Gamble of the week: Mood turns sour on artifical sweeteners

A profit warning has sent investors running for cover, says Phil Oakley. But there's still much to like about this maker of artificial sweetners.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

One of the best times to buy a share is when it is very unpopular and the price is depressed. If the reason for the shares being depressed is temporary and can be reversed, then buying can reward patient investors.

But too often this point is overlooked and people end up catching the proverbial falling knife, finding out later that the shares were not that cheap after all. Shares in bad businesses usually have low price tags for a good reason.

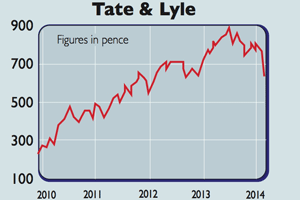

This is the problem facing prospective buyers of shares in this artificial sweetener makerright now. A few weeks ago the company issued a profits warning and its shares have been hammered.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The prices it can charge for its sucralose artificial sweetener, Splenda, are expected to fall by 15% this year due to large stocks of Chinese products flooding the market. Profits from Splenda, which account for about 20% of Tate & Lyle's(LSE: TATE) earnings, will take a big hit.

All this is unfortunate as it masks the good things that are going on elsewhere. Tate & Lyle has some good products that could be very useful in combating the global obesity crisis (my colleague Matthew Partridge wrote about these in the magazine a couple of weeks ago).

In particular, its intense sweeteners Tasteva, which is based on stevia, and Purefruit, based on monk fruit, could have a lot of potential. Elsewhere, the company is also doing well with its speciality starches and low sodium salt substitute, which promote healthy living.

If the sales of these products can grow strongly over the next few years, thenthey will form a bigger part of the company's profits and help lessen the worries about Splenda. They could also help Tate's total profits to start growing again.

Tate & Lyle shares look like they could fall further, as it seems likely that they will be relegated from the FTSE 100 index this week. This means that FTSE 100 tracker funds will have to sell them and push down the share price.

This could be good news for prospective buyers. Tate & Lyle shares look reasonably valued at just under 12 times forward earnings and offer a yield of 4.4% on a dividend that is expected to keep on growing. The company also appears to have strong finances. The shares look worth a punt.

Verdict: buy at 640p

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Last chance to invest in VCTs? Here's what you need to know

Last chance to invest in VCTs? Here's what you need to knowInvestors have pumped millions more into Venture Capital Trusts (VCTS) so far this tax year, but time is running out to take advantage of tax perks from them.

-

ISA quiz: How much do you know about the tax wrapper?

ISA quiz: How much do you know about the tax wrapper?Quiz One of the most efficient ways to keep your savings or investments free from tax is by putting them in an Individual Savings Account (ISA). How much do you know about ISAs?