Japanese stocks remain a buy

Foreign investors may be unnerved, but there's still much to like about Japanese stocks.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

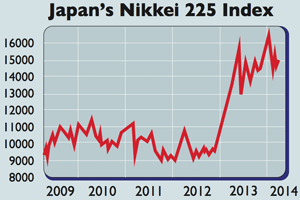

Japan's Nikkei stock index leapt by 57% last year, but so far this year it has been one of the developed world's worst performers. It lost around 10% in the first quarter.

Foreign investors, who account for most of the market's trading volume, have been unnerved both by events abroad and by this week's increase in Japan's consumption tax.

This tax, equivalent to VAT, was last raised in 1997. It is now going up from 5% to 8%. The idea is to raise an extra 1% of GDP in taxes, and start making a dent in Japan's annual overspend important given the country's overall public debt pile of 240% of GDP.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But the fear is that this could choke off Japan's recovery and cause another recession, as the last hike is thought to have done in 1997.

Yet "a rerun of 1997 does not seem terribly likely", as the FT's Lex pointed out. Back then the real culprit was corporate confidence, not consumers' mood. It was only as companies collapsed, exposing "wobbly banks", that consumers pulled back.

The Asian crisis of 1997 hardly helped. Today, banks are fixed and firms have paid off their debts. Indeed, half the companies in the wider market hold net cash.

Also, back in 1997 unemployment was rising, hardly good for consumer spending, whereas today it is at a fresh low of 3.6%. Meanwhile, the ratio of jobs to applicants has hit a new high of 1.05, which should lead to wage rises as companies compete for scarce staff.

Investors are also awaiting reforms to raise the economy's long-term growth rate. These include liberalising the labour market and deregulating cosseted sectors, such as health care and agriculture. These reforms should be announced by the summer.

In the meantime, it's good news that the special economic zones' which will spearhead the reforms cover an area of Japan worth 40% of GDP, says Aaron Back in The Wall Street Journal.

That's a good sign: around a decade ago, the last time such zones were put in place to showcase big changes, they were "tiny". Throw in cheap valuations and the Bank of Japan's willingness to print more money to prop up the stock market, and Japan remains a buy.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Should you buy an active ETF?

Should you buy an active ETF?ETFs are often mischaracterised as passive products, but they can be a convenient way to add active management to your portfolio

-

Power up your pension before 5 April – easy ways to save before the tax year end

Power up your pension before 5 April – easy ways to save before the tax year endWith the end of the tax year looming, pension savers currently have a window to review and maximise what’s going into their retirement funds – we look at how