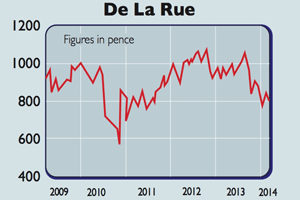

It has been 18 months since we last looked at shares in this money printer. Back in September 2012, they cost 1,050p each and looked expensive on over 18 times forecast earnings too punchy for us.

The company was battling against too much capacity in the paper banknote market, which had squeezed its selling prices. Shareholders were to be kept happy with a big cost-cutting plan that was expected to take trading profits from £60m to £100m in just over two years.

A lot has happened since then. The firm will fail to hit its £100m target it will be nearer to £90m instead after issuing two profit warnings.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

On top of that, the chief executive decided to jump ship. CEOs have developed a canny knack in recent years of getting out when there's nothing more to gain. Investors are right to be cynical. So it's no surprise thatDe La Rue's (LSE: DLAR)shares have fallen back.

However, although times are tough for the company, it is still the world leader in printing bank notes and has good potential for profiting from the introduction of plastic ones. It could also go on to create a decent business with passports, although this is taking some time to develop.

In 2010, French firm OberthurTechnologies failed with a 905p pershare bid for De La Rue. While no-one iscurrently predicting that it'll return soonfor another go, when industries havetoo much capacity one of the ways ofdealing with it is through mergers andcost cutting. This can help prices andprofits for those companies that remain.

Verdict: a speculative buy

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge