Three signs that the London housing market has gone mad

London’s property prices are well above their pre-crash levels. Everything points to this being a massive bubble, says Matthew Partridge. Here, he outlines the three key signs that prove it.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

I've been flat hunting in London for the past few weeks. I already knew the market was pretty over-heated, but there's nothing like grim first-hand experience to show you just how mad it is out there.

Flat viewings are mobbed. One place I saw had over 90 people view it in a single showing. And they're being snapped up. Go to see a flat over the weekend and you'll need to put an offer in by Monday lunchtime if you want to have a hope.

Prices are well above their pre-crash levels. I saw a basement flat that went for £210,000 in 2006 being put on the market for £350,000.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

But it sold for even more. The asking price seems to have become a floor rather than a ceiling. Rather than haggle for £10,000-£15,000 off the list price, you're expected to offer quite a bit more.

Now, maybe I've been unlucky with where I'm looking. But there's plenty of hard evidence that this sort of things is happening across the board. All the figures point to this being a massive bubble here are three key points that prove it

1. Buyers are paying the asking price

The first major sign that there's a bubble is the fact that the gap between the asking price and the agreed price has all but vanished.

Estate agents like to use the promise of high valuations to persuade homeowners to sign up with them. Of course, buyers know this is going on, so they tend to put in a low-ball offer. As a result, the final deal lies somewhere between the two.

However, according to property website Hometrack, this gap has shrunk to just 2%. Buyers are so desperate that any concept of negotiation has gone out of the window. It also implies that prices are rising so fast that even estate agents are unable to keep up.

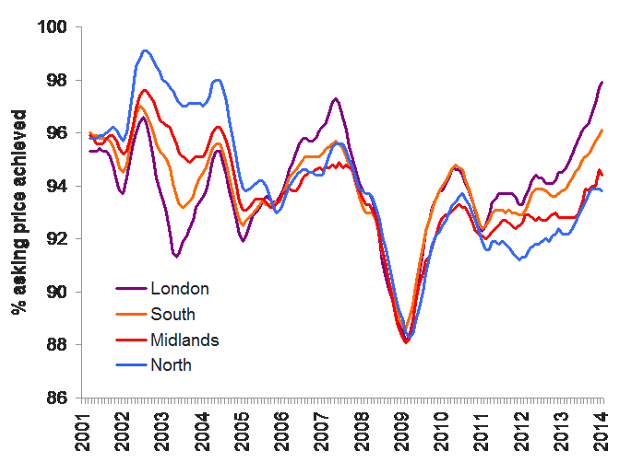

Hometrack's historic data, which goes back to 2001, suggests that this indicator is a reliable sign that housing prices may be about to peak. Take a look at the chart below, courtesy of Hometrack.

% asking price achieved aggregated regions

The purple line shows Greater London. The last time sellers were getting offers this close to their asking price, was in the summer of 2007, a few months before the market turned.

Similarly, the gap was at its widest in December 2008, around the same time as London prices hit their bottom.

As you can see, it's quite clear that prices elsewhere in the country, particularly anywhere north of the M25, are nowhere near as overheated as London.

But in London, if anything, the bubble is even worse than last time. In the summer of 2007, the gap was 3% - this time it is only 2%.

2. Properties are being snapped up

Another indicator is that London properties are being snapped up almost as soon as they go on the market. As you'd expect, there's normally a lag between a property being listed and the date an offer is accepted. And the slower the market, the longer the lag.

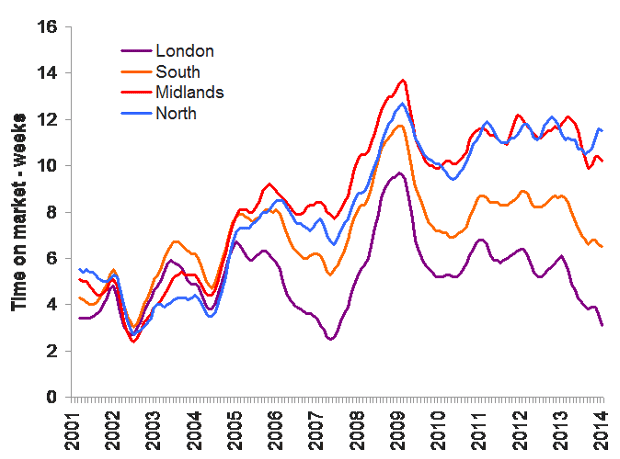

Now take a look at Hometrack's chart below.

Time on market aggregated regions

As you can see, the average time on the market in London shrunk to as little as 2.7 weeks in January. Even if you take a three-month average it is still just over three weeks.

At the bottom of the market in early 2008 it took two and a half months to make a sale. The historical average since 2001 is 5.2 weeks. We haven't seen this sort of enthusiasm in the market since the first part of 2007.

Again this suggests that buyers are making quick judgements. Instead of looking around, and thinking things through, they are jumping at the first thing available in a desire not to be left behind'. This is typical of what happens when bubbles reach their peak.

3. Prices are surpassing 2007 peak

Another indication that things are getting crazy in the capital is that prices are now well above the peaks set before the last crisis. According to Nationwide, greater London prices are now 13.5% higher than they were in the fourth quarter of 2007. Similarly, the Land Registry data shows that prices have risen by an even greater amount - 15.2%.

Of course, it's been more than six years since the crash so you would expect prices to reach their past peaks eventually. And not every index is setting new records. Halifax, which keeps its own measure, thinks prices are still around 4% lower.

But given that wages have barely shifted since the financial crisis, the sort of rebound we've seen in London is about far more than just keeping up with inflation.

In fact, Nationwide estimates that at 7.5 (compared with a previous peak of 7.2 in 2007), the ratio of first-time buyer house prices to mean gross earnings in London is the highest it has been since the survey started in 1983.

I need to rethink my flat-hunting strategy

These three warning lights' are classic signs of a bubble about to burst. They were certainly a wake-up call for me. While I won't give up my search for a flat quite yet, I will rethink my strategy.

Of course, if I don't buy now, there's the risk that I'll miss out on the rest of the bubble. And if you'd bought at the end of 2005, two years before the peak, and sold at the trough in late 2008, you would still have made money.

However, history suggests that was exceptional. If you had bought in 1987, and held through the 1989-92 crash, you would have had to wait until 1996 to see your purchase regain its original value (and that's not even accounting for inflation).

Our recommended articles for today

Why the future belongs to the convenience kings'

The insatiable quest for convenience is shaping our lives, says Bengt Saelensminde. And if you have any consumer-facing investments , you'll have to be on top of this phenomenon.

The investment opportunity: 38 million pizza-starved Poles

Domino's Pizza has been a tremendously successful business in Britain, says David Thornton. But will it catch on in Poland?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

8 of the best properties for sale with minstrels’ galleries

8 of the best properties for sale with minstrels’ galleriesThe best properties for sale with minstrels’ galleries – from a 15th-century house in Kent, to a four-storey house in Hampstead, comprising part of a converted, Grade II-listed former library

-

The rare books which are selling for thousands

The rare books which are selling for thousandsRare books have been given a boost by the film Wuthering Heights. So how much are they really selling for?