Shares in focus: Has Pepsi lost its fizz?

The drinks firm is being shaken up by activist investors. Is it time to buy the shares? Phil Oakley investigates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

The drinks firm is being shaken up by activist investors the shares are a buy, says Phil Oakley.

Companies with good brands definitely have an advantage over those that don't lots of loyal customers who keep on buying year in, year out on the strength of a brand generally lead to a very valuable business. That's certainly true in the case of PepsiCo.

As well as its iconic cola drink, it has some great food brands, such as Doritos, Walkers Crisps and Quaker Oats. These make a lot of money for the company and have boosted the shares. To buy the whole business on the stock exchange today would cost you $119bn.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

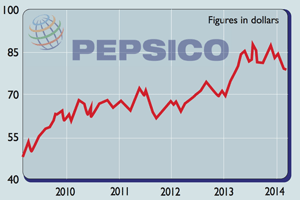

But for the last few years there has been a growing feeling among some investors that PepsiCo hasn't been doing quite as well as it should have been. Growth in profits has been sluggish, while its share price up by 52% in the last five years has lagged behind rivals such as Coca-Cola and Dr Pepper Snapple, which gained 76% and more than 230% respectively over the same period. PepsiCo is under pressure from activist investor Nelson Peltz to break itself up.

Peltz reckons that separating the fizzy drinks business from the snacks business will make shareholders better off. PepsiCo, on the other hand, thinks it will be better off staying together. So, is PepsiCo undervalued or has it reached its limits?

What's holding the company back?

Sales of Pepsi are going down in America and consequently the drinks business is running hard to maintain its profits. According to Peltz, the sluggishness of this business is doing a lot of damage and detracting from the better fortunes of the food and snacks division.

Despite the unfavourable effect of foreign-exchange rates, sales of PepsiCo's food and snacks are growing nicely, especially in places such as Latin America, boosting profits. Peltz believes that if this part of the business were separated from the bigger company, it would become more focused and innovative, which would allow it to make more money.

This argument seems reasonable. Kraft split off its snacks business (including Cadbury's) to form a company called Mondelez. It now trades on the stock market priced at 20 times its expected earnings, compared with 17 times for PepsiCo. If PepsiCo's snacks business was given a similar valuation, then Pepsi's shares look cheap.

Is Pepsi really undervalued?

It reckons that combining drinks and snacks allows it to gain access to retailers on more favourable terms than if the businesses were separate. It estimates that the extra costs of running two separate businesses would be between $800m and $1bn a year. This makes you think that if the businesses were separate, investors such as Peltz might be pushing for a merger in order to capture the cost savings.

Peltz is now trying to convince other shareholders to back his plans for a break-up. Whether he succeeds or not remains to be seen. However, his presence will keep the heat on management to improve the company, which would be good news for shareholders.

How's the management?

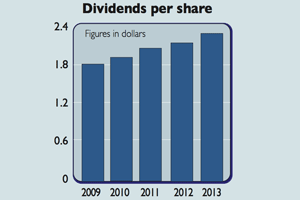

It's also going to pay out more cash to shareholders. PepsiCo has increased its dividend for 42 years in a row and will hike its annualised payout by 15% to $2.62 per share from June this year. It has also promised to buy back more shares. In total it expects to pay cash returns of $8.7bn in 2014, giving it a shareholder yield (dividends plus buybacks as a percentage of the company's equity market value) of 7.3%.

PepsiCo's return on capital employed (ROCE) is a healthy 17%, while the business generates lots of surplus cash flows to keep paying higher dividends. The promised productivity gains should allow for further improvements on these measures in the future. Debt levels are modest, while paying the interest bill is not a problem. PepsiCo is by no means a basket case.

So, should you buy the shares?

The dividend yield and the prospects for further dividend growth make the shares quite appealing for income-seekers. If you are looking for some foreign shares for your portfolio, then PepsiCo's shares could be well worth tucking away.

Verdict: buy for dividends

Pepsico (NYSE: PEP)

Directors' shareholdings

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Phil spent 13 years as an investment analyst for both stockbroking and fund management companies.

-

Pitch to Portfolio: Lioness Jill Scott's investing game plan

Pitch to Portfolio: Lioness Jill Scott's investing game planPodcast After bringing football home as a Lioness, Jill Scott discusses how she transformed her finances and became an investor in this latest episode of MoneyWeek Talks.

-

UK unemployment hits highest level since 2021 – will interest rate cuts follow?

UK unemployment hits highest level since 2021 – will interest rate cuts follow?UK unemployment reached its highest rate in almost five years by the end of 2025. Is AI to blame and will the Bank of England step in with an interest rate cut in March?