Expect return of inflation

Rising inflation in Western economies may catch many by surprise.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Should we be worried about deflation, or will inflation take off again? One reason why many believe inflation will remain subdued is the belief that there is plenty of spare capacity in Western economies. In other words, there is a huge, negative output gap or gulf between potential and actual GDP thanks to the brutal recession that began in 2008.

This implies that there is no prospect of demand exceeding supply, and hence inflation becoming entrenched, any time soon: the economy can gradually grow into the capacity that was left idle.

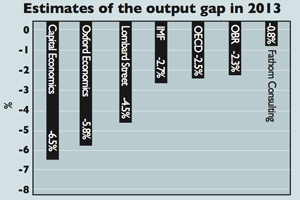

But measuring the gap is more art than science. GDP estimates tend to be heavily revised, even years after the first estimate, so it's hard to get a handle on output, let alone potential output. Current estimates of Britain's output gap from various think tanks and institutions (see chart below) range from near zero to 6.5% of GDP.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

If the estimates positing a big gap are wrong, the economy will be more inflation-prone than most analysts think.

For instance, during the recession that followed the oil crisis, the US Federal Reserve thought the output gap was vast, and kept monetary policy very loose. But it later transpired that the economy was operating at almost full capacity as it entered the oil crisis.

So, unnecessarily loose monetary policy fuelled the stubborn inflation that bedevilled the US for a decade.

When growth is skewed towards sectors underpinned by unsustainable debt-fuelled demand in our case housing and consumption much of the capacity created becomes obsolete once the demand falls away; think countless estate agents and home-improvement stores. So the output gap may be far smaller than many economists think.

Keep in mind, too, that money will move around the economy increasingly quickly as the credit freeze continues to thaw and lending rises. And central banks are in any case not much good at draining liquidity from the system before inflation sets in.

So, the output gap, and the likelihood that it shrank more than expected in the last recession, is another reason to worry that investors can expect inflation to return in the years ahead.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.