Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

There is no doubting the fact that China is set to become the biggest economy in the world and in doing so will make an ever greater demand upon natural resources such as oil and metals. These are of finite supply, so increased demand added to existing demand is a recipe for much higher prices. Over time the improving standard of living for China and other emerging markets will be to the detriment of the developed world's.

The life-blood of America is the dollar. Its role as the world's reserve currency gives them the freedom to print money and borrow excessively without fear - unlike other nations whose foreign debt is denominated in dollars but whose currency is not.

Events are coming towards us faster than we realise, and are hugely negative for the US dollar and the US economy. The potential is for a collapse of the dollar and for the cost of natural resources such as oil to be priced in a basket of currencies with only modest exposure to the weakening dollar, so causing the oil price and other commodities to soar in dollar terms.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Given what's at stake, it is hardly surprising that gold is launching into the stratosphere. The signals say that we are probably in the third and euphoric phase of the gold bull market. Acceleration is an end of something and so the third phase of the gold bull market will be coupled with huge acceleration. In the two months, December 1979 and January 1980, when gold topped out at $850/oz, the price of gold rose $400, it doubled in two months. January 1980 marked the end of the third and last phase of that gold primary bull market. This suggests $2,000/oz plus sooner than most people might think possible.

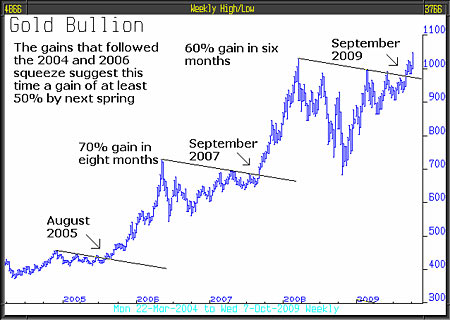

We have watched the gold squeeze in slow motion as fortnight after fortnight we have drawn attention to its development. Below is the latest weekly chart highlighting the three squeezes. If the first two are repeated, then over the next few months gold could, before eventually peaking at $2,000/oz or more, rise at least 50%.

The reasons we think the third phase has started are all around us. First the dollar risk, if it has fallen off that cliff, the gold price will soar. Secondly, purchasers of second hand gold are to be seen everywhere, in shopping malls and advertising on television and in newspapers. Gold is an investment that will eventually be in everybody's portfolio whereas currently it is hardly in anybody's. Even institutional investors such as Barclays Capital are saying that gold has significant upside potential into 2010. It is hard to imagine the enormous impact of institutions getting on to the bandwagon.

Gold is now very easy to own. Exchange Traded Funds (ETFs) are much easier to buy than gold bullion and there are no storage or insurance problems.

Several times recently gold has sold off; earlier this week it fell $11, but that was immediately followed by a sharp increase of $20. Any kind of pull back is attracting aggressive buying.

According to the Commodities Futures Trading Commission, a year ago speculative buyers compared to sellers were at a ratio of four to one, most recently it's ten to one. Don't doubt this is a primary bull market. Gold has been higher at the end of each of the last nine years.

The model portfolio has been and is still generously exposed to gold-related investments. These alone will dramatically increase future model portfolio performance. Should we be right about the ongoing rise in the gold price, be sure to realise it is a flashing neon light saying, "The economy ain't gonna work". All the authorities have achieved with their monetary and fiscal policies is to prolong the agony, delay the inevitable. The truth is that the banking system has not been saved because on a mark to market basis most of it is still insolvent and if the banking system is still in a precarious position, the outlook for the economy is bleak. It's a bitter sweet thing, if we all make a lot of money out of gold, we will in truth be making money out of the hardship of others.

Gold is saying that you can't have a banking system in a state of terminal collapse in October 2008 and then in March 2009 commence sustainable global economic growth. If the gold primary bull market is real, then everything else is an illusion.

This article was written by Full Circle Asset Management, and was published in the threesixty newsletter on 9 October 2009

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

How a ‘great view’ from your home can boost its value by 35%

How a ‘great view’ from your home can boost its value by 35%A house that comes with a picturesque backdrop could add tens of thousands of pounds to its asking price – but how does each region compare?

-

What is a care fees annuity and how much does it cost?

What is a care fees annuity and how much does it cost?How we will be cared for in our later years – and how much we are willing to pay for it – are conversations best had as early as possible. One option to cover the cost is a care fees annuity. We look at the pros and cons.