Shares in focus: Can Resolution ride out the storm?

Resolution's shares have taken a battering. So is it time to snap up the insurer? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

The insurer's shares have taken a battering, but they're currently too cheap, says Phil Oakley.

It's been a rough couple of weeks for insurance company Resolution soon to be renamed Friends Life. First, George Osborne announced a radical shake-up of pensions, which means that in future people could cash in their retirement savings in one go rather than buying an annuity.

Then there were rumours that the Financial Conduct Authority (FCA) was going to look into whether insurance companies selling products such as endowments, pensions and life insurance had treated their customers fairly on policies going back to the 1970s.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

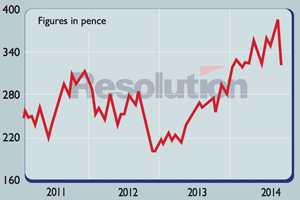

These two announcements have got analysts worrying about how much money a company like Resolution might be able to make in the future. Its share price fell by nearly a quarter in just over a week, which would seem to imply that profits will be a lot less than they are now.

That said, the stock market often overreacts to news. Resolution's shares have recovered some of their lost ground after the FCA said that any investigation would be a lot narrower than had been previously feared.

What is clear is that Resolution, which makes meaningful amounts of money from pensions and annuities, does have a cloud hanging over it. What does this mean for the shares?

The outlook

Critics point to the fat profit margins that annuity providers are currently making, but that doesn't automatically show that they have treated customers unfairly. Equally, the scale of the political embarrassment caused by the FCA's poor handling of the announcement has put the regulator on the back foot for now.

Of more concern is what happens to the pensions that are still being built up. Friends Life is a big player in the provision of defined contribution (money purchase) pension schemes for private individuals and companies. Many of the policyholders would have bought an annuity on retirement; they might not do so in future.

Yet things might not turn out as bad as people think. Annuities have come in for a lot of criticism for paying low rates, but it is very hard for pensioners to get a higher guaranteed income for life from other investing strategies.

Some analysts are predicting that the annuity market in the UK could decline by up to two thirds, yet annuities still remain popular in markets such as Switzerland, where the compulsory purchase of them has also been axed.

There's also the possibilitythat Friends Life's pensions businessgets a boost from people saving moreto take advantage of the decent tax benefits. The introduction of auto enrolment for company pensions isalso likely to be helpful.

But Resolution needs to keep winning new business to maintain and grow its profits. At the moment, the bulk of its profits (and, importantly, its cash flow) come from a closed book of insurance policies where the focus is on boosting returns by cutting the costs of running the policies.

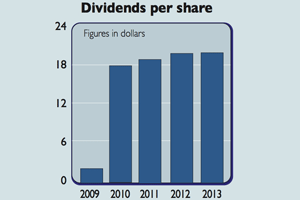

But the expectations built into the firm's share price seem to be quite low. The dividend yield is currently 7% and looks safe for now. It probably will not grow until the business can generate a cash surplus of £400m, compared to £331m in 2013, but might be worth tucking away.

The other thing to note is that at 300p a share, the company is valued at just under £4.3bn. This compares with an embedded value a measure used to value insurance companies based on their net asset value and the present value of future cash flows from contracts already written of £6bn.

Embedded value is not the easiest of things for the man in the street to understand, but the near-30% discount suggests that Resolution shares could be too cheap.

Verdict: a buy for the brave

Resolution (LSE: RSL)

Directors' shareholdings

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge