Gamble of the week: A punt on oil exploration

The shares in this Aim-listed oil explorer are a very risky punt, says Phil Oakley. But the rewards could be huge.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

If you fancy a punt on the stock market, there's no shortage of places to put your money. These days you'll find a lot of shares in the oil and gas and mining sectors. Most of these companies are looking for commodities in the hope that they will make them and their investors rich. Some will succeed, but most of them will wither on the vine if history is any guide.

This Aim-listed energy stock could be among the winners. What makes this company interesting is that it is the latest venture of Peter Levine a man who has hit the oil jackpot once before and is hoping to do so again.

Levine founded Imperial Energy in 2004 with the aim of making lots of money from old Siberian oil fields. The shares floated at 25p and soared to 1,250p when the company was taken over in 2008.

Try 6 free issues of MoneyWeek today

Get unparalleled financial insight, analysis and expert opinion you can profit from.

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Now Levine is chancing his arm in Paraguay with PresidentEnergy(Aim: PPC), in which he has a stake of 19.2% (around £24m). The company has exploration rights in the Chaco area in the north of the country. This area is home to a potentially large source of oil and sits next to adjacent oil fields in Bolivia and Argentina.

Consultancy company RPS has undertaken a detailed study of President's eight oil fields there. Based on a probability of hitting oil of between 13.4% and 26.8% (which seems quite conservative), RPS reckons that President Energy's share of the potential reserves could be equivalent to 130 million barrels of oil.

If these fields were successfully developed at the same time, then they could be worth $2.4bn (£1.4bn)today compared with President's current valuation of £126m.

That said, Paraguay seems quite friendly to foreign companies at the moment, offering low tax rates, and is keen to develop its own energy sources.

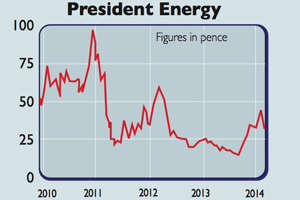

There's also the risk that President will keep asking shareholders for more money. It did so twice in 2012 and has recently tapped them for a further £31m in order to finance its drilling projects. This has caused the share price to fall by nearly a third in recent weeks.

Drilling in Paraguay is scheduled to begin in May. It will be a while before we know whether Levine's gamble has paid off. At 32p the shares look to be a very risky punt.

Verdict: a speculative buy

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

What do rising oil prices mean for you?

What do rising oil prices mean for you?As conflict in the Middle East sparks an increase in the price of oil, will you see petrol and energy bills go up?

-

Rachel Reeves's Spring Statement – live analysis and commentary

Rachel Reeves's Spring Statement – live analysis and commentaryChancellor Rachel Reeves will deliver her Spring Statement on 3 March. What can we expect in the speech?