Shares in focus: Conveyor belts bring profits

Fenner is a good buy for the long term, but should you wait for a cheaper entry point? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

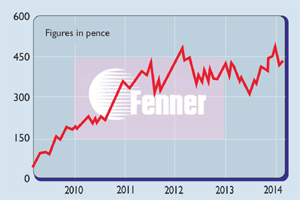

I first recommended buying shares in manufacturer Fenner just over two years ago. It has not worked out well. Anyone buying at 455p per share back in February 2012 will not have made any money. Instead, the shares have been extremely volatile, bouncing around as the company has had to deal with challenging trading conditions in its key markets. On Tuesday this week Fenner warned that its profits in 2014 would be hit by the current strength of the pound (this lowers the amount of overseas profits when they are translated back into pounds).

Fenner has some very good businesses, but the lack of profit growth over the last couple of years is likely to test the patience of some investors. The question is, are Fenner shares still worth buying or should you look elsewhere for better returns on your money?

How the business has fared

For years Fenner has been dominated by its heavy-duty conveyor belt business, where it is the world leader. Its belts are used extensively in the mining industry, shifting millions of tonnes of coal, iron ore and copper every year. Trading under the famous Dunlop brand name more commonly associated with tyres, Fenner conveyor belts have a reputation for quality and durability. Although they are more expensive, Fenner's hard-wearing belts are more economical to use than cheaper belts which need replacing more often. This is what gives Fenner its competitive edge. It has reinforced this by investing in manufacturing plants in the world's biggest mining markets namely America and Australia.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

That's all well and good, but the mining industry is very sensitive to changes in the world economy. If times are tough and commodity prices are falling then Fenner's mining customers tend to buy fewer replacement conveyor belts even though it may cost them more in the long run. This is essentially what's been happening recently as worries about the strength of the Chinese economy which has been buying up a large chunk of Australia's coal and iron ore production have been weighing on commodity prices.

The growth of cheap shale gas in theUS the world's largest producer of coal has also hit demand from mines over there as some electricity producers have switched fuels. Fenner has had to cut the price of its belts to hang on to business, but it has been able to weather this storm relatively well. Its decision to invest in belt maintenance businesses has cushioned some of the effects of the downturn as has an investment to support conveyor belts in Chile's copper industry. Still, profits fell sharply last year.

Longer term, the outlook for conveyor belts looks reasonable and profits should recover and grow over time. Volumes of coal and iron ore are still increasing. This is likely to continue in the long run as demand for steel and electricity remains robust. Copper is becoming harder to get out of the ground, which means more rocks and need for tougher conveyor belts.

But conveyor belt profits are still likely to bounce around a lot. To counter this, Fenner has been steadily building up its Advanced Engineered Products (AEP) business. This business uses advanced polymer technologies to create niche, problem-solving products that are critical to the performance of goods or manufacturing processes. Examples include high integrity seals used in theoil and gas industry and bits used formedical implants.

Fenner has been buying up more businesses in recent years that add to its product offering and has started selling to growth areas such as fracking, used in the production of shale gas. The profits of the AEP businesses have been able to grow nicely in recent years they have trebled since 2009 and are a lot more resilient to changes in the economy. The products tend to be difficult to copy which means that they are quite hard to compete with. Above all else though, Fenner is selling into areas with good long-term growth prospects such as energy and medical.

It is still going to take some time for AEP profits to be greater than for the conveyor belts business, but this will eventually happen. Conveyor belts will remain a valuable business, just one where the profits continue to jump around. This will make Fenner a less risky, better investment. In the meantime, its fortunes are still going to be subjected to the ups and downs of the mining industry, sentiment regarding the health of China's economy and exchange rates.

Should you buy the shares?

I still think that Fenner is a business that will reward very patient long-term investors. The trouble is that in theshort-term its shares may get cheaper than they are now. At 15 times current year earnings they are not a steal. During the last year or so, investors have been willing to pay higher p/e ratios for lots of shares. However, this has usually required a low p/e to begin with and/or the prospect of strong profits growth. Fenner has neither of these at the moment.

The price you pay determines the returns that you ultimately receive. Pay too high a price and you often end up disappointed. My original tip on Fenner was an example of this mistake. I think Fenner shares could go back to 350p (about 12.5 times earnings). At that price they would be a better long-term buy.

Verdict: one for the watchlist

The numbers

Directors' shareholdingsN Hobson (CEO): 272,872R Perry (CFO): 626,701M Abrahams (chair): 726,726

What the analysts say

Buy: 10Hold: 9Sell: 1Target Price: 475p

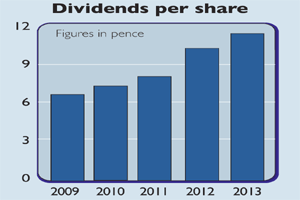

Key factsStockmarket code: LSE: FENRShare price: 418pMarket cap: £812mNet assets (Aug 2013): £362mNet debt (Aug 2013): £121.1mP/e (prospective): 15.0 timesYield (prospective): 2.9%ROCE: 18.0%Dividend cover: 2.3 times

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Financial education: how to teach children about money

Financial education: how to teach children about moneyFinancial education was added to the national curriculum more than a decade ago, but it doesn’t seem to have done much good. It’s time to take back control

-

Investing in Taiwan: profit from the rise of Asia’s Silicon Valley

Investing in Taiwan: profit from the rise of Asia’s Silicon ValleyTaiwan has become a technology manufacturing powerhouse. Smart investors should buy in now, says Matthew Partridge